Shares of artificial intelligence company Remark Holdings (NASDAQ:MARK) are on a fantastic bull run, as MARK stock is up almost 200% year-to-date. But I believe the momentum will lose steam as we move further along the road to recovery.

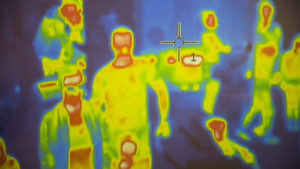

The reason for the exponential rise is down to Remark’s touch-free thermal imaging equipment. The technology uses artificial intelligence for facial recognition that can help detect people with a high fever. This helps in potentially tracing people suffering from the novel coronavirus. It also has an integrated database that keeps every scanned person on file.

Hence, it’s a no-brainer why the stock is doing so well these days. Any place that relies on social gatherings to function like airports, casinos, entertainment venues, hospitality organizations and retail venues will naturally want to use Remark’s products to trace any Covid-19 patient on their premises.

However, the big question is what will happen when we eventually get a Covid-19 vaccine. Will people still flock to buy MARK’s cameras if the disease goes the way of the Ebola virus. There is a real risk that if demand falls for their products so will the company’s share price.

That makes me skeptical of investing money in MARK stock, especially at a time when shares are trading at an enterprise value-sales ratio of 37.

MARK Stock Is a One-Trick Pony

Although Remark dabbles in several areas of business, its principal source of revenue for the foreseeable future is its thermal imaging equipment.

Several states are mulling restricting public gatherings once again, as we see a spike in Covid-19 cases. At the same time, there is intense demand to keep things open as businesses have already suffered heavy losses due to the virus. In this environment, companies are trying different things to make sure they remain open, albeit in a responsible fashion.

MGM Resorts (NYSE:MGM) and Caesars Entertainment (NASDAQ:CZR) have already mandated wearing masks, and many gaming operators have gone ahead and installed thermal cameras at their facilities. Specifically, Remark cameras are in place at the University Medical Center of Southern Nevada.

Remark has to do little to market its products; they sell themselves. That means operating margins are sure to be great for the next few quarters. But then again, the company’s fortune is too closely tied to the AI-enabled thermal cameras.

Also, due to issues with Chinese regulators, the company’s fintech operations have suffered to the point that they have become a non-factor.

Chinese Connection Is an Achilles Heel

Remark is based in Las Vegas and has additional offices in Los Angeles, Beijing, Hangzhou and Chengdu. Although incorporated in the U.S., the company has a strong affiliation with China. That will undoubtedly raise some eyebrows. As I mentioned in my article on Luckin Coffee (OTCMKTS:LKNCY), China has an unenviable history of dealing with corporate fraud.

Investors from the U.S. will always be wary of pouring their hard-earned cash in Chinese companies after that scandal. The recent issues with Luckin Coffee will only heighten these fears.

Also, the trade war with the U.S. does not help matters for Remark. There are already laws in place that restrict the movement of capital to its Chinese offices. If issues between the U.S. and China worsen, it could lead to stricter regulations.

Last Word on MARK Stock

Without a doubt, MARK stock has greatly benefited from this crisis. But I believe there are limits to its Covid-19 induced growth. Its purpose-built systems could become a permanent fixture of our daily lives, as InvestorPlace‘s Chris Markoch mentions in his piece.

However, I don’t believe that Remark cameras will be in every nook and cranny of the U.S. or China. The tech is useful, but its demand will fall as soon as medications for Covid-19 hit the market, which could be sooner rather than later.

On top of that, the company’s affiliation with China can prove costly. There could be several sets of regulations introduced to ensure the data recorded by the thermal imaging cameras is kept on-site instead of stored on a foreign server.

In addition, any further complications between China and the U.S. could make it tougher for the company to transfer technology and capital to and from its different offices worldwide.

For all these reasons, I believe MARK stock is trading too hot at the moment. It’s benefiting from overenthusiastic traders, who are forsaking fundamentals for the sake of short-term gain. I would wait for share prices to fall substantially before buying.

Faizan Farooque is a contributing author for InvestorPlace.com and numerous other financial sites. His passion is to help the average investor make more informed decisions regarding their portfolio. He does not directly own the securities mentioned above.