Value is a word that is thrown around by analysts, investment managers and plenty of others in the market. But for me it comes down to how a stock of a company is priced against its trailing sales or against its intrinsic value known as the book value.

Earnings, of course, are what most focus on when looking at valuation. However, earnings come with all sorts of caveats as companies report a lot of one-off items to smooth numbers for any given quarter. And it is always interesting to look at quarterly and annual reports. I like to compare the reported numbers and numbers that are reconciled with generally accepted accounting practices (GAAP).

I always run the numbers on a GAAP basis to get a better apples-to-apples comparison. This also helps get through some of the financial fluff. And it even gets more entertaining when looking at tax and U.S. Securities and Exchange filings which often can be quite different from standard releases. It’s not a good idea to fib to Uncle Sam.

In addition, I come from a credit and buy-side perspective. For decades I was in international banking and had to do plenty of credit analysis. And in fund management, I had to know that I wasn’t buying a pig-in-a-poke.

Companies Can’t Hide From Real Numbers

It’s harder for a company to fudge its sales and book value. Sales are sales — unless there is fraud. And sure, companies can take sales in a particular quarter that may be actually pending. But again, it’s pretty easy to see through accounting abuses.

Book value takes all of a company’s assets and subtracts liabilities to come to an intrinsic value. But it can also include goodwill — particularly from acquired businesses. Goodwill takes into consideration an implied value in an enterprise such as its customer base. This value is intangible, but it’s still there.

So, taking sales, I use the trailing total sales for the last four quarters and then compare it to the market capitalization. This gives me the price-sales ratio. And I compare that ratio to the market and to a company’s peers to see how that company’s stock is valued.

Then when looking at book value, I do the same with the current book against the market capitalization to get the price-book ratio.

Now, the vast majority of stocks that I recommend are at premiums to sales or book value ratios. This means that I am paying some percentage more than the trailing sales or the current book value. I only do that at levels that are at discounts to the market and a stock’s peers.

But now and again I find some very good stocks that are valued by the market at discounts to trailing sales or book value. These are special value stocks that the market is incorrectly pricing.

And the average stock’s valuation is currently running at or near three-year highs. Just look at the S&P 500. It has a price-book ratio of 3.6 times and a price-sales ratio of 2.3 times.

S&P 500 Price-Book Ratio (Orange) and Price-Sales Ratio (Olive)

The value stocks that I find make for very good buys, and I have a selection of some inside the model portfolios of my Profitable Investing. In addition, they all have dividend income. Here are five value stocks I’m recommending now:

- AllianceBernstein (NYSE:AB)

- Compass Diversified (NYSE:CODI)

- Kar Auction Services (NYSE:KAR)

- Thor Industries (NYSE:THOR)

- Hercules Capital (NYSE:HTGC)

Value Stocks to Buy: AllianceBernstein (AB)

AllianceBernstein (AB) Total Return

AllianceBernstein is an asset management company that is set up as a limited partnership. And the shares are held by 16 members of the company’s management team — so they have skin in the game. I have known the company for decades as it has been a customer of mine, and it’s run several funds that I have recommended or owned.

I have always liked the asset management sector because it provides a market-neutral quality. This means that if the stock and bond markets go up or down, asset management companies still get fee income on the assets under management (AUM). And sure, if the markets are up, AUM will reflect this with more fee income than when markets are down. But fee income keeps flowing — as long as the company is good at keeping existing customers’ assets as well as gathering more over time.

Even with the market’s severe drop in March, AUM is running at $542 billion. AllianceBernstein’s AUM continues to climb over the past seven years alone by a compound annual growth rate (CAGR) of 3.2%.

Sales are up over the past year through the most recent quarter despite market gyrations. And the company pays an ample and tax-advantaged dividend yielding 9.7%. Debt is minor compared to assets.

The shares have delivered a return of 44.8% over the past three years. And here’s where it gets good. The stock is priced at a discount to sales of 23.4% making for a discounted value. It should be bought in a taxable account.

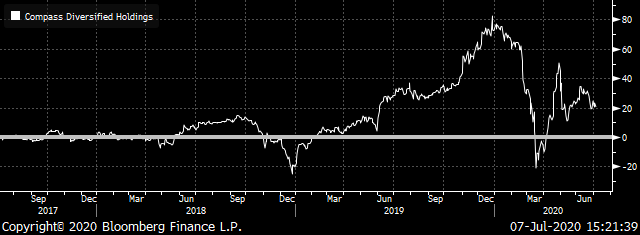

Compass Diversified (CODI)

Compass Diversified (CODI) Total Return

Compass Diversified Holdings is a company that — like AllianceBernstein — I’ve known, followed, recommended and owned almost since it came to the public market. It is structured under the Investment Companies Act of 1940 as an investment holding company, which allows it to avoid corporate income taxes.

It owns a collection of strongly branded industrial and consumer products companies. Think of it like a smaller and more strategic Berkshire Hathaway (NYSE:BRK.A, NYSE:BRK.B) in the early days of Warren Buffett.

Revenue is up by 6.8% over the past year and operating margins are thinner — but still good at 4.2%. And it delivers for shareholders with a return on equity of a whopping 24.1%. It has tons of cash with a current ratio of 310%, and debts are low at only 25.9% of assets.

The dividend yields 8.6% and has been dependable through all sorts of market and economic conditions.

Now here’s where it gets good. The stock is priced at a discount to sales by 30% making for a very good buy right now. It should be bought in a taxable account.

Kar Auction Services (KAR)

KAR Auction Services (KAR) Total Return

There are a lot of cars out in the market right now — including thousands upon thousands of used cars. Kar Auction Services, as its name implies, provides auctions for cars. This helps to get rid of inventories from dealers and creditors that need cash and need to get rid of the cars.

In normal economic conditions, Kar is a leader in making the used car market all the more efficient. But in bad times — such as now — the company is a go-to solution for raising cash and getting rid of cars.

And it also extends to salvaged cars. Accidents always happen, and with today’s cars full of all sorts of sensors, even a fender-bender can result in thousands of dollars in insurance-paid repairs. This means that salvaged cars can be worth more for parts or for foreign markets where safety and other standards are lower than in the U.S. Kar gets rid of both types of cars very well.

Revenue was off for the last quarter with the mayhem in the economy. But it has a long history of revenue gains, with the past ten years showing a compound annual growth rate of 3.3%. And for its core auction operations, the past three years show an average annual sales gain of 11.2%.

Kar has suspended its dividend for the current quarter, but plans to restore it later this year. It typically yields 3.6%. Cash and equivalents are good at 130% of current liabilities and debts are low at only 35.1% of assets.

Here’s where it gets good. The stock is priced at a discount to sales by 40%. This makes it a bargain in a leading segment. Buy KAR stock in a tax-free account.

Thor Industries (THO)

Thor Industries (THO) Total Return

There’s a lot to like about RVs. They’re the perfect solution when you have the need to get out — and stay out — of your home. Modern RVs even benefit from the coming 5G revolution, bringing new communications capabilities.

Granted, RVs aren’t really cheap, so you might be asking who potential buyers are as unemployment numbers remain higher. But don’t worry. There’s still plenty of cash in the economy to purchase these get-away vehicles.

My pick for my Profitable Investing subscribers has been Thor Industries. The company is primarily focused on North America and builds and sells motor homes, trailers and related accessories. Its brands are well-known to those that research the RV market including Airstream, Heartland, Jayco and Starcraft.

The company’s sales were trailing off from late 2016 through the first quarter of 2019. But the last four quarters have seen improvements. And I believe that the company will see further improvement in the current and pending quarters.

Thor Industries has thinner margins, like for many auto companies. But it runs a tighter ship with a return on equity running at 10.2%. It has a good cash surplus compared to liabilities exceeding 40%. And while public, management has been conservative resulting in its debt representing just 33.7% of assets.

Plus, THO pays a dividend yielding 1.7%. And even as the stock is beginning to draw attention, it is still valued at a 30% discount to its trailing sales. It is a buy in a tax-free account.

Hercules Capital (HTGC)

Hercules Capital (HTGC) Total Return

Hercules Capital is my pick for the InvestorPlace.com Best Stocks for 2020 contest. It’s an alternative financial company providing funding to technology businesses in various stages of development. Technology is one of the better forward-looking segments through the virus mess. That’s because the sector is providing solutions for more e-commerce, remote work and life sciences. Many of its highly diversified portfolio companies should continue to advance.

So how does it work? Hercules provides loans to fund company development as well as asset-based finance. It works with its companies to bring them to IPOs or takeovers. And since its founding back in 2003, it has successfully worked with nearly 500 companies, bringing billions of dollars of value to the markets.

It breaks down its portfolio into four primary groups: life sciences, general technology, sustainable and renewable energy companies, and special opportunities.

Hercules has worked with plenty of bold names over the years. Currently, it supports Fan Duel, BrightSource Energy and American Superconductor (NASDAQ:AMSC). All three are leading in their respective industries. Hercules also is benefiting right now from work-from-home trends with DocuSign (NASDAQ:DOCU) and Evernote.

And the financing isn’t just about making loans. Hercules also gets equity stakes as part of each transaction, including warrants. These provide it with gains as companies progress. But Hercules doesn’t just stop at financing and equity participation. It also provides guidance as companies develop and mature, and in turn, its portfolios become more profitable for Hercules.

HTGC distributes dividends in both regular amounts of 32 cents per share and additional special additional distributions throughout the year. That brings the annual dividend to a whopping 13.7%.

But what really makes for a compelling buy is that the stock is so cheap, even with the big return over the past quarter. The stock’s value is barely above its intrinsic value. Price-book is only 1.04 times. That compares to the average price-book ratio of the S&P Information Technology Index members of 8.9 times. Hercules is a genuine bargain right now.

Plus, Hercules’ 13.7% annual yield is even more of a value proposition. Buy HTGC stock in a taxable account now.

Neil George was once an all-star bond trader, but now he works morning and night to steer readers away from traps — and into safe, top-performing income investments. Neil’s new income program is a cash-generating machine … one that can help you collect $208 every day the market’s open. Neil does not have any holdings in the securities mentioned above.