As the markets look to finish the first full week of the new calendar month, the current bullish trend in motion continues to look friendly overall. But notorious fabled advice is also making sense in select overbought price charts, hinting at stocks to sell right now.

It wasn’t long ago that the novel coronavirus pandemic allowed bears to tear up stocks and market averages with record-breaking authority. Without needing to be to specific, broad-based leadership from Apple (NASDAQ:AAPL) to Zillow (NASDAQ:Z) saw stock prices crushed, as uncertain economic and social plights were aggressively priced in.

Regrettably, greedy bears overstaying their welcome have been punished in stocks almost uniformly across-the-board. An impressive and near historic rally over the last several weeks has handsomely benefited bulls staying the course and investors buying in along the way.

More unambiguously, the S&P 500 has returned around 35% at its recent high and retraced a full 62% of the short-lived bear market. It’s amazing to say the least. And stocks like Apple and Zillow have seen their shares turn in fairly common, but amazing retracements of about 76% and 62%, respectively.

Alas, some stocks may be taking today’s rally and recently crowned new bull market a bit too far:

Timeless advice offered by Warren Buffett to be fearful when others are greedy, aligned with seasonal instruction to sell in May and overbought price charts point at three stocks to smartly sell right now.

Stocks to Sell: Shopify (SHOP)

Source: Charts by TradingView

Shopify is the first of the key stocks to sell now. Growth investors are familiar with the e-commerce outfit. Shopify’s multiple platforms help businesses grow their online presence. And without question it has been one of the more consistent bear-killing growth stories of the last couple years.

Today’s well-overused “new normal” environment has only solidified Shopify’s prospects. This week’s earnings beat appears to have offered a glimpse of even greater things to come. Still, it seems like a better time to be fearful.

Even the best and brightest growth stocks go through corrections. What’s more, those market cycles typically happen when everyone is most excited about a stock. And right now, there is increasing post-earnings chatter of Shopify being the next Amazon (NASDAQ:AMZN), which raises a flag. But that’s not the only bearish signal.

From a technical perspective, SHOP stock is also overbought. The weekly chart shows bullish investors have pushed prices outside the weekly Bollinger band, while challenging multiple Fibonacci extension levels. All told, potential upside returns take a backseat to today’s more authoritative downside risks in the near-term.

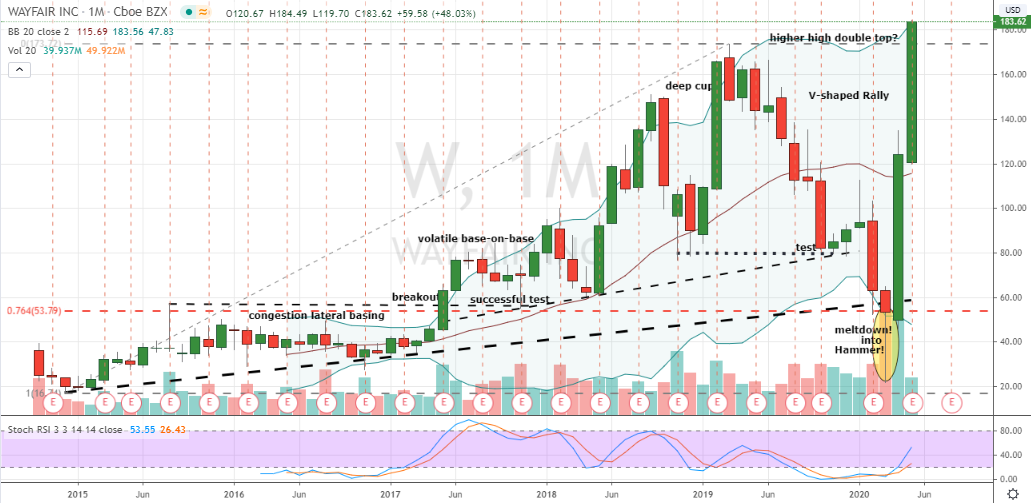

Wayfair (W)

Source: Charts by TradingView

Next up? Wayfair. This is another company trying to muscle in on Amazon’s action. The angle here is that with many sitting more comfortably in their cribs during stay-at-home orders Wayfair will profit greatly. After all, it is a home goods retailer.

As with Shopify, business has been good for Wayfair. This week’s earnings are a testament to consumers willing to make purchases other than toilet paper or sanitizer during the coronavirus. Here though, the quarterly results also show a company still steeped in massive red ink.

But now, Wayfair’s heavily shorted and largely underwater bear population have the opportunity to beat back bulls.

From a deeply oversold position at the height of the coronavirus selling, shares have rocketed higher out of a monthly hammer bottom by a staggering 700%, give or take a few percentage points. Adding to our fear, W stock bulls have gone too far. The V-shaped rally is challenging the monthly chart’s upper Bollinger Band amid price action, which could turn into a bearish higher-high, double-top pattern.

Peloton Interactive (PTON)

Source: Charts by TradingView

Peloton Interactive is the last of the key stocks to sell now. For consumers that aren’t reinventing their living rooms from Wayfair, some have been caught purchasing Peloton’s pricey connected fitness cycles. This week’s earnings saw a solid sales beat, a surprising and extremely low churn rate of less than half a percent, raised guidance and forecast of 1 million full-year subscribers to the outfit’s live, online cycling classes.

The news and environment has clearly been in gear for bulls. But away from headlines and sound bites, Peloton shares are another example of investors maybe growing too ambitious for their own good.

Technically, this is another name to take profits as Peloton challenges Fibonacci and Bollinger Band resistance. Shorting? You’d be in good company. Shares do sport short interest of roughly 42%. Personally, I’m not onboard for a more bearish “spin cycle.” And given a healthy cooling off period, this stock to sell would be much more buyable down the road.

Disclosure: Investment accounts under Christopher Tyler’s management does not own any securities mentioned in this article. The information offered is based upon Christopher Tyler’s observations and strictly intended for educational purposes only; the use of which is the responsibility of the individual. For additional market insights and related musings, follow Chris on Twitter @Options_CAT and StockTwits.