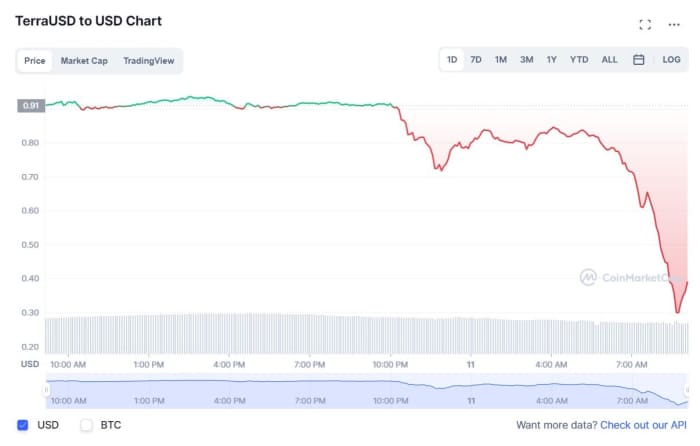

The so-called algorithmic stablecoin TerraUSD fell as low as 30 cents on the dollar on Wednesday, demonstrating in real-time the difficulties the cryptocurrency community will have in providing an alternative to the traditional financial system.

TerraUSD is a coin backed by another crypto, called Luna. The way it’s supposed to work is that when TerraUSD, or UST as it’s called, falls below $1, traders can exchange it for the equivalent of $1 of Luna.

But Luna

LUNAUSD,

also is in freefall.

Coinmarketcap

The Luna Foundation Guard earlier this week said it lent $1.5 billion, half in bitcoin, to help protect the peg.

Related: What is an algorithmic stablecoin? Why is Terra in the news? Here’s what investors need to know.

Other stablecoins, such as Tether

USDTUSD,

and USD Coin

USDCUSD,

have held their value.

Treasury Secretary Janet Yellen on Tuesday warned about the threat to financial stability from the unregulated cryptocurrency markets. “A stablecoin known as TerraUSD experienced a run and declined in value,” Yellen said. “I think that simply illustrates that this is a rapidly growing product, and that there are risks to financial stability, and we need a framework that’s appropriate.”

The largest crypto by market cap, bitcoin

BTCUSD,

slipped 1% on Thursday, and has dropped 34% this year.