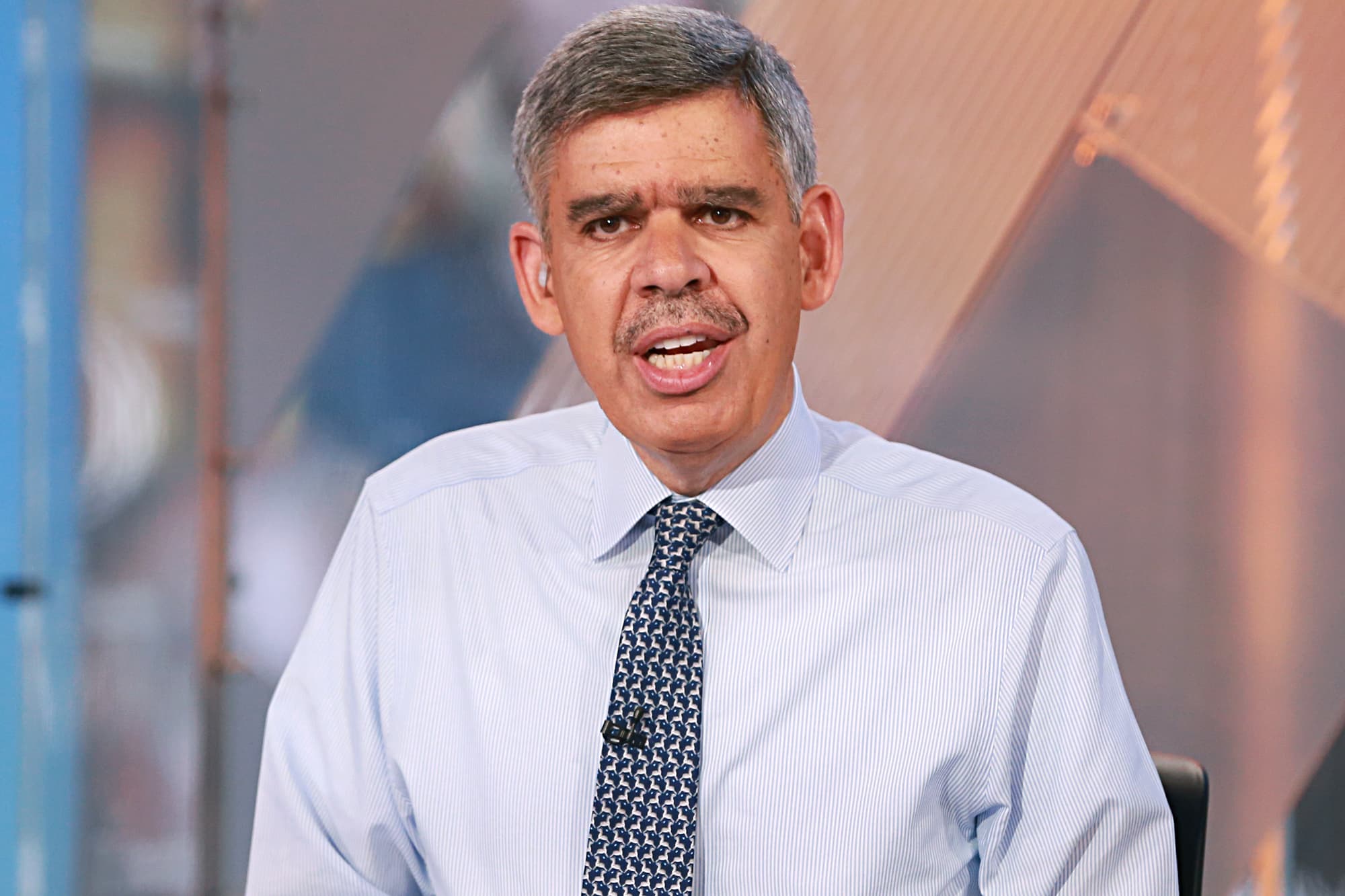

Mohamed El-Erian told CNBC on Thursday he’s waiting to put cash to work as the stock market faces more uncertainty due to the coronavirus pandemic.

“I have money on the sidelines, and I missed the last rally of the last three weeks. I’m not putting it to work here,” the chief economic advisor at Allianz said on “Squawk Box.”

El-Erian’s comments came after Wall Street on Wednesday suffered its worst day since June 11 due to growing worries about rising Covid-19 cases across the country. The S&P 500 gave up 2.59% while the Dow Jones Industrial Average fell 2.72%. The tech-heavy Nasdaq shed 2.19%, its first negative session in the past nine.

Dow futures indicated further declines at Thursday’s opening bell, following the latest weekly jobs report that showed filings for initial unemployment benefits totaled 1.48 million last week, slightly higher than expectations.

El-Erian, who in early March correctly called a coronavirus-driven bear market, has largely been cautious during the public health crisis, telling CNBC on June 8 that he was “uncomfortable” betting on a continued rally in equity markets.

Stocks fell sharply beginning in late February, hitting their virus-driven bottom on March 23 and then mounting a swift rally on fiscal and monetary rescue efforts and hopes of a strong economic recovery. As of Wednesday’s close, the S&P was nearly 40% higher than its intraday low on March 23.

El-Erian, former CEO of investment giant Pimco, said that when he begins to feel comfortable putting money to work, he will look to areas “under the umbrella.”

“There’s two types of umbrellas out there. If you are comfortable with moral hazard, the umbrella support by the Fed, which involves high-quality bonds and certain high-yield bonds,” he said. “If you’re comfortable with a market-based umbrella, it is companies with very strong balance sheet and positive cash-flow generation. There’s quite a few of them … out there, and I suspect they will continue to do well, albeit in a very volatile fashion.”

El-Erian said he believes the volatility will persist until the markets are able to find their next “anchor.” Initially, that was the policy response from the Federal Reserve and Congress and then transitioned to the economic reopening, El-Erian said. From there, retail investors who moved into beaten-down stocks helped power the market higher, he contended.

“But retail flows no longer have the same influence. You can see from what’s happened to the rotation trade. You can see this from what happened yesterday,” he said,. “So the big question is, what is the next anchor for markets? And it’s not clear to me where that’s going to come from.”