DENVER, Colo. (Project Syndicate)—For decades, we at the Rocky Mountain Institute (now RMI) have argued that the transition to clean energy will cost less and proceed faster than governments, firms, and many analysts expect. In recent years, this outlook has been fully vindicated: costs of renewables have consistently fallen faster than expected, while deployment has proceeded more rapidly than predicted, thereby reducing costs even further.

Thanks to this virtuous cycle, renewables have broken through. And now, new analyses from two authoritative research institutions have added to the mountain of data showing that a rapid clean-energy transition is the least expensive path forward.

“Either we will continue to waste trillions more on a system that is killing us, or we will move rapidly to the cheaper, cleaner, more advanced energy solutions of the future.”

Policy makers, business leaders, and financial institutions urgently need to consider the promising implications of this development. With the United Nations Climate Change Conference (COP26) in Glasgow in session, it is imperative that world leaders recognize that achieving the Paris climate agreement’s 1.5° Celsius warming target is not about making sacrifices; it is about seizing opportunities. The negotiation process must be reframed so that it is less about burden-sharing and more about a lucrative race to deploy cleaner, cheaper energy technologies.

Wasting money and time

With the world already suffering from climate-driven extreme weather events, a rapid clean-energy transition also has the virtue of being the safest route ahead. If we fail at this historic task, we risk not only wasting trillions of dollars but also pushing civilization further down a dangerous and potentially catastrophic path of climate change.

One can only guess why forecasters have, for decades, underestimated the falling costs and accelerating pace of deployment for renewables. But the results are clear: bad predictions have underwritten trillions of dollars of investment in energy infrastructure that is not only more expensive but also more damaging to human society and all life on the planet.

“If we get to work now, we can save trillions of dollars and avert the climate devastation that otherwise will be visited upon our children and grandchildren.”

We now face what may be our last chance to correct for decades of missed opportunities. Either we will continue to waste trillions more on a system that is killing us, or we will move rapidly to the cheaper, cleaner, more advanced energy solutions of the future.

Explosive exponential growth

New studies have shed light on how a rapid clean-energy transition would work. In the International Renewable Energy Agency (IRENA) report The Renewable Spring, lead author Kingsmill Bond shows that renewables are following the same exponential growth curve as past technology revolutions, hewing to predictable and well-understood patterns.

Accordingly, Bond notes that the energy transition will continue to attract capital and build its own momentum. But this process can and should be supported to ensure that it proceeds as quickly as possible.

Policy makers who want to drive change must create an enabling environment for the optimal flow of capital. Bond clearly lays out the sequence of steps that this process entails.

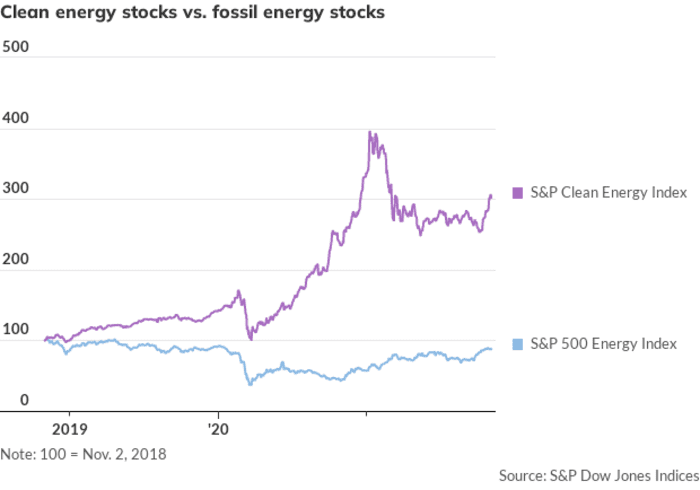

Examining past energy revolutions reveals several important insights. First, capital is attracted to technological disruptions, and tends to flow to the areas of growth and opportunity associated with the start of these revolutions. As a result, once a new set of technologies passes its gestation period, capital becomes widely available. Second, financial markets draw change forward. As capital moves, it speeds up the process of change by allocating new capital to growth industries, and by withdrawing it from those in decline.

Capital markets understand the future of clean energy.

The current signals from financial markets show that we are in the first phase of a predictable energy transition, with spectacular outperformance by new energy sectors and the derating of the fossil-fuel sector. This is the point where wise policy makers can step in to establish the necessary institutional framework to accelerate the energy transition and realize the economic benefits of building local clean-energy supply chains. As we can see from market trends highlighted in the IRENA report, the shift is already well under way.

Saving trillions of dollars

Reinforcing the findings from the IRENA report, a recent analysis from the Institute for New Economic Thinking (INET) at the Oxford Martin School shows that a rapid transition to clean energy solutions will save trillions of dollars, in addition to keeping the world aligned with the Paris agreement’s 1.5°C goal. A slower deployment path would be financially costlier than a faster one and would incur significantly higher climate costs from avoidable disasters and deteriorating living conditions.

“McKibben warns that precisely because solar and wind will save consumers money, the fossil-fuel industry will continue to try to slow down the transition in order to mitigate its own losses.”

Owing to the power of exponential growth, an accelerated path for renewables is eminently achievable. The INET Oxford report finds that if the deployment of solar, wind, batteries, and hydrogen electrolyzers continues to follow exponential growth trends for another decade, the world will be on track to achieve net-zero-emissions energy generation within 25 years.

In its own coverage of the report, Bloomberg News suggests as a “conservative estimate” that a rapid clean-energy transition would save $26 trillion compared with continuing with today’s energy system. After all, the more solar and wind power we build, the greater the price reductions for those technologies.

Moreover, in his own response to the INET Oxford study, Bill McKibben of 350.org points out that the cost of fossil fuels will not fall, and that any technological learning curve advantage for oil and gas will be offset by the fact that the world’s easy-access reserves have already been exploited. Hence, he warns that precisely because solar and wind will save consumers money, the fossil-fuel industry will continue to try to slow down the transition in order to mitigate its own losses.

We must not allow any further delay. It is essential that world leaders understand that we already have cleaner, cheaper energy solutions ready to deploy now. Hitting our 1.5°C target is not about making sacrifices; it is about seizing opportunities. If we get to work now, we can save trillions of dollars and avert the climate devastation that otherwise will be visited upon our children and grandchildren.

Jules Kortenhorst is CEO of RMI.

This commentary was published with permission of Project Syndicate—Clean Energy Has Won the Economic Race

More climate coverage from MarketWatch

Why COP26 will make ‘strong’ companies ‘stronger and the weak, relatively weaker’