In my last piece discussing Inovio (NASDAQ:INO) stock, I mentioned reasons to remain positive on the biotech company despite a sharp pullback recently. But it looks like Inovio’s chances for mounting a comeback are slowly slipping away.

The markets have spoken. They want something concrete from the biotech company before they can start rewarding it again. Pharmaceuticals are an extremely volatile sector at the moment. Yeah, you have the usual suspects in the shape of Johnson & Johnson (NYSE:JNJ), Novartis (NYSE:NVS), GlaxoSmithKline (NYSE:GSK), and Sanofi (NYSE:SNY). These companies have a history of excellent fundamentals. But then there are also stocks like INO. These biotechs are indebted, almost completely, to the novel coronavirus pandemic for the recent surge in market cap. But a slowdown in the company’s progress is hurting market sentiment.

The Food and Drug Administration (FDA) also didn’t help matters when it placed a temporary hold on Inovio’s mid-to-late stage coronavirus vaccine trial. All in all, INO stock has been very volatile and is down 64.1% from the highs of $31 in late June. Things are firmly in the point of no return zone for the company right now.

The FDA Puts INO Stock on Hold

The global spread of coronavirus has put the spotlight on pharmaceutical companies that are developing vaccines. Inovio was one of the first companies, alongside Moderna (NASDAQ:MRNA), to put their hat in the ring and manufacture a vaccine to end this crisis. INO-4800 went immediately into Phase 1 clinical trials. And the markets rewarded the company with a significant uptick in its per-share value. However, supply chain issues and costly delays meant the company lost its way quickly thereafter.

The FDA’s recent halt of its clinical trials is just an additional headache for the company. In a press release dated Sept. 28, Inovio said the federal agency had questions regarding the planned Phase 2/3 trial of its Covid-19 vaccine candidate INO-4800, including its CELLECTRA 2000 delivery device. Inovio did not divulge any further details.

However, as my colleague Ian Bezek highlighted, it’s unlikely that the FDA questions have anything to do with the proprietary handheld electronic device used to deliver the vaccine into human cells. That’s because there are several clinical trials that the company continues to pursue. And although the nature of the medicines is different, the administration method remains the same.

Out of the Race

Inovio was one of the earliest entrants in the race to find a Covid-19 vaccine. As a result, INO stock price shot unprecedented highs, and it’s still up approximately 55% in a six-month period.

Now it’s time to make a sad but realistic admission. With several pharmaceutical and biotech companies in Phase 3 trials, it seems a tough ask for Inovio to mount a comeback from here. Even if it manages to satisfy the FDA, the company cant resumes clinical trials until November at the earliest. Meanwhile, major pharmaceutical companies are trying to commercialize a vaccine at breakneck speeds.

Moderna, the clear frontrunner at this stage, is hoping to provide a vaccine in January 2021 to the frontline workers and at-risk patients. Thereafter, the company is hoping to reach the general public by spring. Considering the timelines here, I believe that the initial advantages for Inovio are now lost. However, I maintain that the administration method for INO-4800 is unique and provides an advantage for the company.

Studies suggest 63% of young adults – those born in 2000 or later – fear needles. Since the proprietary CELLECTRA smart device uses electric pulses to create temporary pores in the cell membrane to ensure the delivery of nucleic acids into the cell, it doesn’t use needles. In simpler terms, the device directly inserts the medicine into your DNA.

Considering the U.S. Department of Defense gave $71 million as a grant for the device, I would say that it’s one of the unique selling points that Inoviio has under its belt. So, it would be surprising that the FDA now finds an issue with the very device they are looking to support.

Product Line Issues

Undoubtedly, INO stock is a big beneficiary of Covid-19 induced momentum trading. However, it’s easy to forget that Inovio has a complete suite of products apart from its coronavirus vaccine candidate. At the moment, Inovio has 15 DNA medicine clinical programs focusing on anal dysplasia, vulvar dysplasia, cervical dysplasia, and recurrent respiratory papillomatosis. These diseases are all related to human papillomavirus.

Although I am bullish regarding these vaccine candidates, the fact is that the company doesn’t have any FDA-approved vaccines under its belt. And until the vaccine race is over, the company’s focus will be on INO-4800.

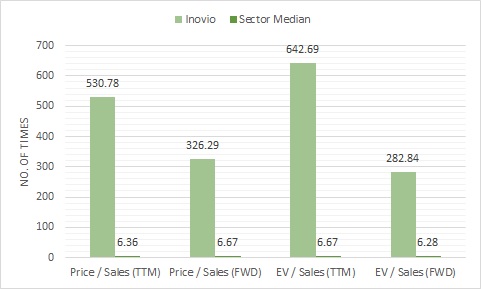

In 2019, the company’s revenue stood at $4.1 million, a 90% drop from the 2017 figure of $42.2 million. Hence, even before the pandemic, things weren’t all hunky-dory. Like a lot of companies, Covid-19 is a lifeline for this biotech. Unfortunately, it looks like that lifeline is no longer available. And that’s why the stock’s sky-high valuations don’t make any sense.

My Final Word

The current crisis is an unprecedented one in the history of the world. As a result, every sector has been upended. Several stocks have managed to flip the narratives and make a killing. INO stock is one such example.

Going by fundamentals, the company’s performance has not been impressive over the last several years. Also, since its inception, the company doesn’t have any FDA-approved products to boast. I am never a fan of a company that doesn’t have excellent fundamentals. If you add the fact that Inovio is effectively out of the Covid-19 race, you have the recipe of a risky stock.

INO is a sell for me.

On the date of publication, Faizan Farooque did not have (either directly or indirectly) any positions in the securities mentioned in this article.

Faizan Farooque is a contributing author for InvestorPlace.com and numerous other financial sites. He has several years of experience analyzing the stock market and was a former data journalist at S&P Global Market Intelligence. His passion is to help the average investor make more informed decisions regarding their portfolio.