Stocks climbed again on Thursday, with the S&P 500 up about 85 basis points as of this writing. However, poor breadth has traders wondering if the rally is getting a bit tired. With that in mind, let’s look at a few top stock trades as we head into Friday.

Top Stock Trades for Tomorrow No. 1: Roku (ROKU)

Roku (NASDAQ:ROKU) was a fun trade on Thursday. We saw buyers step in on Wednesday, bouncing shares off that $102 area.

With Thursday’s continuation, shares are breaking above short-term downtrend resistance and rotating over the prior session’s high. That has investors looking at Wednesday’s action as a reversal.

Roku is also reclaiming the 50-day moving average in the process.

I want to see if shares can reclaim the 20-day moving average next, putting short-term resistance near $120 back in play. Above that puts the 200-day moving average in play. Below $100, however, and we’ll have to wait for Roku to set up again.

Top Stock Trades for Tomorrow No. 2: Snap (SNAP)

Snap (NYSE:SNAP) stock continues to trade quite well on the long side. Shares are above the 10-day and 20-day moving averages, and continue to put in a series of higher lows.

That’s evident by the stock’s uptrend support mark (highlighted by the blue line on the chart). A move below that mark could send shares down to the 200-day moving average near $15.35.

However, shares currently are butting up against $18.50 resistance. A move over that mark could trigger a return to the prior high up at $19.76. The chart is forming what’s known as an ascending triangle, a bullish technical development. Bulls are looking for a breakout over resistance. Should support give way, the setup is broken.

Top Stock Trades for Tomorrow No. 3: Ulta Beauty (ULTA)

Ulta Beauty (NASDAQ:ULTA) is trading well ahead of earnings — but you never know how it will do once the numbers are out. The event is scheduled for Thursday after the close.

Earlier this week, Ulta broke out over resistance at $230. For the last two sessions, the stock has clung to the 200-day moving average as support. The charts are now laid out pretty clearly.

On a dip, I want to see the $230 level act as support. Below, and I want to see the 10-day and 20-day moving average buoy Ulta. On the upside, though, I want to see if shares can rally to $270. Above that could trigger a rally up toward $300.

Top Trades for Tomorrow No. 4: Dollar General (DG)

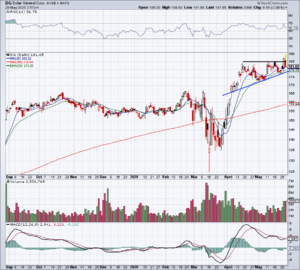

Dollar General (NYSE:DG) also has an ascending triangle setup, with bulls looking for a post-earnings breakout over $185 resistance.

In fact, they got it ahead of earnings and with shares racing to $190 early in the session, it looked to be playing out to perfection. But the stock reversed, breaking back below resistance.

It’s not a good look, but the setup isn’t totally ruined. So long as DG remains above the 20-day moving average and uptrend support, bulls can stay long. A close below support puts $172.50 back in play.

Bret Kenwell is the manager and author of Future Blue Chips and is on Twitter @BretKenwell. As of this writing, Bret Kenwell did not hold a position in any of the aforementioned securities.