Now is the time to consider dividend stocks to sell. Income investors who counted on yield alone thrived up until earlier this year. Since then, the Federal Reserve has realized it was behind the curve. Inflation, as measured by the consumer price index, rose uncontrollably. Thus, the central bank appears intent on increasing interest rates at every meeting, until price increases start to slow. Higher rates on risk-free assets like bonds, debt, and cash are bad news for dividend stocks.

Companies that have strong pricing power have nothing to worry about. Conversely, firms that sell goods that are demand-elastic, or sensitive to prices, are in trouble. Input costs rose with inflation, meaning companies that are unable to pass higher costs to customers will post lower profits.

I expect the Fed to raise rates by at least 75 basis points in each of the two meetings to end this year. That will take the Federal Funds rate to a range of 4.75% to 5.00% by early next year.

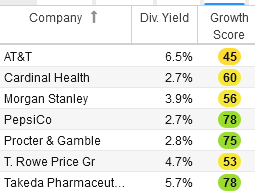

Dividend stocks in the table above have fair growth scores. Their generous dividend yields may not convince investors to overlook scores as low as 45/100. This list of dividend stocks to sell represents a wide variety of sectors, from telecom to consumer discretionary to pharmaceutical.

| CAH | Cardinal Health | $73.67 |

| MS | Morgan Stanley | $79.07 |

| PEP | PepsiCo | $176.86 |

| PG | Procter & Gamble | $129.00 |

| T | AT&T | $17.50 |

| TAK | Takeda Pharmaceutical | $12.63 |

| TROW | T. Rowe Price | $104.54 |

Cardinal Health (CAH)

First on the list of dividend stocks to sell is Cardinal Health (NYSE:CAH). This company began its business transformation before the pandemic. It focused on increasing its Cardinal brand mix to increase profit margins. Both during and following the Covid pandemic, macro supply chain disruptions hurt its momentum.

Now, the company is investing heavily to strengthen its supply chain. That said, these added costs will weigh on Cardinal Health’s margins. Customers will not experience benefits from those investments in the short-term. For example, the sales team needs time to re-engage to drive sales volumes.

Recently, some bullish momentum has taken CAH stock on a nice ride, with the stock now trading near 52-week highs. Many investors appear to be betting that the company’s pharma business will remain resilient. Still, the company may deploy its excess capital inefficiently. It will have $3.1 billion in cash to invest. With a tight labor market and increasing competition for resources, the company may disappoint investors.

Cardinal Health shares pay a dividend of $1.98, which yields 2.72%. This rate will fall significantly behind that of risk-free Treasury Bills. The 2-year U.S. Treasury now yields 4.483%.

Morgan Stanley (MS)

Morgan Stanley (NYSE:MS) has an attractive dividend that yields almost 4%. In the third quarter, the company posted a drop in net revenue and net income.

Indeed, the company’s results may not necessarily speak to this being among the dividend stocks to sell, at least on an initial look.

Looking deeper, Morgan Stanley posted revenue of $13.0 billion, with the company’s net income falling from $1.98 a share to $1.47. Investors should worry about the bank’s defensibility in terms of its return on equity. The world is disengaging from the easy monetary policies that boosted stocks for over a decade. Global tensions are hurting market sentiment. For example, Europe had its first land war in Europe in 70 years.

MS stock faces selling pressure as the Fed handles the highest inflation rates in 40 years. The higher rates rise, the sooner investors look at bank stocks to sell. Bulls might buy Morgan Stanley because it benefits from high net interest income. However, an economic slowdown hurts deal-making volumes, offsetting this tailwind to a considerable degree.

The bank managed to attract $65 billion in investment for its Wealth Management unit, despite tough market conditions. I think investors should play it safe by waiting for broader investing activity to recover before jumping into this dividend stock.

PepsiCo (PEP)

Another top holding of many investors, I view PepsiCo (NASDAQ:PEP) as one of the top dividend stocks to sell. That’s despite the company posting strong revenue growth in the third quarter. Revenue grew by 8.8% in Q3, to $21.97 billion. Thus, after raising its full-year outlook, why is PEP stock on this list at all?

Indeed, Pepsi’s strong organic growth rate of 12% (up from 10% previously) and capital distributions to shareholders are impressive. The company expects to return $6.2 billion to investors through dividends. In addition, it will buy back $1.5 billion worth of shares.

That said, the company’s recent earnings per share outlook came in basically in-line with estimates. I think the company’s bottom line is where it will see weakness. Moving forward, Pepsi might experience weaker-than-expected demand. Consumers face higher costs from big-ticket purchases. If demand falls by 1% to 2%, investors will fear an accelerated slowdown for Pepsi’s business.

Pepsi has invested heavily in its brands, including in digitizing its business. This strengthens its long-term sustainability. That said, the stock trades at a price-to-earnings ratio of 24.54 times. Thus, Pepsi really needs to post only one bad quarter to trigger a stock selloff. At these prices, the stock is not worth the risk.

Procter & Gamble (PG)

Another one of the dividend stocks to sell that made this list despite strong earnings is Procter & Gamble (NYSE:PG). The consumer goods giant posted revenue of $20.61 billion in its first fiscal quarter of 2023. That said, the company’s revenue growth of 1.3% year-over-year is too low for a firm whose stock trades at a 22.16-times price-earnings ratio.

For the fiscal year, P&G expects an earnings per share growth rate at the low end of its guidance range. This range only goes up to 4%, which many would call anemic. Shareholders might count on the company’s $9 billion in dividend payments and $6 billion to $8 billion in stock buybacks to boost its price. However, this is also a company that’s been investing heavily, and may need to pull back on these distributions in difficult times.

This investment is exemplified by the company’s accelerated push toward greater productivity. To accelerate growth, P&G needs to find potential acquisitions that complement the company’s existing product lines. Productivity increases eventually peak. Fortunately, the company is building digital capabilities. This may help it deliver results at lower costs over time.

P&G said that it spent more than $1.2 billion on media. As consumers tighten their wallets, this company might need to increase its spending to support sales further.

AT&T (T)

Next on the list of dividend stocks to sell right now is a more volatile option of late, AT&T (NYSE:T). Recently, T stock bounced from around $14.65 to close at $17.10 by Oct. 21, 2022. This is due to markets responding positively to the company’s subscription growth rates. After languishing throughout the year, I think investors should sell T stock before other profit-takers do.

AT&T added 708,000 postpaid phone customers and 338,000 fiber customers. While the company’s $14 billion in free cash flow will attract income investors, the telecom firm has high capital expenditure requirements. It must spend $6.8 billion in capital to support its infrastructure. In the fourth quarter, AT&T might convert its investment efforts to support cash flow growth. Thus, investors should expect the company’ stock price to peak sometime this quarter.

AT&T’s high debt load appears to be manageable. That said, before interest rate rates increase further, AT&T many plan to use its cash to cut its debt. The company has a net debt to adjusted EBITDA target of 2.5-times. Investors might panic sell the stock ahead of management posting its status report on its planned debt reduction in the fourth quarter.

Takeda Pharmaceutical (TAK)

Takeda Pharmaceutical (NYSE:TAK) is a Japan-based pharmaceutical company which has been treading water of late. This year, TAK stock has tried many times to break out above the $15 level. When it failed in August, investors appear to have given up. Shares closed at $12.68 last week.

On its conference call, Takeda hinted it would post strong first-quarter results. The firm posted improving margins. At a product level, the company’s management team is watching for revenue erosion from generic Velcade. This drug treats multiple myeloma and mantle cell lymphoma.

The drug firm needs its Entyvio drug, which treats ulcerative colitis and Crohn’s disease, to take market share. Additionally, Takeda is expected to launch a subcutaneous formulation of this drug in the U.S. in the next few years. In this market climate, investors are likely unwilling to wait that long for Takeda’s efforts to pay off.

U.S. investors might prefer domestic drug stocks. That’s because domestic options generally remove currency exchange risks seen with Takeda. Indeed, the weakened Yen has already considerably hit the company’s margins. This could be exacerbated in the coming quarters.

T. Rowe Price (TROW)

The last entry on our list of dividend stocks to sell is investment management firm T. Rowe Price (NASDAQ:TROW). The stock market’s plunge is scaring investors. In August, the company posted a net outflow of $24.6 billion in the third quarter of 2022. The fewer dollars T. Row Price has to manage, the less revenue it collects from asset management fees.

TROW stock faces significant selling pressure. Despite the stock’s dividend yielding 4.7% (which is above that of risk-free Treasury bonds), weak stock markets prospects has hit this company hard. Despite T. Rowe Price being a great asset management firm, in the short term, these macroeconomic headwinds are too great for its shareholders to overcome.

The macro environment could get worse before it gets better. This increases the risk of a steeper sell-off in the stock. Now that the company’s price-earnings ratio is below 10 times, this stock actually shows promising value. That said, should a panic ensue in the stock market, I think the company’s price-earnings ratio could drop as low as 8-times earnings, implying 20% downside from here.

This is a stock to take profits on and to add to the watch list. The company has good long-term prospects, once investors return to the stock market.

On the date of publication, Chris Lau did not have (either directly or indirectly) any positions in the securities mentioned in this article. The opinions expressed in this article are those of the writer, subject to the InvestorPlace.com Publishing Guidelines.