As we move closer to a vaccine that will end the novel coronavirus pandemic, several biotech stocks are losing steam. And it’s understandable. Aside from the tech sector, pharmaceuticals have been the biggest beneficiaries of the pandemic. Markets are reacting hyperbolically to any news regarding a potential Covid-19 vaccine. It’s not surprising that Sorrento’s (NASDAQ:SRNE) SRNE stock is sparking similar concerns regarding overvaluation. Shares have slumped to $7.56 from 52-week highs of $19.39 a pop.

However, this month, Sorrento’s stock price movement is a testament to how quickly things can change in the sector. The stock rose 11.2% after it filed an investigational new drug (IND) application with the U.S. Food and Drug Administration (FDA) to start an early-stage clinical study assessing experimental intranasal drug STI-2099 in treating the virus.

Now, you might be wondering why the hype. The FDA’s decision is pending. But the markets are not taking that into account. Anything virus-related is good enough for a bump.

However, if you take a step back, you will see a company that has overhyped its preclinical test results. Sorrento’s share price has been very volatile in recent months, and that is because of the PR machinery it has employed to disseminate information regarding its product pipeline.

Unless some concrete results come soon, this stock looks dead in the water as Pfizer (NYSE:PFE) and Moderna (NASDAQ:MRNA) move ahead with their respective solutions.

SRNE Stock Is a Beneficiary of the Times

It’s safe to say that this year has been unlike one we have seen for a long time. The repercussions of the pandemic are wide-ranging. Economies have lost trillions, and unemployment is rampant across several countries. People the world over are looking for any viable, commercial solution to end this crisis.

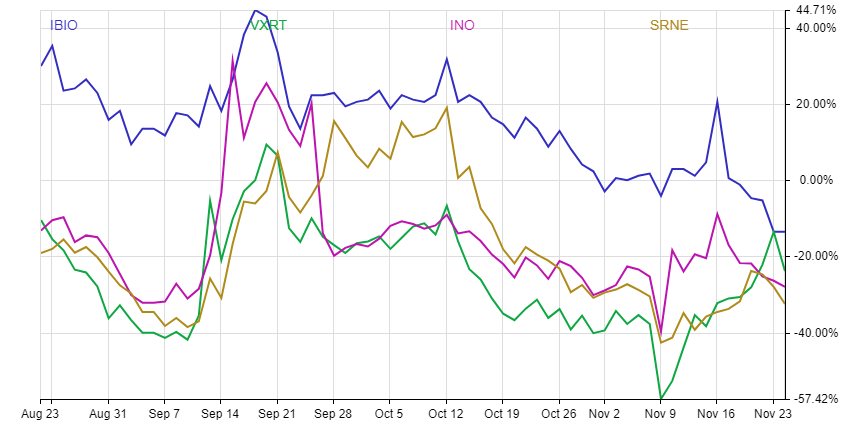

Unfortunately, that has led to outsized valuations for several pharmaceutical and biotech stocks that put their hat in the race at the start of this crisis. Companies like Ibio (NYSE:IBIO), Vbib (NASDAQ:VBI), Vaxart (NASDAQ:VXRT), Inovio (NASDAQ:INO), among others, are down by more than 50% in the last few months.

This is because we are getting closer and closer to the end of the vaccine race. Granted, the crisis scale is so large that every company will benefit somehow because we are talking about the entire planet’s immunization.

Still, the gains are slowly evaporating for the also-rans. The situation is a trader’s delight and has been for six months now. But time is running out. The company has to deliver solid results from its antivirals, vaccines, tests, etc.

Quarterly Results Don’t Paint a Pretty Picture

When we come back to fundamentals, the company isn’t doing so well. Sorrento reported $11.8 million in sales in the third quarter, a 103.45% uptick from the year-ago figure of $5.8 million. It’s still negligible considering the company’s market cap is close to $2 billion. W

hat’s more troubling is that the bulk of Sorrento’s revenue comes from subsidiary Scilex Pharmaceuticals‘ flagship product, ZTLido, which treats pain due to post-herpetic neuralgia. With no FDA-approved products on its plate, the only reason you should be bullish on the stock is if you value its Covid-19 product pipeline, one that doesn’t have any strong candidate as of yet.

The same issue haunts iBio, another company that has no track record of developing any vaccines but has unsurprisingly skyrocketed in recent months. Track records matter, especially in the biotech space. If you don’t have a product to show for your efforts, the markets will eventually catch on. And in the case of SRNE stock, analysts and investors are now catching on as well.

Final Word on Sorrento Stock

Shares of the antibody-centric biopharmaceutical company still offer value for day traders. The news cycle will continue to impact the markets, but it will have less impact as we move further along the path to recovery and vaccine frontrunners emerge.

The money is still there to be made for the nimble traders, and I wouldn’t want to fault anyone for doing it. But for those who value fundamentals, the end is nigh.

It’s time to sell Sorrento stock and load up on some established names.

On the date of publication, Faizan Farooque did not have (either directly or indirectly) any positions in the securities mentioned in this article.

Faizan Farooque is a contributing author for InvestorPlace.com and numerous other financial sites. He has several years of experience analyzing the stock market and was a former data journalist at S&P Global Market Intelligence. His passion is to help the average investor make more informed decisions regarding their portfolio.

Faizan Farooque is a contributing author for InvestorPlace.com and numerous other financial sites. He has several years of experience analyzing the stock market and was a former data journalist at S&P Global Market Intelligence. His passion is to help the average investor make more informed decisions regarding their portfolio.

Faizan Farooque is a contributing author for InvestorPlace.com and numerous other financial sites. He has several years of experience analyzing the stock market and was a former data journalist at S&P Global Market Intelligence. His passion is to help the average investor make more informed decisions regarding their portfolio.