I wanted to find five dividend stocks that had very high yields that appeared to be quite secure. As you know, the dividend yield ratio is calculated by dividing the annual dividend by the price of the stock. In this case, the dividend is the latest quarterly dividend paid by the company annualized over the next 12 months.

This was also to be a diversified list of non-real estate-related companies that had enough free cash flow (FCF) to cover the dividend payments.

The following five stocks pay high dividends where the FCF is enough to cover the cost. The dividend yields equal 9% to 10% of their stock prices. The dividend stocks are:

- CenturyLink (NYSE:CTL)

- Dine Brands Global (NYSE:DIN)

- BP (NYSE:BP)

- Halliburton (NYSE:HAL)

- Meredith Corp (NYSE:MDP)

These companies are all in diversified industries. None of them are REITs. They represent an interesting cross-section of American culture.

In each of these cases, the companies are facing lower earnings and FCF because of the novel coronavirus. I factored this into my estimate of their FCF on a run-rate forward basis, so they look like good bargains.

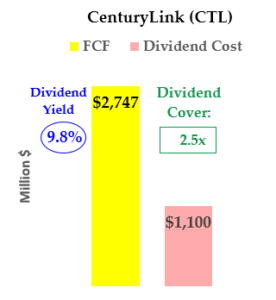

5 High Yield Dividend Stocks: CenturyLink (CTL)

Dividend Yield: 9.79%

CenturyLink is an $11 billion market cap broadband and telecom stock. It more than doubled its revenue and fiber optic capability with the cash and stock acquisition of Level 3 in late 2017. Prior to that, it acquired Qwest Communications in 2011.

CTL stock has a very attractive dividend yield of practically 9.8%, which is more than covered by the company’s abundant FCF generation.

CenturyLink now derives over 75% of its 2019 revenue of over $22.4 billion from large and small businesses. This shields it from the downturn in consumer demand in 2020.

I estimate that its FCF of over $3.05 billion last year will be down just 10% or so this to $2.75 billion. That is more than enough to cover the CenturyLink dividend cost of $1.1 billion.

In fact, it covers the dividend cost by 2.5 times. So the CTL $1 per share dividend, which yields almost 10% at today’s price of just over $10, is very secure.

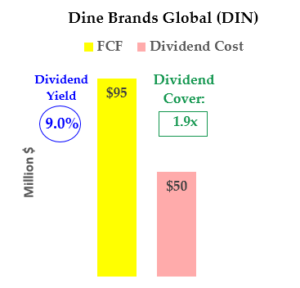

Dine Brands Global (DIN)

Dividend Yield: 9.43%

Dine Brands operates Applebee’s and IHOP restaurants. Most of its 3,618 stores are franchised. That means most of Dine Brands’ revenue is royalty and advertising income. Dine Brands owns only 69 of its brand name restaurants.

Therefore, Dine Brands’ revenue is more secure than just running a restaurant business because of its royalty income. Nevertheless, I estimate that revenue and free cash flow will be down at least 30% this year.

Cash flow from operations (CFFO) was $155.4 million in 2019. Dine Brands spent $19.4 million in capex. FCF was $136 million. I estimate FCF will be under $100 million or $95 million this year.

However, this is still enough to cover the cost of the company’s dividend. It cost just $50 million last year, so the $3.04 dividend per share is more than secure. The company’s adjusted FCF covers the dividend by almost two times.

At today’s price of just under $34, DIN stock has a very attractive dividend yield of 9.4%. In fact, recently the stock’s cheap valuation has caught the attention of activist investors.

Dine Brands revealed early this month that JCP Partners, a Houston-based investment firm, had put a proposal forward for shareholders at the May 12 annual meeting. They want shareholders to vote to spin-off Applebee’s as a separate public company. According to Reuters, JCP’s rationale was Applebee’s has been a drag on growth and that other restaurant chains have successfully spun off segments. For example, Darden Restaurants (NYSE:DRI) sold Red Lobster to a private equity company in 2014.

Whatever happens, DIN stock is likely to be seen as a bargain with its high dividend yield once restaurants start to open back up for business.

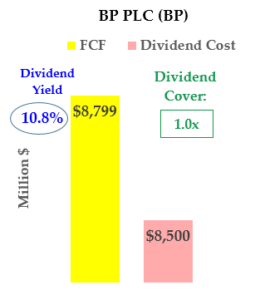

BP plc (BP)

Dividend Yield: 11%

BP is an oil and gas stock with a very high dividend yield of 11%. It has been hit pretty hard in the past year, down 45% from its 52-week peak. In the past month, though, BP stock has actually risen 34% from its low on March 18.

Part of the reason for its cheapness is the company’s debt levels. I wrote about this last week. BP wants to reduce its gearing ratio to below 30%. Gearing measures the company’s financial leverage compared to its equity.

However, I estimate that the company will have just enough FCF to cover its dividend even after a 15% fall in FCF this year. You can see this in the chart at the right. This shows that the FCF dividend cover ratio is 1.0 times.

It also shows that the dividend costs about $8.5 billion but FCF will still be above this at $8.8 billion. In fact, the company can probably afford to continue paying the dividend even if FCF is not as high as the dividend cost. This is because it can sell assets and borrow while it waits for oil and gas prices to recover.

BP has already announced cuts in its forward capex spending. The bottom line is that the company expects to shave $2.1 billion from spending by the end of 2021. This will help it to continue paying the dividend.

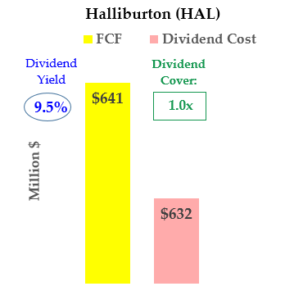

Halliburton (HAL)

Dividend Yield: 9.2%

Halliburton is an oil and gas services company that has a high dividend yield of around 9.2%. Moreover, based on my estimates, the company can still afford its dividend.

I estimate that, given its recent cuts in operating costs including executive pay and capex spending, Halliburton will still generate enough FCF to cover the dividend. For example, last year Halliburton had $2.46 billion in CFFO and $1,530 million in capex. I estimate this year its $915 million in FCF will be down at least 30%.

As the chart at the right shows, the dividend coverage ratio will still be 1.0 times. That is because the dividend costs about $632 million compared to the estimated FCF of $641 million.

I wrote about this in more detail earlier this month. Now that Saudi Arabia and other OPEC and oil-producing states have agreed on oil production cuts, the price of oil may stabilize. It should begin to rise as the U.S. and other economies recuperate from the impact of the coronavirus. That will help bring Halliburton’s business growth back.

Investors will then see that HAL stock’s dividend yield is a good bargain. Look for good things to happen with this dividend stock from here on out.

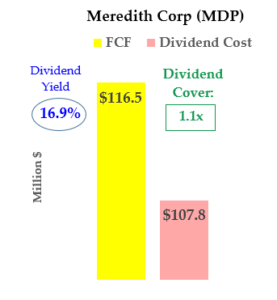

Meredith Corp (MDP)

Dividend Yield: 18.7%

Meredith is the No. 1 magazine operator in the U.S. It publishes People, In-Style, Better Homes and Gardens and Martha Stewart Living. It also owns 17 TV stations. Its businesses focus on selling ads to women.

MDP stock is very cheap and sports a 18.7% dividend yield. But I estimate that even with a 40% drop in its FCF from last year, the dividend will still be covered by FCF.

Last year, MDP made $258 million in CFFO and it spent only $64 million on capex. So its FCF of $194 easily covered the $108 million cost of the dividend.

Even if FCF falls 40% to $116 million, the dividend will still be covered by 1.1 times. Recently Meredith took actions to ensure that its advertisers stuck with the company.

For example, Meredith claims to reach more than 190 million American consumers every month and nearly 95 percent of all women in the U.S. It announced a program called the Meredith Audience Action Guarantee (MAAG). In effect, it guarantees that people will take action as a result of seeing a brand campaign in Meredith magazines. This is a unique way of trying to keep its clients.

In time, the MDP stock will be seen as a good bargain with this very high dividend yield.

Bottom Line on These 5 High-Yielding Dividend Stocks

Overall, this set of dividend stocks has cheap valuations and very high-yield dividends. That’s a good bargain.

These non-real estate-related companies have good underlying cash flows that will pick up as the economy revives. But even if it takes longer than expected, these stocks will be able to afford their high dividend yields. The idea is that over time investors will recognize this and bid the stocks higher.

In conclusion, this looks to be a good bargain for value-based investors. For example, it is ideal for those who are looking for a group of high-yield stocks that can cover those dividends with free cash flow.

As of this writing, Mark Hake, CFA does not hold a position in any of the aforementioned securities. Mark Hake runs the Total Yield Value Guide which you can review here.