We all can’t wait for the day when life gets “back to normal” and the COVID-19 pandemic behind us.

But back to normal won’t mean “back to the way it was before.”

One of the biggest lessons we’ve learned over the past year is that access to fast, reliable internet service isn’t just nice … it’s essential.

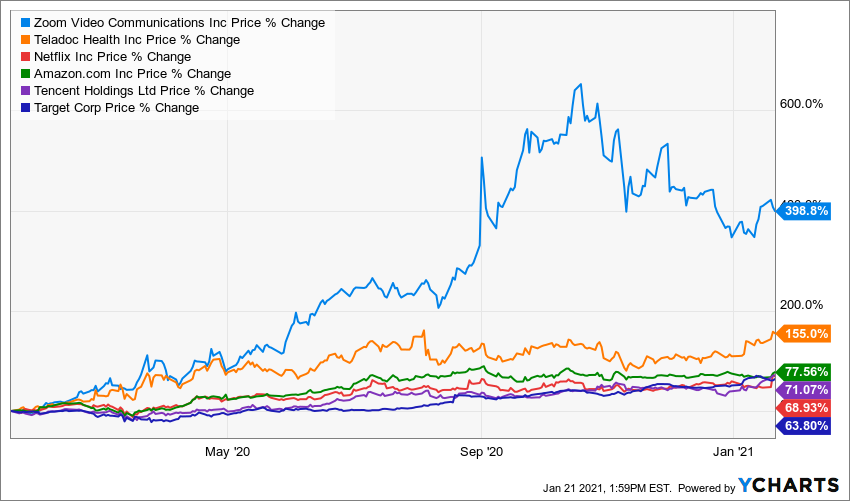

Hunkered down at home, Americans use needed video meeting services like Zoom Video Communications (NASDAQ:ZM) or Google Classroom to work, go to school, and stay connected with family and friends.

We visit doctors virtually through Teladoc Health (NYSE:TDOC). We watch shows on Netflix (NASDAQ:NFLX) and Amazon (NASDAQ:AMZN), play more video games from companies like Tencent (OTCMKTS:TCEHY), and order groceries through the likes of Target (NYSE:TGT) and others.

It’s no coincidence that these stocks are all up big in the last 12 months.

These and other stocks have thrived thanks to the online communication system that supports the global economy. This “information superhighway” includes the fiber optics cables, cell towers, Wi-Fi hubs, and other equipment that relay our texts, emails, phone calls, payments, entertainment, and more.

But here’s the thing …

As much as we’ve relied on all this over the past year, a massive and mind-blowing upgrade to the whole system is just now beginning.

Faster phone speeds are great, but there’s so much more to 5G in the technologies it enables and the investment opportunities it gives us.

Think how much worse the impact from COVID-19 would have been if we didn’t have technology to connect remotely. More workplaces would have shuttered. Schools would have come to a halt for a very long time. We’d have seen less of friends and family through video calls.

Indeed, as shutdowns were taking effect, some residential areas saw their average internet traffic jump 20% in a matter of days, according to Ericsson (ERIC) CEO Borje Ekholm.

Providers know this, which is why the FCC’s latest auction of wireless spectrum licenses to be used for the continuing rollout of 5G totaled roughly $95 billion … about 3X what analysts expected.

Think of 5G as the mother of all wireless network upgrades. COVID-19 only spotlighted its importance and accelerated its buildout.

When your health or your job is literally on the line, faster connections aren’t just nice — they’re necessary.

The next generation of mobility will blow your mind with download speeds that are 100X faster. If you’ve experienced janky or lost connections — haven’t we all? — you’ll appreciate that part of the upgrade.

But it’s more than just a nice improvement. I call 5G a “keystone” technology because it will enable many other breakthroughs that will change our lives.

I mean amazing things like self-driving cars, remote robotic surgeries, virtual and augmented reality, billions of connected devices known as the Internet of Things (IoT), telehealth, smart factories, smart cities, and on and on.

Add it all up and you’re looking at breakthroughs worth more than $56 trillion.

The rollout over the next seven to 10 years is creating a massive long-term investment opportunity.

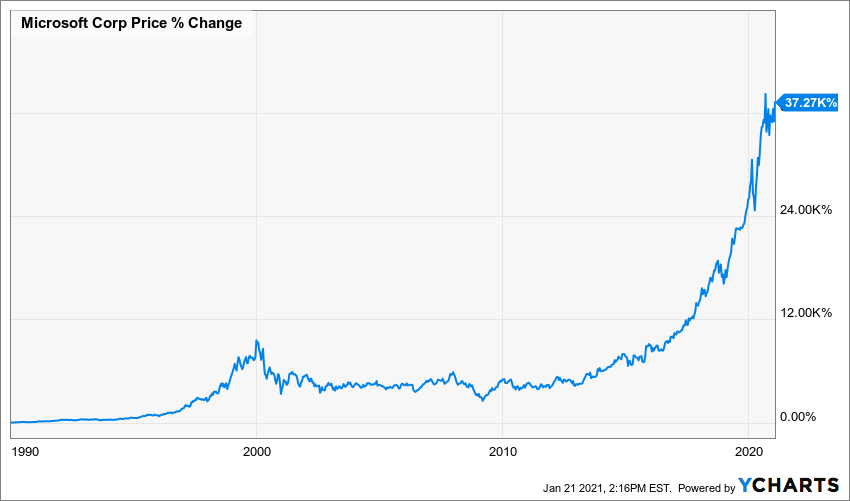

It’s just like what happened during the rise of the internet in the 1990s. And probably even bigger.

Back then, companies that set up shop along that superhighway used the continuous stream of information flowing across it to unlock tremendous value for customers. Investors who spotted the trend early were rewarded with eye-popping gains.

Microsoft (NASDAQ:MSFT) is one example. It turned office software into one of history’s largest corporate money piles and saw its stock rise more than 37,000% from 1990 until now.

The key is that Microsoft set up shop along the highway and profited for decades, unlike those who built the highway … and then were done.

eBay (NASDAQ:EBAY) is another good example. The e-commerce juggernaut didn’t build the internet highway but sat right on it, and saw its shares increase more than 6,500% since the late 1990s.

The companies setting up shop along the new 5G superhighway will also see the value of their businesses increase exponentially. They will profit for years and years.

A post-COVID world opens up even bigger opportunities, not just to keep us connected but also because businesses will need and demand faster, more efficient, and more reliable supply chains and production lines. That will be possible with data fed by countless connected sensors.

5G’s speed and reliability will enable this shift. With 5G, data can be processed in as little as two milliseconds. If that sounds incredibly fast, it is.

It’s faster than the human brain, which processes information in 13 milliseconds.

That’s why it’s not an exaggeration to say the breakthroughs made possible by 5G will ultimately dwarf the economic impact of the internet.

Years from now, we’ll look back at the creation of 5G the way we look back at the buildout of America’s railroads. And for investors, it’s the best chance to turn small investments into life-changing wealth.

On the date of publication, Matthew McCall did not have (either directly or indirectly) any positions in the securities mentioned in this article.

Matthew McCall left Wall Street to actually help investors — by getting them into the world’s biggest, most revolutionary trends BEFORE anyone else. Click here to see what Matt has up his sleeve now.