Investors have got the jitters as a big week unfolds — several central bank meetings including the Fed, earnings from Apple and Amazon.com, and jobs data. Yikes.

Read: The Fed and the stock market are set for a showdown this week. What’s at stake.

Any investor out there who isn’t nervous, perhaps should recheck his gut, says our call of the day, from Standard Chartered’s global head of research, Eric Robertsen.

“We do not expect an extreme economic hard landing, but we think the proverbial Goldilocks scenario is too optimistic,” Robertsen told clients in a Sunday note, adding that they are “now turning cautious on risky assets.”

Robertsen explains the two sides of an important market debate right now — the just-right Goldilocks crowd and the “recessionist” bears.

The former is growing confident with their view that inflation and central bank tightening is nearing a peak and any recession will be “shallow and short-lived,” he explains. The reduction of that “central-bank driven left-side tail risk” matters more to markets than any slowdown, that side also says.

“A central bank pause, declining inflation, and attractive yields and valuations will prompt investors to reduce their underweight exposure and increase their allocation to risky assets, the Goldilocks camp argues,” he said.

He says the varied year-to-date performance across asset classes reveals 2022’s laggards are 2023’s outperformers so far. “This suggests that short-covering may be a significant contributor to performance so far, rather than overwhelming faith in the Goldilocks economy.

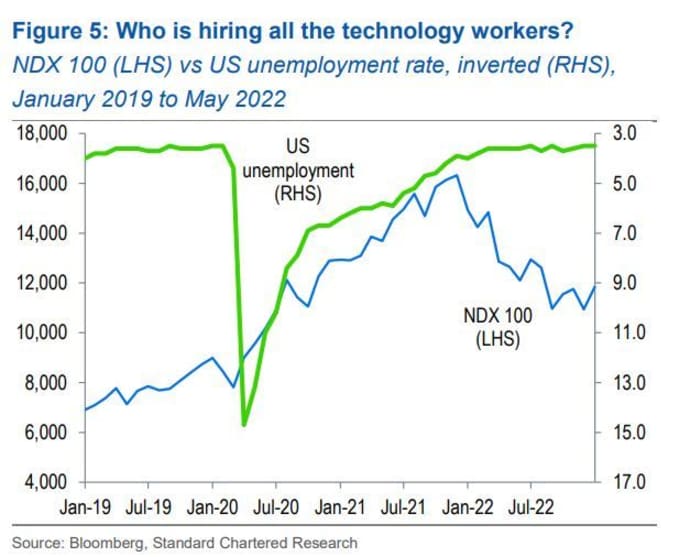

“The outperforming sectors are distinctly pro-cyclical – which is surprising with recession themes all the rage,” he says, noting that “ominous message about the health of the labor market” from tech job cuts.

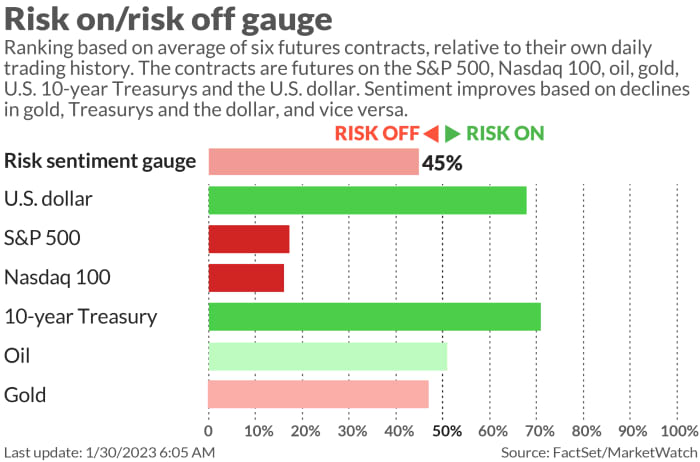

On the other side, the bears say investors are overstating a decline in volatility and understating economic risks, writes Robertsen, who is on board here, hence his caution on riskier assets.

“Real-time indicators are showing a loss of economic momentum, while others – such as the U.S. labor market – have yet to reflect growing economic headwinds,” he said. “Underlying the bear case is the view that we have yet to feel the full cumulative impact of the most aggressive monetary tightening cycle in decades.”

He says “volatility measures have fallen too far and the improvement in

risky assets is due for a pause,” adding that the catalyst could be any number of things: aggressive rate cuts priced into the U.S. money-market curve that will be unwound, a too-tight move from the European Central Bank or even an actual tightening from Bank of Japan, for example.

Should the Fed disappoint markets this week

Risk assets may also struggle with the Fed’s message this week if it fails to reassure the rate-hiking cycle is complete, says Robertse,n who expects the central bank will push back on “aggressive easing priced into the money-market curve.”

The markets

Dow futures

YM00,

are down 200 points, with bond yields

TMUBMUSD10Y,

TMUBMUSD02Y,

creeping up and oil

CL.1,

pulling back. The China CSI

000300,

rose slightly as the market reopened after a week off. The Hang Seng

HSI,

slumped 2.7% as Alibaba fell (more in buzz) and Taiwan’s index

SET,

surged 3.7% as Taiwan Semi

2330,

soared.

For more market updates plus actionable trade ideas for stocks, options and crypto, subscribe to MarketDiem by Investor’s Business Daily. Also check out MarketWatch’s Live blog for up-to-the-minute markets updates.

The buzz

The A-listers of earnings are lining up this week, with not just Apple

AAPL,

and Amazon.com

AMZN,

but Alphabet’s Google

GOOGL,

Meta

META,

Starbucks

SBUX,

McDonald’s

MCD,

Caterpillar

CAT,

and Ford

F,

as well.

Alibaba shares

BABA,

9988,

are tracking a slump in Hong Kong amid speculation the company will shift headquarters to Singapore. Alibaba dismissed the rumors.

Russia’s invasion of Ukraine will lead to lower oil and gas demand and a move to greener sources, says BP

BP,

The data calendar is quiet for Monday, but the week is busy with updates on the housing market, manufacturing, unit labor costs and nonfarm payrolls.

A 25-basis point hike is forecast from the Fed this week, while a 50-basis point cut is expected from the ECB and Bank of England, which could narrowing the differential between the two sides.

Best of the web

A short seller report has now wiped $72 billion in value from companies of the world’s number-eight billionaire

Who gives the best retirement advice? Suze Orman and Dave Ramsey or economists?

Rio Tinto is looking for a lost radioactive capsule the size of a coin in Western Australia.

We are ‘greening’ ourselves to extinction

The tickers

These were the top-searched tickers on MarketWatch as of 6 a.m. Eastern:

| Ticker | Security name |

|

TSLA, |

Tesla |

|

GME, |

GameStop |

|

LCID, |

Lucid Group I |

|

APE, |

AMC Entertainment Holdings preferred shares |

|

BBBY, |

Bed Bath & Beyond |

|

AMC, |

AMC Entertainment Holdings |

|

NIO, |

NIO |

|

MULN, |

Mullen Automotive |

|

AAPL, |

Apple |

|

AMZN, |

Amazon |

Random reads

Ain’t no greased pole greasy enough for Philadelphia Eagles fans celebrating that NFC win over the San Francisco 49ers.

Boris Johnson says Russian President Vladimir Putin threatened to take him out as the war in Ukraine began.

Need to Know starts early and is updated until the opening bell, but sign up here to get it delivered once to your email box. The emailed version will be sent out at about 7:30 a.m. Eastern.

Listen to the Best New Ideas in Money podcast with MarketWatch reporter Charles Passy and economist Stephanie Kelton