Paypal (NASDAQ:PYPL) stock suffered a minor blip, losing 5.1% in five trading days in an otherwise stellar year.

The trivial loss in per-share value is attributable to the company’s purchase of BitGo, one of the country’s oldest cryptocurrency firms, falling through. In October, it was first reported that the digital payments juggernaut was in talks to buy the company, which now holds more than $16 billion worth of cryptocurrency assets for its customers.

It’s a rare bad headline for a company that has done everything right in 2020.

PayPal growing faster than any regular bank. In November, PayPal saw 350 million people use its services to execute financial transactions, more than any U.S. financial institution. Plus, Paypal now allows you to buy and sell cryptocurrencies like Bitcoin and Ethereum.

Bitcoin is another Cinderella story for the year, much like electric vehicle (EV) stocks. Amid the novel coronavirus pandemic, the largest cryptocurrency in the world more than tripled in 2020. Getting exposure to this fast-growing trend is a major coup for PayPal.

All things considered, PYPL stock will attract buyers on every major dip.

Paypal Stock Is Set to Have a Blockbuster 2021

PYPL stock outperformed the S&P 500 by 93.3% and its sector by 114.5% in the past year. While the pandemic is a curse for most companies, it’s actually a significant tailwind for the online payments system provider. When most payment providers are reporting losses, PayPal delivered two stellar quarters in a row.

In the second and third quarters, the company beat estimates by 24.6% and 15.9%, respectively. Paypal expects 17% to 18% growth in fourth-quarter adjusted earnings per share, which amounts to 97 cents to 98 cents. The company boosted its EPS forecast for the full fiscal year. It now expects adjusted EPS growth of 27% to 28% for 2020, an approximately 25% boost from the previous estimate.

Revenue came in at $5.46 billion in the third quarter, up from $4.38 billion in the year-ago period, soundly beating analyst estimates of $5.42 billion. For Q4, Wall Street is expecting $6.09 billion in Q4, a 22.80% year-over-year gain. Meanwhile, PayPal is forecasting low-to-mid 30% growth in total payment volume and 20% to 25% revenue growth.

Revenue and EPS are expected to grow 18.6% and 18.9% the next year. Considering that out of the last 12 quarters, PYPL beat estimates nine times, I believe these projections will be easily surpassed.

To put it simply, PayPal is a disruptor in every sense. It’s upending the traditional financial services sector, outpacing juggernauts like Goldman Sachs (NYSE:GS), Morgan Stanley (NYSE:MS), Bank of America (NYSE:BAC) and JPMorgan (NYSE:JPM) as America’s fastest-growing bank.

PYPL Will Continue to Benefit From Bitcoin’s Rise

On Dec. 30, 2020, Bitcoin reached a new all-time high of more than $28,900 per unit. It brings to an end a bumper year for the cryptocurrency. However, blockchain analytics firm Glassnode believes Bitcoin will continue to grow thanks to the few units available in the market.

And now we come to the best part. Between 800 and 900 new bitcoin are added to the market daily And research from hedge fund Pantera Capital shows PayPal and Square (NYSE:SQ) users are procuring all of them. Naturally, this is big news for Paypal users, since they buy, hold, and sell cryptocurrencies such as bitcoin and ethereum for as little as $1.

Since its such a diversified company, we can’t say how much of Paypal’s recent stock price hike is attributable to bitcoin. But it’s pretty much a given that this will be a major source of the company’s revenue moving forward.

Valuation Is a Sore Spot

With so much going for the company, it’s no surprise that Paypal stock gained 113.5% in 2020. That leads to inevitable concerns regarding overvaluation. Unfortunately, it doesn’t look like this thesis will change anytime soon.

Out of 31 analysts covering the stock, a solid 23 has given a “strong buy” rating on its shares.

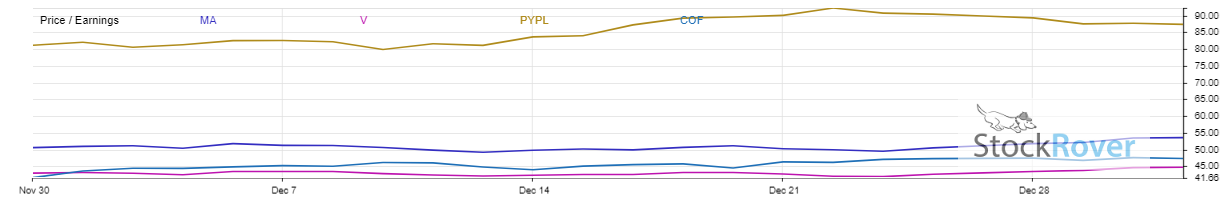

Paypal stock trades at 87.2x price-to-earnings, versus some of the more established names like Visa (NYSE:V) and Mastercard (NYSE:MA) that are trading at 44.7x and 53.6x, respectively. But you will have to pay a premium for a stock that has outperformed the S&P 500 by 426.5% in the past five years when the financial services sector has underperformed the market by 35.5%.

A Whole New World

The world is accelerating toward a digital-first economy and companies like Paypal are leading the charge. Large financial institutions are finding it tough to compete with the litheness and versatility of disruptors since they offer services at a fraction of the cost. New money disruptors like PayPal are the future, offering everything from merchant services to the ability to invest in cryptocurrencies.

Valuation remains an issue but you can’t blame the markets for trying to price in future progress. For example, the company forecasts $900 million in revenue for Venmo alone during 2021. Management has done everything right over the past five years and the will keep on adding to its suite of services in 2021 to maintain momentum.

Bottom line: Paypal stock is a secure investment. Don’t let the price point deter you from parking your capital in this one.

On the date of publication, Faizan Farooque did not have (either directly or indirectly) any positions in the securities mentioned in this article.

Faizan is a contributing author for InvestorPlace.com and numerous other financial sites. A former data journalist at S&P Global Market Intelligence, he’s passionate about helping retail investors make more informed decisions regarding their portfolio.