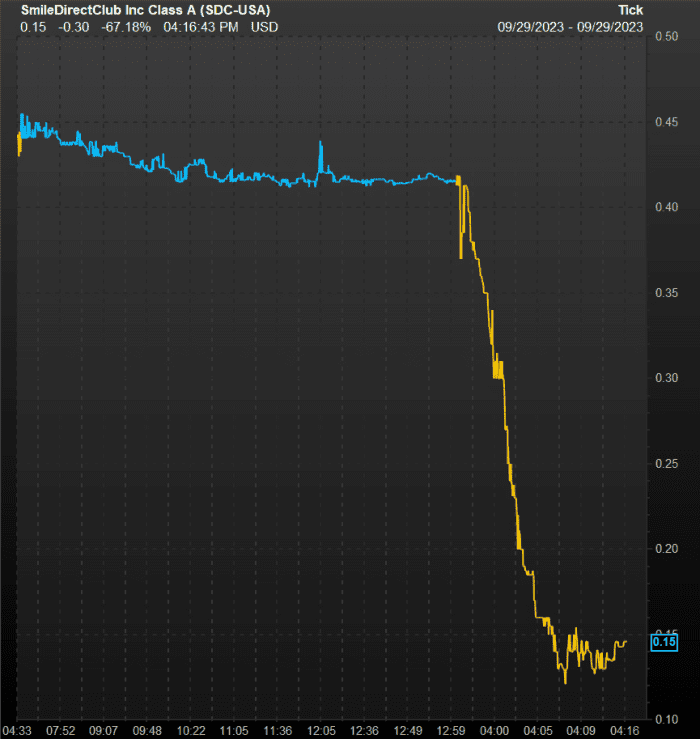

SmileDirectClub Inc. shares plummeted in the extended session Friday after the company said it had voluntarily filed for Chapter 11 bankruptcy protection as founders seek to recapitalize the teeth-straightening business.

SmileDirectClub shares

SDC,

which had been halted while up 0.9% in after-hours trading pending news, promptly dropped as much as 85% when trading in the stock reopened.

The stock had closed Friday’s regular session down 6.6% at 42 cents a share, giving the company a market capitalization of just under $170 million.

In a statement late Friday, SmileDirectClub said that its “founders have committed to invest at least $20 million to bolster the company’s balance sheet and to protect its near- and long-term financial health,” and that “up to $60 million of additional capital is available upon satisfaction of certain conditions.”

SmileDirect shares in after-hours trading Friday.

FactSet

“The founders’ investment in the company reflects their commitment to SmileDirectClub’s mission of democratizing access to premium oral care, as well their conviction in the success of the recently launched SmileMaker Platform and CarePlus growth initiatives,” the company said.

“To effectuate the transaction, SmileDirectClub has voluntarily filed for protection under Chapter 11 of the U.S. Bankruptcy Code in the U.S. Bankruptcy Court for the Southern District of Texas,” according to the company.

SmileDirectClub has had a rocky time of it since its public debut a little over four years ago, when the company priced some 58.5 million shares at $23.

The stock never closed above $19.48, which occurred a week after the IPO, and had traded at a record intraday high of $21.10 during its post-IPO debut on the Nasdaq exchange, according to FactSet data.