Wall Street continues to hold steady as traders and investors consider when and how the U.S. economy will reopen after weeks of disruption as the novel coronavirus outbreak changes the way Americans live, work, and play.

When will non-essential businesses open? What is the timing on a treatment regime and vaccine? Will facemasks become the new normal?

There are lots of questions with few answers. But one thing that’s become abundantly clear is that there is a blitz of innovation underway as the health care industry ramps up its fight against Covid-19.

A number of stocks in the industry are perking up nicely:

So let’s see what makes each of these an interesting stock to watch here.

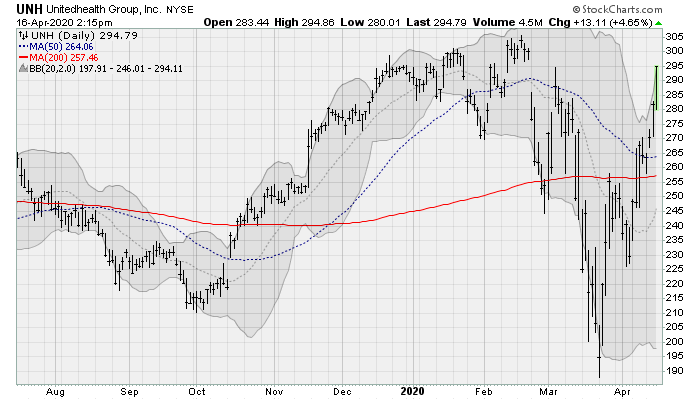

Healthcare Stocks to Buy: UnitedHealth Group (UNH)

UNH shares are blasting off from the 50-day moving average, closing in on past highs just over the $300 level to cap a 50%+ rally off of late March lows. All of this is in the context of a three-year sideways range going back to late 2018. Shares are being fueled by better-than-expected earnings, bolstered by strength across its business lines.

The nation’s largest health insurer kept its 2020 outlook intact thanks in part to a lower-than-expected medical loss ratio of 81.0% of premiums paid versus estimates of 81.57%. Earnings clocked in at $3.72 per share, beating estimates of $3.63, on a 6.8% rise in revenues. Shares were recently upgraded by analysts at Deutsche Bank, who are looking for a price target of $308.

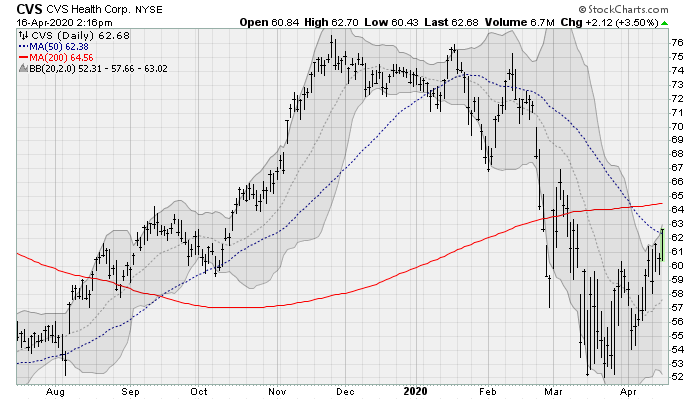

CVS Health (CVS)

CVS shares are rising off of double-bottom support near $50. The stock is now zooming back towards prior highs near $76 that have been tested time and again since the current trading range was established in late 2016.

CVS has been at the center of a number of Covid-19 developments, thanks both to its 2018 acquisition of Aetna as well as its role as a national provider of drive-through testing services.

The company reported strong Q4 2019 results back in February, with revenues up 22.9% for the quarter and 32% for the year. Earnings of $1.73 per share beat estimates by four cents. Q1 results will be reported on May 6, with earnings of $1.62 per share expected on revenues of $64.1 billion.

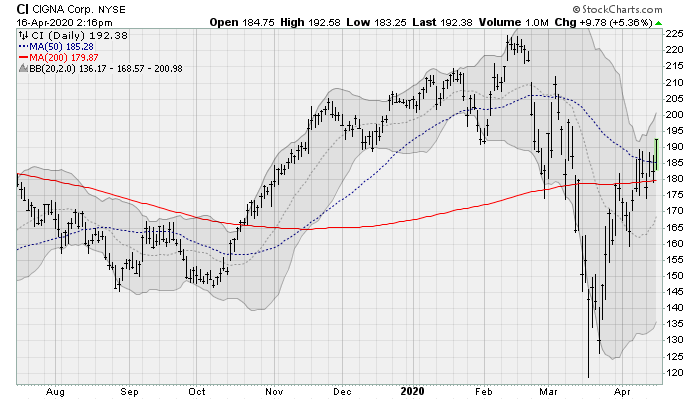

Cigna (CI)

CI shares are rallying strongly back towards triple-top resistance near the $225-a-share level capping a rise of more than 60% of its March lows. The company has been among the insurers waiving co-pays related to Covid-19 treatment and recently launched a pilot program to address loneliness as a result of social distancing and stay-at-home measures.

Shares were recently updated by Raymond James ahead of the next earnings report on April 30 before the bell. Analysts are looking for earnings of $4.35 per share on revenues of $37.2 billion. When the company last reported on Feb. 6, earnings of $4.31 beat estimates by 11 cents on a 165.7% rise in revenues.

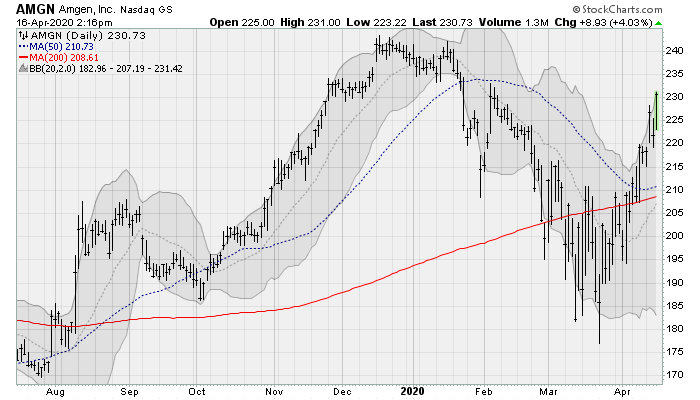

Amgen (AMGN)

AMGN shares are pushing back towards their previous high near $240, topping a rise of more than 30% from their recent low. The company recently announced a strategic partnership with Adaptive Biotech (NASDAQ:ADPT) to develop a treatment for COVID-19, either as a preventive or a cure.

The company will next reports results after the close on April 30. Analysts are looking for earnings of $3.73 per share on revenues of just over $6 billion.

When the company last reported earnings on Jan. 30, earnings of $3.64 per share beat estimates by 23 cents per share. Analysts at Guggenheim recently resumed coverage with a “neutral” rating.

As of this writing, William Roth did not hold a position in any of the aforementioned securities.