Federal Reserve Chair Jerome Powell’s optimistic comments about the U.S. economy on Wednesday added to a debate among investors about whether stocks have reached a bear-market bottom.

On the one hand, Thursday’s report on the health of the American economy, prompted an even more confusing discourse on where things actually stand when it comes to a recession.

Second-quarter GDP data, which showed the U.S. economy shrank by 0.9% on an annualized basis in the three-month period from April through June, intensified fears that the economy might already have slipped into recession.

See: Is the U.S. in recession now? Not yet — and here’s why

On the other hand, the S&P 500

SPX,

officially entered bear-market territory in mid-June, and cemented its worst first-half performance since 1970, signs that many investors have been pricing in an economic downturn.

Adding to the malaise was the June consumer-price index that came in especially hot at 9.1%, a 41-year high. It was followed Friday by the release of the Fed’s preferred monthly inflation gauge, the personal-consumption price index, which provides no reprieve from price pressures at a four-decade high.

But a view that the Fed might need to “pivot” and back away from its full slate of planned rate hikes though 2023, if the economic picture worsens, has been gaining steam on Wall Street, helping major stock benchmarks in July to book their best month in nearly two years.

Strong performance for stocks and other parts of credit markets in July have led to a torrent of viewpoints heading into August, telling investors why that strategy looks flawed, or not.

“When looking at moving averages at the stock level in the S&P 500, it would suggest we are not out of the woods,” said Megan Horneman, chief investment officer at Verdence Capital Advisors, in a client note this week. “The S&P 500 just crossed above its 50-day moving average for the first time since April last week. However, there are only 55% of stocks in the index that are above that average.”

“When you want to signal the ‘all clear,’ that number needs to be higher — 80 or 90%. That’s when we’re all clear on if we have reached the bottom,” Horneman told MarketWatch in a follow up call Friday. “That’s why I’m not convinced that the bottom has completely been made. I think there’s a chance for a lot more volatility.”

Read: Whatever you’re feeling now about stocks is normal bear-market grief — and the worst is yet to come

Are we in a recession?

The central bank has taken pains to remind people that just two quarters of negative growth doesn’t automatically mean the economy is in a recession, but one still could be “almost a slam dunk over the next 12 months,” wrote Jim Reid, a strategist at Deutsche Bank, in a Thursday note.

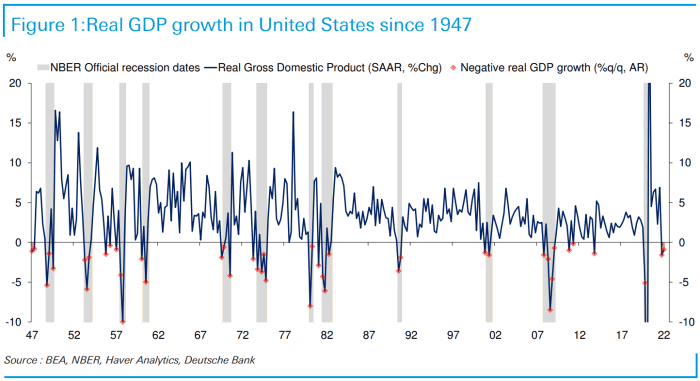

Historical data suggests that since 1947 (see chart below), there have never been two successive negative quarterly GDP results without the period being defined as a recession by the National Bureau of Economic Research (NBER), the official documenter of the U.S. economic cycles. “It’s been rare to have negative GDP quarters at all outside of a recession,” according to Reid.

SOURCE: BEA, NBER, HAVER ANALYTICS, DEUTSCHE BANK

From Horneman’s perspective, the U.S. technically already entered a recession after two quarters of declining growth.

Either way, there have been some bright spots for households as inflation cuts into paychecks. Wages and salaries for civilian workers increased 1.4% in the second quarter and 5.3% over the year ending in June, according to data from the U.S. Bureau of Labor Statistics on Friday. A closely watched economic data point next week will be Friday’s jobs report for July. A robust June report fueled optimism that recession still might be averted.

U.S. Treasury Secretary Janet Yellen on Thursday said the economy has weakened, but it’s still healthy by many measures compared with previous downturns. She said some slowdown in the economy is necessary to help combat inflation.

What earnings show: consumer spending

Consumer spending has long been a key driver of the American economy, with corporate earnings from the likes of Apple Inc.

AAPL,

and Amazon

AMZN,

this week bringing cheer to investors, even as inflation ripples through the economy.

Bryan Perry, senior director at Navellier & Associates, said “one theme keeps showing up from the leading companies that have reported their numbers — demand for their goods and services is healthy,” in a Friday note, adding that top trucking, railroad, airline and lodging companies have been reporting solid demand.

Through Friday morning, nearly half of the S&P 500 companies had reported a blended profits growth rate of 7.6%, with 76% beating Wall Street forecasts, according to I/B/E/S data provided by Refinitiv.

Perry also said “a recession is looking less likely, at least one of any significance that will derail the stock market from violating its long-term uptrend line.”

Horneman has been telling investors to look at areas that appear to have priced in the most downside risk to start putting their dry powder to work.

“At this point, the market has priced in the majority of the downside risk,” Horneman said.

To kick off August, Friday’s nonfarm payroll will be a highly anticipated economic data point for the week. But before that, the ISM manufacturing index and the final reading of the manufacturing PMI is due Monday. Tuesday brings the June job openings and quits data.

All three major U.S. stock indexes in July posted their best monthly gains. The large-cap benchmark S&P 500

SPX,

ended Friday up 1%, while the Dow Jones Industrial Average rose 1.4%, helping both book their biggest monthly gains since November 2020, according to Dow Jones Market Data. The tech-heavy Nasdaq Composite

COMP,

advanced 1.9% Friday to sweep to its largest monthly advance since April 2020.