Many traders today are looking for cyclical turnarounds, or else are looking to get on the bandwagon of the latest “momentum” stock. These stocks make new highs each day but are untethered from any real value or reason anchor. In the end, they tend to falter when growth fails. I would rather look for reliable stocks that have growth potential, and if they can provide a little pocket money via healthy dividends, all the better.

So buying one of these cheap dividend stocks gives an investor a long-term edge. First, the stock is cheap on a P/E basis and dividend yield basis. Moreover, the stock is undervalued based on three measures of value. The first is a historical dividend yield method, the second is a historical P/E method, and the third is a peer-based valuation.

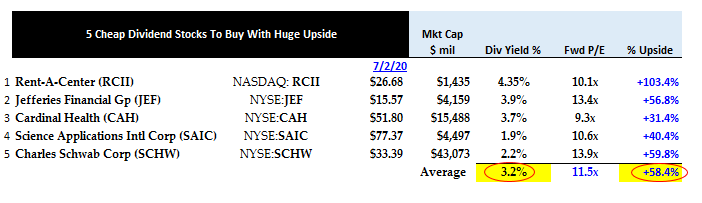

Here are the five cheap dividend stocks to buy with huge upside potential:

- Rent-A-Center (NASDAQ:RCII)

- Jefferies Financial Group (NYSE:JEF)

- Cardinal Health (NYSE:CAH)

- Science Applications Int’l Corp (NYSE:SAIC)

- Charles Schwab (NYSE:SCHW)

Let’s take a closer look at these five stocks.

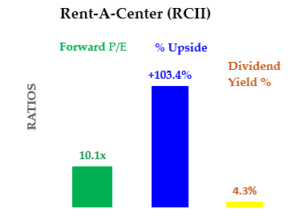

Cheap Dividend Stocks With Huge Upside: Rent-A-Center (RCII)

Market Value: $1.4 billion

Dividend Yield: 4.4%

Forward P/E Ratio: 10.1 x

Target Upside: +103%

Rent-A-Center is a major renter of consumer electronics, computers, furniture and appliances. During the Q2 coronavirus restrictions, 75% of its 2,100 company-owned stores remained open. The other stores operated with closed showrooms.

So Rent-A-Center’s earnings and value as an enterprise have actually grown during this crisis period. By contrast, its main competitor, Aaron’s (NASDAQ:AAN), closed all of its stores until recently.

As a result, earnings per share (EPS) for 2020 are expected to surge 25% higher to $2.28 per share over last year’s $1.82 EPS on a normalized basis. Moreover, estimated EPS for 2021 is forecast to be 15% higher at $2.69 per share. This puts RCII stock on a cheap valuation – just 10 times forward earnings.

This hasn’t gone unnoticed on Wall Street. For example, Stephens just wrote a report on RCII in May saying that Covid-19 had largely unaffected its earnings.

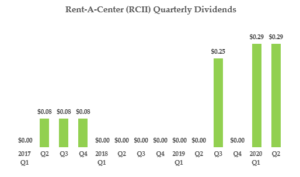

Moreover, the stock has an attractive 4.4% dividend yield. The table at the right shows that the company just recently started paying that dividend. This is also a sign of its confidence in future earnings prospects.

In effect, people are now more willing to rent rather than buy major purposes. This often happens during recessionary periods when thrift and near-term savings are more important.

I estimate that RCII’s target value is over twice today’s price, at $54.27. I used three valuation methods and averaged them. The three methods are a (1) historical dividend yield comparison, (2) a historical price-to-earnings analysis and lastly (3) a peer-based P/E ratio method.

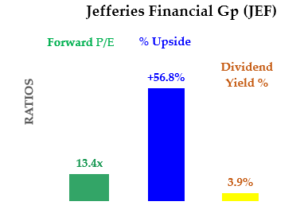

Jefferies Financial Group (JEF)

Market Value: $4.1billion

Dividend Yield: 3.9%

Forward P/E Ratio: 13.4 x

Target Upside: +57%

Jefferies Financial Group is an investment banking firm formerly known as Leucadia National. The company has sold off many of its major private equity holdings, but still focuses on long-term value creation.

It also has an asset management division, a timber company and an energy subsidiary. But investment banking makes up the bulk of its revenues and earnings.

Jefferies was the first to join in with the U.S. Department of Health and Human Services to raise $1 billion for a public-private partnership in response to the Covid-19 crisis. The consortium, called RAPID (Rapid Aseptic Packaging of Injectable Drugs), will provide hundreds of millions of pre-filled syringes with urgently needed drugs.

It turns out that Jefferies is very cheap valued right now. JEF stock trades for just 13 times earnings, which are expected to grow almost 100% next year.

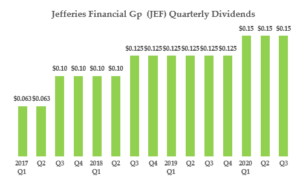

In addition, the yield is very attractive at 3.9%. You can see from the table at the right that Jefferies has paid a consistently growing dividend over the years.

In fact, based on its dividend history, JEF stock should yield 2.62%, according to Seeking Alpha data. That implies the stock is worth 48% more than today. Its other valuation comparisons show that its average value is over 56% higher than today’s prices at $24.42 per share.

Based on its historical P/E ratios, JEF stock should be at $32.15, over double today’s price. In addition, based on a comparison with its peers it should be at $18.21, or 17% higher. The average target price is 48% above today’s price.

Cardinal Health (CAH)

Market Value: $15.5 billion

Dividend Yield: 3.7%

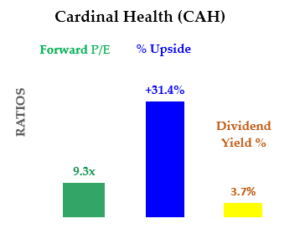

Forward P/E Ratio: 9.3 x

Target Upside: +31%

Cardinal Health is one of the largest U.S. distributors of prescription medication and clinically proven medical products. Cardinal produced an impressive 11% increase in its March quarter-end revenue on a year-over-year basis.

Pharmaceuticals, which account for almost 90% of the company’s total revenue, grew 12% year-over-year in the quarter.

In addition, its earnings per share grew 2% on a non-GAAP basis. This shows that the company’s fundamental business is very sound and poised for further growth.

Moreover, the outlook for the company is for 5.7% earnings per share growth for the coming fiscal year (ending June 2021). This puts CAH stock at a cheap valuation, selling for just 9.3 times next year’s EPS.

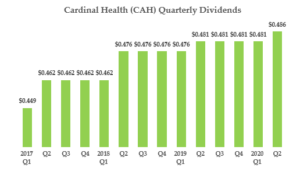

Cardinal Health also boasts a very attractive dividend with a 3.7% yield.

Moreover, the company has consistently increased the dividend every four quarters. Investors can depend on this to continue as earnings have remained on an upward trend.

Based on my analysis of the company’s historical dividend yield, CAH stock is worth $58.97, almost 14% above today’s pricing. In addition, its historical P/E ratio valuation is over 59% higher than today at $$82.47. Lastly, based on a comp review of its peers, CAH stock is worth $62.79, or 21.2% higher.

Therefore, the stock’s average valuation is $68.08, which represents an upside of over 31% from today’s price.

Science Applications Int’l Corp. (SAIC)

Market Value: $4.5 billion

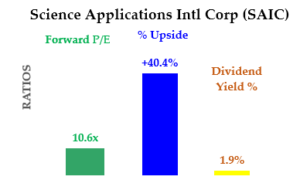

Dividend Yield: 1.9%

Forward P/E Ratio: 10.6 x

Target Upside: +40%

Science Applications International Corp (SAIC) makes most of its money from Uncle Sam. It is a prototypical “Beltway Bandit,” selling technical, engineering and information technology services and products to the government.

As a result, SAIC has had consistent profit growth. For example, over the past fiscal year ended January 31, revenue jumped 36.9% and net income rose almost 65%.

Moreover, growth continued in its fiscal first-quarter ended May 31. Organic revenue was up 3% year-over-year, despite the effects of Covid-19 and related lockdown restrictions. SAIC projected that without these restrictions, revenue would have risen 5%.

SAIC is also extremely profitable. For the fiscal year ended May 31, the company produced $626 million in free cash flow. Since revenue was $6.52 billion, its FCF margin was 9.6%. This is a very high ratio compared to most companies. This high FCF also supports a healthy dividend.

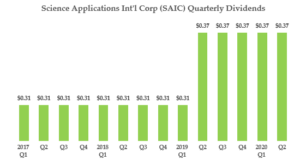

SAIC stock has a good 1.9% dividend yield and has consistently grown that dividend. Moreover, it consistently returns capital to shareholders with buybacks.

Moreover, my estimate of its value is at least 40% higher than today’s price, at $108.61 per share.

This target price is based on three measures of its value using historical and peer-based analysis. For example, its historical dividend yield target price is $86.05, 11% higher than today. Its historical P/E target price is $125.92, while its peer-based target price is $114.86. The average of these three targets is $108.61.

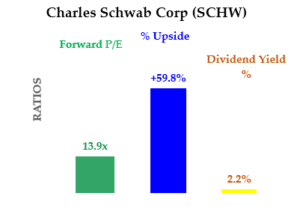

Charles Schwab (SCHW)

Market Value: $43.0 billion

Dividend Yield: 2.2%

Forward P/E Ratio: 13.9 x

Target Upside: +60%

Charles Schwab is more than just a brokerage firm. It has a large asset management firm, a custody business, a bank and a wealth management/advisory firm. Advisor services were 21% of its 2019 revenues.

Last November, Charles Schwab cut a deal to purchase TD Ameritrade (NASDAQ:AMTD) in an all-stock deal. That deal is now worth about $19.5 billion, down a good deal from the original value of $26 billion. This is primarily because SCHW stock has fallen since then.

However, the company expects to be able to gain from increased scale. Schwab projects between $1.8 billion to $2 billion in savings. That could increase its profits by 60% before the dilution of more shares outstanding.

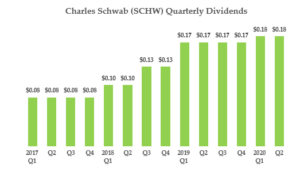

Analysts now expect earnings of $2.40 per share in 2021, up from estimates of $2.30 in 2020. That puts SCHW stock on a cheap 13.9 times P/E ratio. Moreover, the stock has an attractive dividend yield of 2.2%.

Moreover, you can see that dividends have been growing consistently every four quarters.

My estimate of the company’s value is $53.35, an upside of 60% of the price on July 2, 2020. That is based on its dividend yield target price of $68.57, its historical P/E ratio price of $48.25, and its comp-based target of $43.23.

Summary – Cheap Dividend Stocks With Huge Upside

You can see from the table below that the average P/E ratio for this group of five stocks is just 11.5 times earnings. Moreover, the average dividend yield is attractive at over 3.2%.

The potential upside for this group of stocks is over 58%. Even if that took two years to achieve, the average annual gain would be 24% plus per year. In addition, the 3.2% dividend yield would provide a total return of 27%.

That is a very attractive potential return for investors in these stocks as a group.

Mark Hake runs the Total Yield Value Guide which you can review here. As of this writing, Mark Hake, CFA does not hold a position in any of the aforementioned securities.