This year’s Santa Claus rally was harder to spot than usual. It wasn’t system wide, as there are still giant pockets of weakness. The bifurcation is strange, and I don’t remember seeing this much disparity before. But this means that there are dozens of stocks to buy on discount. Investors have been punishing them relentlessly for months.

It is one thing to acknowledge divergences, and it is another to successfully navigate the currents. These are not easy markets to trade, and there are no real experts under these conditions. We now have circumstances that have never existed before, so there’s a lot of room for guess work.

Wednesday, for example, was meek for stocks, and it had a bearish tone. However fear had a terrible day, as the CBOE volatility index (VIX) fell 3.4%. That makes for a whole week of crashing in fear, which is rare. This suggests that investors are comfortable climbing the wall of worry. This includes year-end tax selling, the Federal Reserve’s actions and the highest Covid-19 infection levels yet.

Going into 2022, the macroeconomic conditions still favor more upside. The Federal Reserve will be easing its stimulative programs, but they haven’t yet announced hostile conditions. We do have inflation, but that has been here for months. For as long as consumer spending is healthy, I doubt that the Fed will panic.

Meanwhile the stocks to buy today will continue to be under threat until Wall Street switches focus. For now they are hating on them with no let-up in sight. Investors need to leave room for error from extrinsic threats. You don’t have to agree with the selling, but you also don’t want to fight the tape.

To minimize mistakes, insist on good fundamental thesis combined with solid support levels. Case in point are today’s three stocks to buy:

Stocks to Buy: Oracle (ORCL)

Oracle is a high-tech stock that survived the dot com bubble. Therefore it earned its stripes on Wall Street. Downturns in the stock chart have so far been opportunities to go long. Earlier this month, investors went crazy buying the good news from its earnings report. The stock spiked 20% in a day, but clearly that was a mistake and they quickly fixed it.

Unfortunately for those who chased it late, the mega spike died and the price reverted to the base. And therein lies today’s opportunity — the base will bring buyers back in.

The fundamentals for Oracle don’t need much explaining. The financial statements are bulletproof with no flagrant weaknesses. Management delivers $30 billion in gross profits and $10 billion in net income over the trailing 12 months. Growth could be better, but consistency is all we need for today’s purpose.

This is not a cheap stock — it is boring yet it still carries a 22 P/E. Nevertheless, owners of the stock are realistic with their expectations. Therefore it will be hard to disappoint them too much. What happened earlier this month was a special circumstance. The reversal came from extreme altitudes, and they fixed an over-exuberant reaction to moderately mild news.

Oracle stock will follow the equity markets in general. However, I consider this to be a tactical opportunity, which needs the bull market to continue into 2022.

Riot Blockchain (RIOT)

The topic of crypto remains a controversial one. Even the discussion I have with my own family can get hot. The initial reaction for those who don’t know about it is one of apprehension. I get it, this is something new and is full of knowledge holes.

Meanwhile, a few companies are trying to make a go of it. Riot Blockchain is one that deals with the mining of crypto. Therefore RIOT stock tracks the progression of Bitcoin (CCC:BTC-USD) prices closely. BTC-USD is the crypto spokes-coin. When it rises and falls then so does RIOT.

Crypto prices have fallen in December, so the correction dragged RIOT with it. These happen often so it is nothing that the sector has not seen before. Since the middle of November, the stock has lost almost half its value. The easy work for the bears has already fallen out of the stock price.

About 10 days ago, the bulls made a stand just under $22 per share. The stock is now retesting that zone for footing. The theory today is that support will hold and bring about a tradable rally. The retracement could even bring it back to $32 per share. That the trip back will not be easy, because there are resistance lines at $26 and $30 per share.

Moreover, if for whatever reason Bitcoin falls below $42,000, it could trigger a bearish pattern with ominous circumstances. In that scenario, RIOT stock would follow suit and make new lows. But that also would be an opportunity to add to the position. Investors can start a position now but not a full one. Because it is prudent to leave room for error just in case the worst case scenario develops.

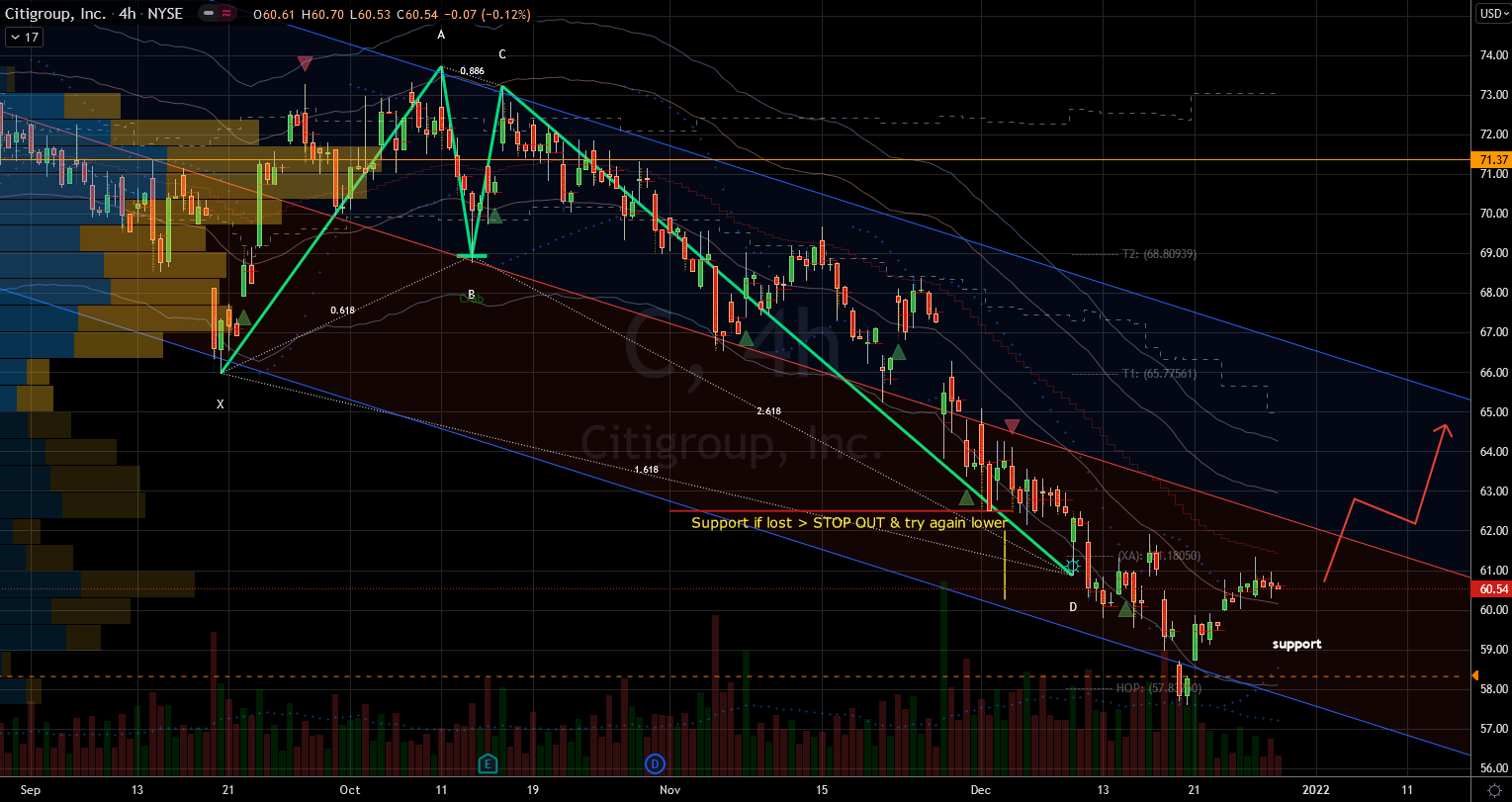

Stocks to Buy: Citigroup (C)

I am even surprising myself with my third pick of the day. I am not a fan of chasing bank stocks going into the Fed flipping monetary policies. But Citigroup stock technically shows a lot of promise. This is more about what’s in the charts rather than what has changed in the company.

The fundamentals for this giant financial center have not changed much. After the 2008 financial disaster, banks cultivated stronger balance sheets. Regulatory limits have kept the financial ingenuity to a minimum.

Nevertheless the fundamental statistics on C stock remain humble. This is a typical characteristic for all major money centers. The trailing price-to-earnings for this giant is under 6. Moreover, the price-to-book is well under one. Therefore investors in Citigroup are realistic with their expectations. This is to say that it will be hard to disappoint them, therefore so the stock has support.

If the bulls are able to stay above $59 per share, they have the opportunity to rally another 10%. There would be a few resistance levels along the way, but technically it is doable. Yesterday U.S. bond yields spiked and that usually places a bid in banks. However the sector was down slightly. This is somewhat concerning since they may have lost their tailwinds.

I would keep this concern on for the next three months. The Fed is pulling back on its stimulus. Some of the bank free rides may disappear. Caution is definitely key to this tactical trade that can also double as an investment.

On the date of publication, Nicolas Chahine did not have (either directly or indirectly) any positions in the securities mentioned in this article. The opinions expressed in this article are those of the writer, subject to the InvestorPlace.com Publishing Guidelines.

Nicolas Chahine is the managing director of SellSpreads.com.