BP Plc (NYSE:BP) stock now theoretically yields 11.55%, as of Friday, May 15. The problem is the company is likely to cut its dividend, making BP stock vulnerable.

You may recall that last month on April 15 I wrote that BP could not afford its dividend at the present level. I showed that the present dividend was not affordable by the free cash flow (FCF) that the company generates.

Without asset sales, the company was not going to be able to pay the annual $8.5 billion cost of dividends.

Analysts and the BP Stock Dividend

Any time a stock has a dividend well above 10% there is considerable doubt that the dividend can be sustained. The way that works is the traders sell the stock in advance of the dividend cut, making the dividend yield higher.

Then when the news hits, it’s often not a case of “Buy the rumor, sell the news.” Shocked holders of the stock tend to push out of the stock, assuming there is something wrong with the company. Often this includes institutional investors who may have “cut bait” rules about stocks that reduce their dividends.

On Friday, May 15, Morgan Stanley downgraded BP to Underweight from Equal Weight. That means to cut your portfolio’s percentage in the stock to lower than it would be as normal weight, either if you are indexing or close to indexing, or if you have a set weight for this kind of stock.

Seeking Alpha reported that the report by Morgan Stanley says BP is likely to cut the dividend by 50%. This is because, over the medium term, this is what will fit into the BP’s capital budget, especially its rising debt.

Earnings and the BP Stock Dividend

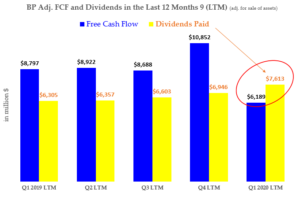

Since then the company announced its earnings for Q1. For the last 12 months, BP generated only $6.189 billion in adjusted FCF. This is lower than the cost of dividends in the past year.

You can see the progression of dividends versus the adjusted FCF in the chart I have put together above.

The reason why I say dividends cost $8.5 billion is that BP raised the quarterly dividend to 63 cents in February. It declared a higher dividend again on April 28.

So you can see that the LTM FCF fell 43% from $10.85 billion to just $6.19 billion. That clearly does not cover the ongoing $8.5 billion cost of the dividends going forward – almost $2.3 billion annually.

The Morgan Stanley Argument for a Dividend Cut

Barron’s reported on May 15 that two other major oil gas companies recently cut their dividends: Royal Dutch Shell (NYSE:RDS.A, RDS.B) and Equinor (NYSE:EQNR). Royal Dutch Shell is based in the UK and the Netherlands and Equinor is based in Norway.

Here is the crux of the Morgan Stanley argument by the analyst, Martijn Rats: He says capital spending needs to be three times the dividend in order to justify the internal rate of return. But BP is going to spend $12 billion, but its dividend will cost $8.4 billion. That is a ratio of 1.5, half of the 3 times ratio needed.

That is why he expects the dividend will be cut 50%. At $4.4 billion annual cost, or $1.26 per share, the ratio will be closer to the 3 times ratio normally used in the industry.

Why Some May Not Believe This Analysis

First of all, if BP was going to cut the dividend, they would have done it when they just declared the recent quarterly dividend on April 28. That was when the company announced its earnings for Q1.

Second, some may believe the dip in oil and gas prices is temporary. The May 1 OPEC production cut plus the global easing of lockdown restrictions reduces supply and increases demand. That will dramatically increase the company’s cash flow.

But Barron’s reported that BP management doesn’t agree with Morgan Stanley:

“On its first- quarter earnings call, the company said that the company had been lowering its break-even level to cover the dividend, meaning that it can withstand lower prices and still feel comfortable with the level of the dividend.”

Barron’s quoted the Morgan Stanley analyst’s response that capital spending productivity may not be the same as in the past.

I tend to agree with the analyst. So far, the market seems to be agreeing with him as well. If major deficits between FCF and dividend costs persist, BP will likely cut the dividend.

As of this writing, Mark Hake, CFA does not hold a position in any of the aforementioned securities. Mark Hake runs the Total Yield Value Guide, which you can review here.