BP (NYSE:BP) stock has been hit pretty hard in the past year. It is down 45% from the 52-week peak. In the past month, though, the stock has actually risen 34% from its low on March 18. Right now BP stock has a very attractive dividend yield of more than 10%. But will this last?

That’s in question because the company’s debt situation seems to be getting worse. That could prevent the stock from rising further if BP cannot raise cash. The company wants to reduce its gearing ratio to below 30%. Gearing measures the company’s financial leverage compared to its equity.

Asset Sales Delay Will Hurt Gearing

Banks are balking at financing the buyer for some of BP’s asset sales, The Wall Street Journal reported last week. BP announced the deal in August 2019 to sell all of its Alaska assets for $5.6 billion. This includes its Prudhoe Bay oil field and its interests in the Trans-Alaska Pipeline system. Hilcorp Energy, the largest privately held energy company in the U.S. was to finance the acquisition with banks.

But now these lenders are wondering how the deal will be worthwhile since the oil prices have dropped 60% since August.

But the problem is BP needs to reduce its leverage. So if this sale does not go through, BP stock could suffer.

For example, the company’s gearing ratio right now is over 35%. Gearing is the ratio of net debt divided by net debt plus equity.

Here are the numbers, according to the company’s recent 20-F annual report (note 27, page 201): Net debt, including leases, is $55 billion. But BP’s equity, as of December, is $100.7 billion. So the gearing ratio, $55 billion divided by $155.7 billion tops 35%.

So, we can estimate how much debt it needs to reduce in order to get down to 30% gearing. For example, if net debt plus leases drop to $43 billion, then the ratio falls to 30% (i.e., $43 billion divided by $143.7 equals 30%).

So that means net debt must decline by $12 billion, or 21.7%, from $55 billion. So you can see that this $5.6 billion asset sale needs to go through. That is less than half of the $12 billion in asset sales that BP needs to complete.

Is the Fat Dividend at Risk?

One thing to take into consideration, is whether BP can still afford the dividend without any sales. For example, right now BP stock has a 10.31% dividend yield. In fact, the company just raised the quarterly payout in February.

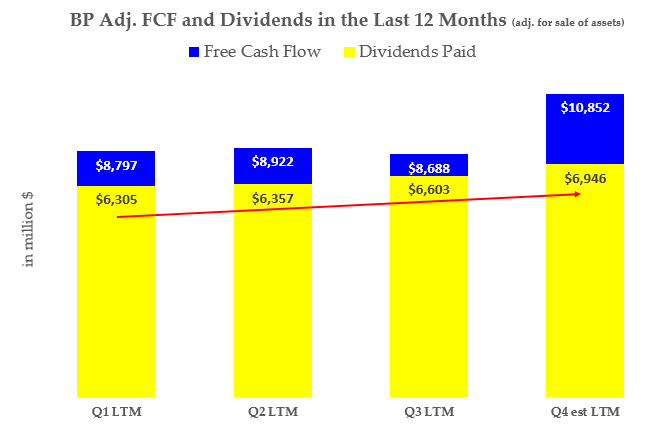

The chart below shows that, with asset sales, BP has had enough free cash flow to cover the dividend over the past 12 months. The dollar amount of asset sales in the last year was just $500 million. So BP was able to finance the dividend with its adjusted free cash flow.

However, in the months ahead, free cash flow will be significantly lower given the reduced oil prices. Some of its production is hedged, so the drop in free cash flow will slowly feed in.

For example, assuming that FCF is 30% lower over the next 12 months, it will be just $7.6 billion. But that includes $500 million in asset sales. So the net number with no asset sales is $7.1 billion.

With a dividend of $2.52 per share and 3.373 billion ADR equivalent shares outstanding, management needs $8.5 billion to keep paying investors. However, current FCF falls short by $1.4 billion. If BP has a downdraft of more than 30% in FCF, this gap will be wider.

What to do With BP Stock?

So you can see that the company needs to sell assets to cover this deficit. Otherwise, it may have to borrow more.

On the other hand, BP has already announced cuts in its forward capex spending. The bottom line is that the company expects to shave $2.1 billion from spending by the end of 2021.

So, it looks like even without asset sales, BP stock can hold up that recently expanded dividend, even at its present 10.31% yield.

I believe that knowing this, BP management will likely wait. They will see if the banks warm up to financing the $5.6 billion Hilcorp purchase of its Alaskan asset sales.

After all, this is the largest deal in the oil and gas sector right now — in fact, it’s looking like the only deals are going to be bankruptcies, such as Whiting Petroleum (NYSE:WLL) and its ilk.

Can the banks really afford to pass this up? I suspect all they want is a lower price tag. BP is likely to accommodate this in order to get the deal done.

The bottom line on BP stock is that this looks like a good time to pick up a great oil and gas name with an affordable, but high dividend yield.

As of this writing, Mark Hake, CFA does not hold a position in any of the aforementioned securities. Mark Hake runs the Total Yield Value Guide which you can review here.