One of the key components of investing in a Software-as-a-Service company like RingCentral is understanding the dynamic of SaaS vs standalone software. The very fact that revenues are typically recognized on a monthly recurring basis and locked-in to an annual plan makes investing in such a company an attractive proposition. On the other hand, the investor must closely watch metrics like new subscription, renewal, and churn rates, which, if not at optimal levels on a consistent basis, could spell trouble down the road. This is amply evident in the case of companies like Netflix (NFLX), where these metrics are the primary drivers of the stock’s price over time.

In all such cases, the value of the service provided is of primary importance. In my last Netflix article called Netflix: Look At The Content, Not Subs, ARPU, Or TAM, I highlighted content as being the core value driver for the stock, with the other metrics merely being symptomatic indicators or “effects” that the core growth engine exhibits. In the case of RingCentral, it’s the increase in the width and depth of the offering through feature additions, new product cross-selling opportunities, and a continually-expanding partnership ecosystem.

Thesis: Sustainable growth, solid subscriber metrics, and new partnerships being formed by RingCentral (RNG) present a potential upside to the current high valuation.

On all fronts, RingCentral appears to be doing well; hence, the “effects” in the form of a strong metrics profile. Let’s go through each of these growth drivers to see whether RingCentral makes a compelling investment case.

Feature Additions and Product Launches

One of the early feature additions that still benefits RingCentral is its API (Application Programming Interface) ecosystem that allows developers to integrate the platform’s capabilities into their own products and other third-party applications. In addition, the growing list of readily-available integrations with other SaaS platforms such as Office 365, G Suite, Zendesk, Salesforce, and Slack makes it easy for businesses to ‘plug and play’ RingCentral’s core Office platform while enhancing their business workflows with a simple subscription-based model.

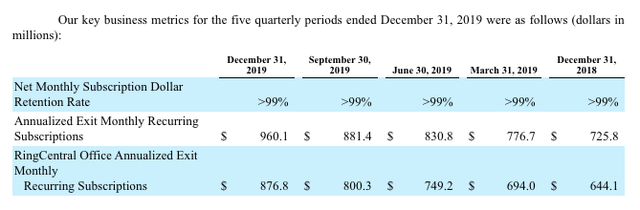

Once a business is engaged in this manner, it’s hard to extricate RingCentral from the overall equation, leading to high renewal rates. This is reflected in their consistently-growing ARR, which is an internal abbreviation of Annualized Exit Monthly Recurring Subscriptions, and Office ARR, a subset metric that only covers the flagship RingCentral Office product and the Customer Engagement offering.

The effect of this integration feature can be seen from the December 31, 2019, ARR figure of $960.1 million compared to the prior period’s figure of $725.8 million, which represents a growth rate of 32%. Three months later, as of March 31, 2020, ARR stood at $1 billion and, as of June 30, 2020, ARR was reported at $1.1 billion for a YoY growth rate of 33%.

In addition, over the years, RingCentral has added more features and product offerings to cater to niche requirements, which now includes the RC App, a desktop application for RingCentral subscribers that unifies messaging, video, and call capabilities. The company also sells pre-configured phones, phone rentals, and professional services to complement its core offerings, but these only contributed to a little over 3% of total revenues in Q2-20. Nevertheless, these product and feature additions perform an essential support function for overall revenue growth.

The takeaway here is that the company continually keeps adding new features to its existing products to enhance user experience. For instance, the RingCentral mobile app saw the launch of file sharing options, message reply actions, and a guest indicator, while the desktop app recently introduced GitHub and Jira integrations, a new workspace, video upload previews, and a calendar presence setting. These initiatives are essential because they draw the user deeper into the RingCentral ecosystem, eventually making it an indispensable part of their business workflows. That lock-in is the virtual moat that most SaaS companies rely on to keep their renewal rates at high levels.

The Expanding Partner Ecosystem

The other major component of driving growth is the vast spread of partners in RingCentral’s ecosystem. On the one side are strategic consumer-facing partnerships with communications operators like Alcatel-Lucent Enterprise, Atos (OTCPK:AEXAY), Avaya (OTC:AVYA), and others; on the other side are partnerships with software developers (independent software vendors or ISVs), channel partners, carrier service providers, affiliates, software-defined networking and a wide area network or SD-WAN, etc.

Together, these vendors and partners make up a crucial ecosystem that tremendously increases the reach of RingCentral’s presence across the world. The reason this is so important for growth is that the company currently earns over 92% of its revenues from the North American market. As these partnerships grow, we should see key growth coming from relatively new markets like Europe, where RingCentral’s presence is complemented by these partnerships. Much of the stock’s upside now comes from this key market segment, where the company has low penetration.

One important move that RingCentral has recently made in Germany is to open a new data center in Frankfurt and an office in Hamburg. This will give it a big boost in the EU market because it is now compliant with regulatory mandates around cloud-based offerings and gives German businesses access to local storage, local phone numbers, and local endpoints. It’s definitely something to watch in the short-term, and we could see some related launches in other key EU member states as well. The recent expansion of Avaya Cloud Office by RingCentral in Ireland is another move to capture the European market, and service availability now includes Ireland, France, and the Netherlands. RingCentral with further expand its presence into “Germany, France, Spain, Italy, Netherlands, Austria, Belgium, Ireland, U.S., UK, and Australia” through its partnership with Atos and the new product, Unify Office by RingCentral, by the end of FY-20.

Another significant takeaway from the Atos partnership is that Unify Office targets the hybrid segment of the business communications market. This enables companies with large legacy on-prem communications investments to leverage the power of cloud-delivered products to modernize their communication systems and make them more flexible and scalable for the future. As the pandemic drives digital transformation and the work-from-home culture, this needs for flexibility has come to the forefront, and it bodes well for RingCentral because that’s exactly what the platform was designed for.

From a higher-level view, the overall UCaaS or Unified Communications as a Service market was estimated at $15.8 billion in 2019 and is expected to grow at a CAGR of 9.5% through 2024. RingCentral’s revenue growth rates for FY-19, Q1-20 and Q2-20 were reported at 34%, 33%, and 29%, respectively. Despite strong YoY growth rates in the prior periods of +33% each, the company has matched it again in the first two quarters of FY-20. This despite macro headwinds during the majority of H1-20. As a leader in UCaaS, RingCentral is growing at more than three times faster than the overall segment, indicating high engagement with its customers versus the competition.

Moving forward, this slew of new partnerships and the expansion of existing relationships with other major players in the communications space represents a significant upside for RNG. And analysts are taking note of that. Morgan Stanley recently raised RNG’s price target to $300 from $280, while Mizuho set a price target of $350, even higher than sell-side analysts’ average price target of $340. That represents a current as-of-writing upside of between 3% and 20%. One of the reasons for this large variance could be the high level of competition in the space, which Morgan Stanley analyst says could impact valuation and ARPU (average revenue per user) if “pricing pressure were significant enough to limit RNG’s ability to continue growing at ~30-35% rates.” Interestingly, Marshall also noted that recent partnership activity could make the competition narrative an “overblown” one.

To extend that argument further, I believe RingCentral has found a way to neutralize much of the competition by forging long-lasting partnerships with key players in the communications space. Rather than battle competitors like Microsoft (MSFT), Cisco (CSCO), and others head-on, which would have involved a possibly insurmountable hurdle in the form of infrastructure investments, RingCentral is finding synergies with larger companies like Avaya and Atos by offering a win-win alternative to collectively deal with the competition. And at the heart of that is the core RingCentral Office platform and its huge integrated ecosystem. That’s not a moat that’s easy to break, and RingCentral has built that moat in the SaaS world, where moats are probably the hardest to create. That assumption is validated by the company’s consistently-high retention rates over the past several quarters.

Source: RingCentral FY-19 Annual Report

This combination of high retention rates and potential growth through new features, new product offerings, strong partnerships, and acquisitions clearly points to sustainability in terms of top-line growth.

What About Profitability?

As with most growth companies, RingCentral has been spending aggressively on core growth drivers such as sales and marketing (near-50% of total revenues) and R&D (15%), resulting in consistent net losses until Q2-20, when the company posted net income of half a million dollars. But profitability is not really a measure we can use to value a growth company, especially in the fast-moving SaaS space.

Instead, software companies often use what’s known as the Rule of 40, which essentially states that in order to be considered financially healthy and sustainable, a company must have a combined revenue growth rate and profitability rate of 40% or higher. As of FY-19, RingCentral’s growth rate of 34% combined with an operating margin of 9% placed it in the ‘financially healthy and sustainable’ category of SaaS companies. Even using the current TTM FCF margin figure of 7.4%, it’s above the 40% mark, if only barely.

What makes this level of sustainability acceptable in the eyes of investors is the consistency of its revenue growth over recent years, and we’ve just seen that the runway for continued growth is considerably long.

In terms of its financial standing, RingCentral has a strong cash position, with cash, cash equivalents, and restricted cash of $774 million against convertible senior notes of $1 billion net of current portion.

Investor’s Angle

While the Rule of 40 is by no means an indicator of future performance, it does reflect the current level of sustainability of a company’s revenue growth rate to a great extent. And when you add future gains from the frenzied partnership activity in recent quarters, it’s easy to see why RNG is trading at such high valuation multiples.

Source: Seeking Alpha

Another key indicator of market sentiment is stock price movement after earnings beats, and there’s little to speak of on that front as RNG continues to trade around pre-Q2-earnings levels, give or take. That could mean that the market has already priced in future growth and is hesitant to take valuations to even higher levels. However, that also represents a solid window of opportunity for long-term investors because RingCentral will continue to forge partnerships and strengthen existing ones in its quest for growth. The markets outside of North America only represent 8% of overall revenues, which gives it a long runway for growth in those geographies. The recent moves in Europe are evidence that this is now the new growth battleground for RingCentral.

As such, even though valuation is sky-high at the moment, I believe it will continue to remain so, leaving ample room for a short-to-medium-term price return for new investors and even more room for investors with a long-term view.

I also don’t see any significant risk from a prolonged pandemic because RingCentral’s core platform offers a viable solution for a work-from-home future for most companies in countries that are still struggling with high infection rates, both in North America and Europe. As a matter of fact, there are ample signs that new businesses are flocking to RingCentral’s platform across different company size segments. Per RingCentral CFO Mitresh Dhruv at the Q2-20 earnings call:

Businesses are turning to RingCentral as they transition workforces to a work from anywhere environment. Mid-market and enterprise customers defined as $25,000 or more in ARR had another strong quarter with ARR up 50%. Underpinning this strength was bookings growth from new enterprise customers with $100K or more in ARR, which was up over 50% sequentially.

As relates to our existing customer base, we mentioned in May that small businesses in verticals like retail, travel and hospitality that account for less than 10% of our overall installed base saw higher churn. But as the quarter progressed, the churn rates improved consistently, although still not at historical levels.

One factor to keep in mind at this particular point in time, though, is that the extremely volatile geopolitical environment will continue to be a risk factor until after the results of the 2020 Presidential Election in the United States are announced. Prudent investors might want to wait for a possible overall sell-off similar to the one that happened in early September that hit the broader market. Notwithstanding those considerations, RNG remains a compelling investment opportunity for long-term investors in the tech space.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.