OpenDoor Technologies (NASDAQ:OPEN) is a housing company focused on the iBuying market. OPEN stock had gotten hammered this year thanks to the selloff in speculative companies plus the sharp rise in interest rates.

However, OpenDoor has enjoyed something of a comeback in recent weeks, with the stock rallying off the lows. Part of that is due to a bounce back in the broader sector.

But there is seemingly some excitement around the idea that the housing market is in better shape than feared as well. However, a closer dive into the situation shows several reasons for caution with OPEN stock.

Zillow’s Exit From Home Buying

Both Zillow (NASDAQ:ZG) and OpenDoor historically put a lot of energy into the iBuying market. However, Zillow shocked the industry last year when it announced it was exiting the arena.

The company simply couldn’t make the math work, saying it would take a write-down of at least $304 million and potentially more as it sought to close down its operations.

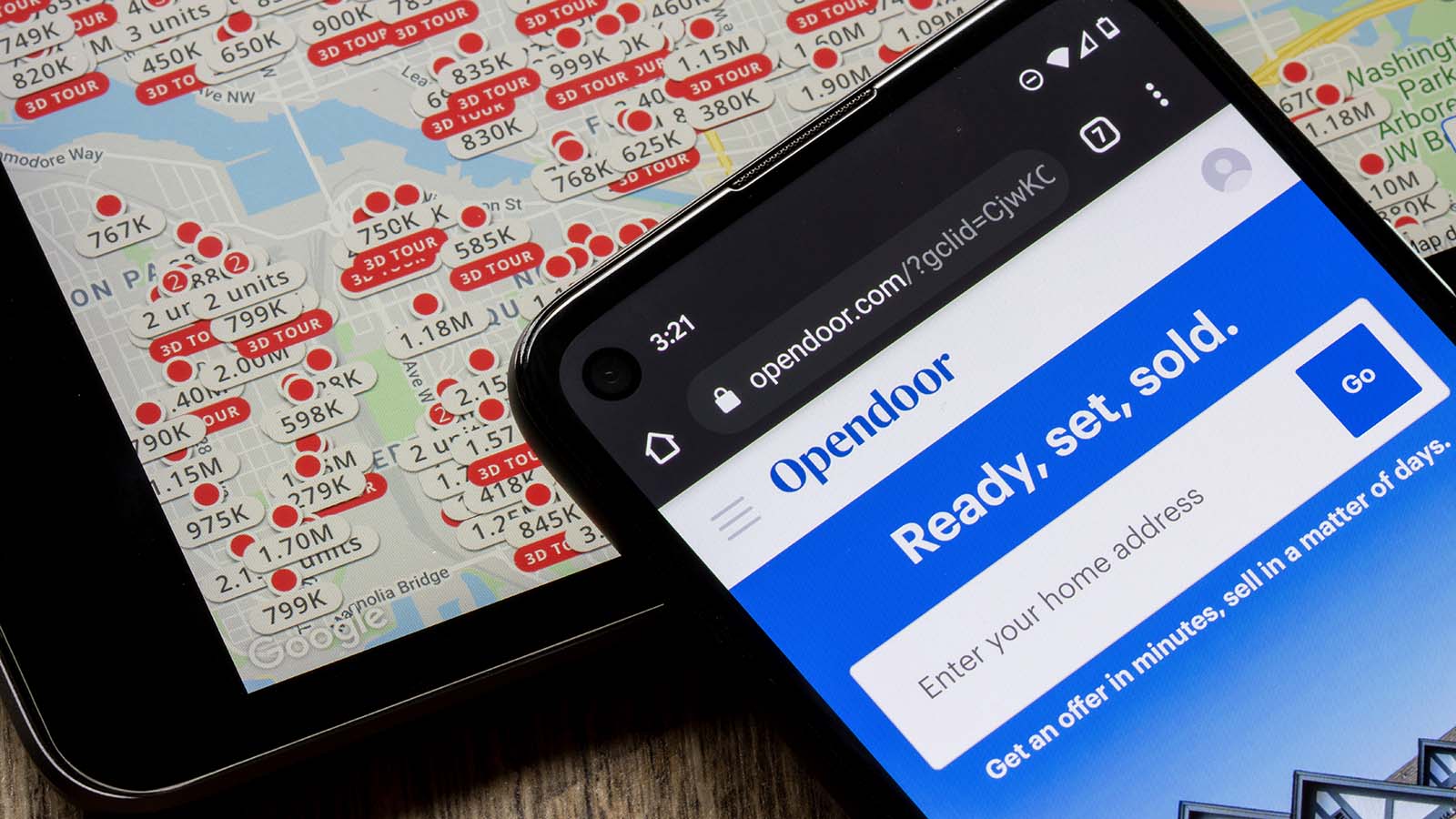

iBuying is where companies like Zillow and OpenDoor offer to buy a house from a seller for cash immediately. These offers tend to be a little low compared to the market, say 10% under the average price, but give the seller an immediate exit. Compared to waiting for a regular buyer to appear through a real estate agent, the instant liquidity can seem appealing.

In theory, Zillow, with its huge real estate database, should have had some top-notch info. Who would be better equipped to profit from pricing discrepancies across different neighborhoods in a city? And yet, in practice, Zillow’s iBuying effort flamed out horribly. This doesn’t bode well for OPEN stock.

Is OPEN Stock an Opportunity or a Risk?

What went wrong for Zillow? Here, OpenDoor analysts can paint a picture in either direction. On the one hand, analysts believe Zillow was a bit too aggressive. Perhaps it put too much faith in its algorithm. Scaling up its home buying operations so quickly while relying on an artificial-intelligence (AI) driven model may have been too much, too fast.

By contrast, OpenDoor is perceived to use a more conservative model to carry out its operations. It seems to try to get a higher profit margin on each home it sells. Plus, it wasn’t as aggressive in terms of marketing its AI system as a magic bullet.

Zillow’s home estimate pricing tool delivers good data in many cases. However, in some specific cities and areas, its estimates sometimes seem way off the mark.

It’s not hard to imagine how savvy home owners were able to use Zillow’s AI-driven estimates to get a good deal selling to Zillow’s automated system. But by contrast, with more humans involved, OpenDoor may be better able to streamline its process and avoid buying mispriced deals.

But Better Execution Might Not Matter

Even if we suppose OpenDoor is better at running the business model than Zillow, that still might not be enough. Simply put, we’ve just witnessed two of the best years in history for the American housing market. Since the summer of 2020, prices have been roaring higher as many folks have wanted to move to new homes.

Against these all-time great market conditions for selling homes, Zillow lost hundreds of millions of dollars flipping properties. It’s hard to overstate how terrible that looks.

If Zillow couldn’t make money flipping homes in 2021, is iBuying ever going to work at a large scale? Sure, OpenDoor may be incrementally better at the business. But the business itself is probably about to get a whole lot worse.

With the average 30-year fixed mortgage in the United States surging, a lot of buyers will have to downsize their potential loans. Every additional dollar that goes to interest can’t go toward principal for a higher offer price.

In addition, soaring inflation and rates tend to hammer consumer confidence. Instead of looking out for the “roaring 20s,” now people are worried about a recession again.

The Verdict on OPEN Stock

The verdict is pretty simple on this one. Long story short, the marginal demand for houses is about to drop. And in that environment, a house-flipping strategy based around making small profits on tons of deals looks especially vulnerable. Margin is so low on this business that any downturn in the housing market could leave OpenDoor and other buyers with large amounts of inventory that can’t be sold profitably.

Perhaps OPEN stock will be able to thread the needle just right to adapt to more challenging market conditions. But with so many speculative stocks still down sharply from their highs, this is hardly the best risk-reward setup on offer today.

On the date of publication, Ian Bezek did not have (either directly or indirectly) any positions in the securities mentioned in this article. The opinions expressed in this article are those of the writer, subject to the InvestorPlace.com Publishing Guidelines.