A decade ago, Democratic and Republican legislators had elaborate plans to fix Social Security’s increasingly shaky finances. Democrats still do. But Republicans haven’t introduced a single comprehensive solvency bill since 2016.

What are they waiting for? Social Security is running out of money. It currently collects less money from workers and employers than it distributes to 65 million beneficiaries. It covers the difference by spending down its once-$3 trillion trust fund.

When the trust fund runs dry—around 2034—benefits will revert to whatever payroll taxes can then support. If Congress doesn’t fix Social Security before then, benefits for everyone—current and future beneficiaries—will be cut by more than one-fifth.

There’s nothing complicated about fixing Social Security. Legislators can raise taxes, as they did in 1977. Or they can cut benefits, as they did in 1983. Alternatively, they could reinvent the program, as they tried in 2005. All three options have been on the table since the solvency problem first emerged in the mid-1990s.

Democratic legislators seem comfortable with the 1977 playbook. All their comprehensive solvency bills target affluent workers by raising or eliminating the maximum taxable wage base. This is the ceiling—currently $147,000—on wages subject to the payroll tax. Some bills also propose raising the 6.2 percent tax rate. Others propose taxing investment income. Democrats disagree, however, on whether most new revenue should be devoted to solvency reform or benefit enhancements.

But Republican legislators have painted themselves into a corner. They insist they won’t raise taxes. But many legislators also promise they won’t harm current beneficiaries.

It is devilishly difficult to protect both taxpayers and beneficiaries in a self-funded program like Social Security. Some groups will have to pay the solvency costs. The only question is which ones.

Between 2010 and 2016, three Republican senators and three Republican representatives introduced comprehensive solvency bills. Each bill would have eliminated the long-term actuarial deficit. That is, it would have made Social Security solvent for at least 75 years.

- Six bills would have increased the full retirement age (currently 67), in one case higher than 70.

- Five would have reduced benefits for future retirees.

- Five would have reduced cost-of-living adjustments for all retirees—current and future.

Any of these bills would have fixed Social Security. Revenue would again fully support benefits.

But the six Republican solvency bills were not very popular in Congress, attracting only eight cosponsors. By comparison, 208 House Democrats cosponsored a Democratic solvency bill in 2019.

Why have Republicans failed to introduce a single comprehensive solvency plan since 2016?

One reason is that five of the six sponsors no longer serve in Congress (all but Lindsey Graham). The Republican caucus needs new volunteers to take up the mantle.

A second reason is that each year it gets tougher to achieve solvency by cutting benefits. In 1983, when Congress raised the retirement age from 65 to 67 (effectively cutting benefits), it implemented the change gradually over four decades. But now the need for revenue is more urgent. There isn’t much runway left for doing things gradually—less than a dozen years.

A third reason is that Candidate Trump and later President Trump promised not to cut Social Security benefits. It was hard for Republican legislators to continue drafting benefit-cutting bills when their leader was opposed.

A fourth reason is that some Republicans are coming to realize that they cannot restore solvency without increasing Social Security taxes. Cutting benefits can be part of a solvency package. But benefit-cutting alone won’t fly politically.

Unfortunately, Republicans cannot publicly admit the need for taxes. Most Republican legislators have signed the so-called Norquist pledge, promising never to support tax increases in any form.

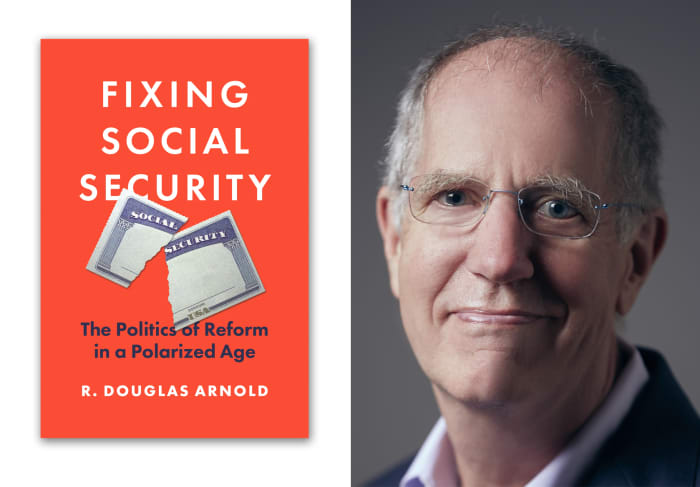

Princeton University Press

Taking the pledge may have made sense when Republicans were first running for office. No one wants to stand out in a crowded primary as the only candidate unwilling to oppose tax hikes.

But governing is tough. If you won’t raise taxes, you have to cut benefits. And if you won’t cut benefits strategically, Social Security benefits will be cut automatically, and across the board, once the trust fund empties around 2034.

Voters understand the hard choices ahead

For a while, Republicans thought reinventing Social Security would do the trick. They advocated moving from the current pay-as-you-go system to one where workers’ contributions would be diverted to individual investment accounts.

But when President Bush proposed such a plan in 2005, both the Republican-controlled Senate and the Republican-controlled House refused to consider it. The principal problem was how to pay for traditional Social Security for current and near retirees while diverting workers’ contributions to individual accounts.

Democrats and Republicans on Capitol Hill are deeply divided over how to fix Social Security. But polls show bipartisan support for Social Security among citizens. Indeed, there is widespread support among Democrats and Republicans, workers and retirees, the poor and the affluent for sensible solvency reforms. These reforms include gradual tax increases as well as modest benefit cuts.

Voters understand the hard choices ahead. Next, they need to demand that their representatives draft and co-sponsor realistic plans for fixing Social Security. Those plans can then provide the foundation for serious negotiations among party leaders about how to fix Social Security now.

R. Douglas Arnold is the William Church Osborn Professor of Public Affairs Emeritus at Princeton University and author of “Fixing Social Security: The politics of reform in a polarized age.”

More opinion: The Trust Act is not the way to fix Social Security

Also: Social Security has quietly crossed yet another financial Rubicon of systemic decay