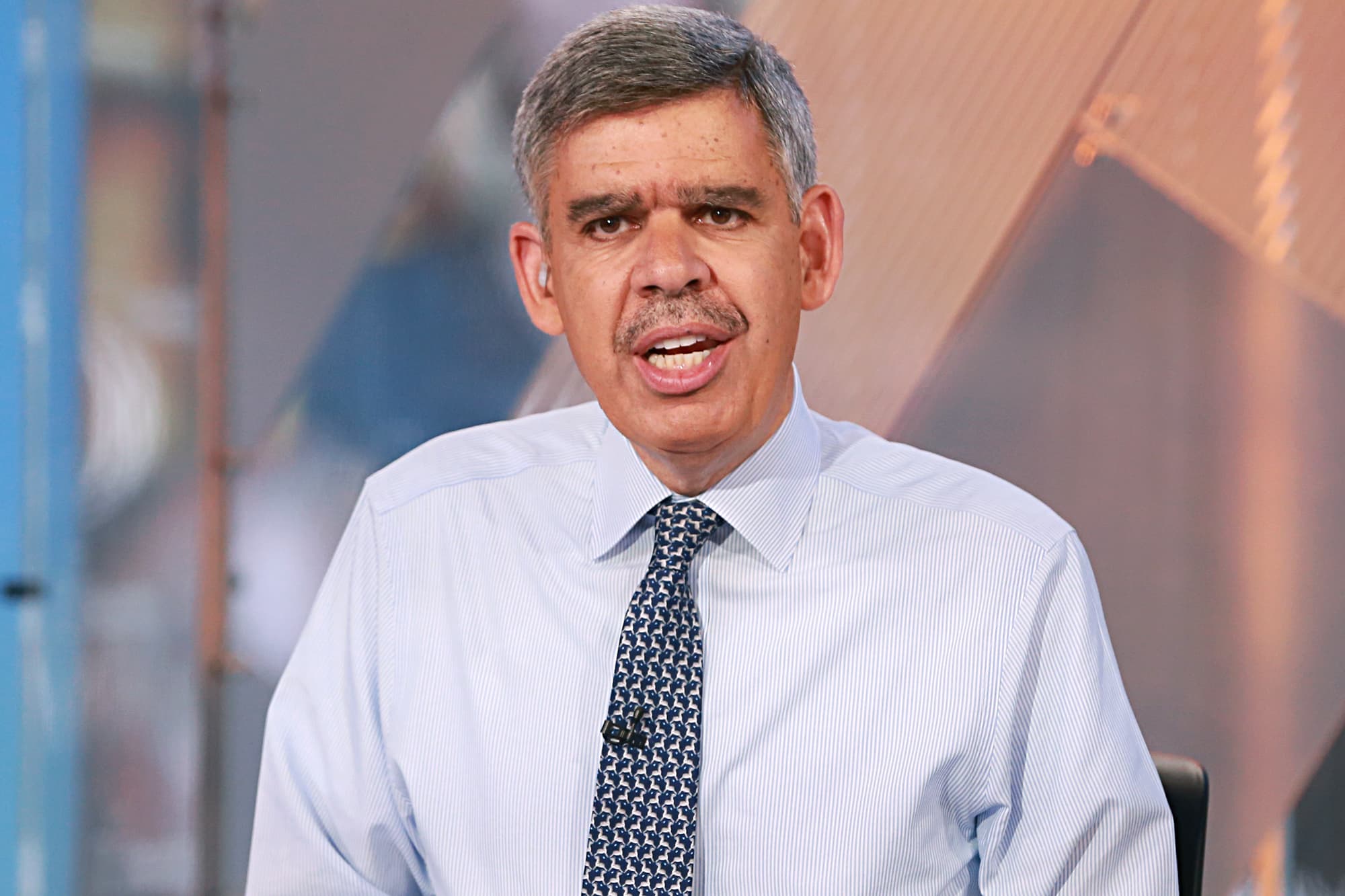

Mohamed El-Erian said Wednesday he would be hesitant to put cash to work, arguing the stock market is still on a downward trend due to the coronavirus pandemic.

But he offered a roadmap for investors who feel inclined to add to their portfolios.

“Whatever cash you have, divide it over five installments,” El-Erian said on CNBC’s “Squawk Box,” suggesting dollar cost averaging into the market over several months.

El-Erian, chief economic advisor at Allianz, said he understands why some may think the strategy of averaging into the market “isn’t very sophisticated.”

“But no one can tell you for sure how these dynamics are going to evolve. We simply have not seen this before,” he said, adding that nobody can pick the market’s exact bottom.

El-Erian’s remarks came as Wall Street was set up for declines on the first day of the second quarter. Dow futures were indicating opening losses of more than 800 points, following Tuesday’s 410-point drop.

The Dow Jones Industrial Average and S&P 500 are coming off their worst first quarters ever, driven by the economic shock from the outbreak. The 30-stock Dow fell more than 23% and the S&P 500 fell 20% in the first three months of the year.

For weeks, El-Erian has been urging investors to be cautious as uncertainty around the coronavirus disrupted financial markets. He correctly predicted in early March that coronavirus-driven selling would continue until a bear market was reached.

The former CEO of investment firm Pimco said Monday he felt that the time for investors to be “selling everything” had passed. But the “all clear” moment wasn’t here yet, he said then.

“If you feel it’s the all clear, go out and buy the index. … I don’t think we’re there yet,” he said Monday.

El-Erian said Wednesday that investors still have opportunities to upgrade the quality of their portfolios. He recommended selling the bonds or equities of any company that has no cash reverses or insignificant cash reserves, very negative cash flow, and a lot of debt coming due.

Part of his concern around companies with these attributes is that they might have to rely on government assistance in economic stimulus packages.

“If you own a company right now, you are betting not just on a bailout. You’re betting on a bailout that’s not going to undermine the capital structure. And I think that most of these bailouts are going to come with conditions,” El-Erian said.

“So be very careful if you’re trafficking in low-quality companies, whether you’re doing this in high-yield bonds .. or whether you’re doing it in certain stocks,” he cautioned.