“If you’ve been thinking about adding more gold positions to hedge your portfolio, you might want to think about also buying some silver.” That’s the advice I offered two months ago here in Smart Money.

So far, so good.

The two specific plays I showed you in that column have climbed by 23% and 49% — far outpacing gold’s 5% gain over the same time frame (more on those silver stocks later).

That impressive recent gain is what I would call a “good start.” I expect silver to continue outperforming gold as the bull market in precious metals continues to gain momentum.

But don’t get me wrong — I’m also looking for gold to shine brightly. Just not as brightly as silver.

Both precious metals are attracting strong investment demand at present.

The Ratio That Reveals Why You Should Buy Silver

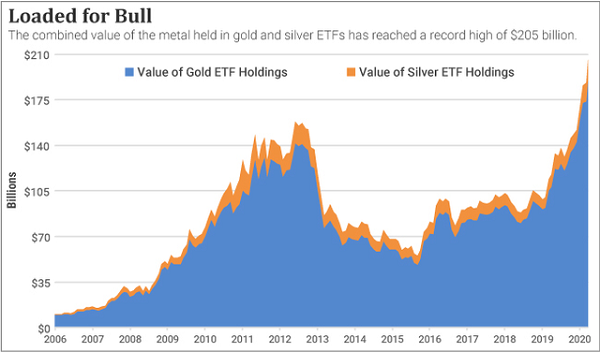

As the chart below shows, the combined value of the metal held in gold and silver exchange-traded funds has reached a record high of $205 billion — double the levels of just a year ago.

Persistent investment flows of this size almost always produce powerful, sustained rallies in gold and silver.

Based on the past 15 years of data, whenever the combined quantity of gold inside all the gold ETFs increased by 20% or more over a six-month time frame, the gold price performed brilliantly over the following one, three and five year time frames.

Based on monthly readings, ETF gold holdings have jumped more than 20% only 36 times out of 179 observations dating back to 2005.

After those 36 instances, the gold price was:

- 17% higher on average one year later

- 40% higher on average three years later

- 106% higher on average five years later

An identical phenomenon holds true in the silver market. Whenever the combined quantity of silver inside all the silver ETFs increased by 20% or more over a six-month time frame, the silver price soared:

- 14% higher on average one year later

- 100% higher on average three years later

- 83% higher on average five years later

Investment flows into both precious metals remain strong and sustained. For eight straight months, gold ETFs have attracted net investment inflows, and their combined holdings of gold bullion have jumped 27% over this time frame.

And what’s good for gold is often great for silver.

For six straight months, silver ETFs have attracted net investment inflows, and over this time frame their combined holdings of silver bullion soared 34%.

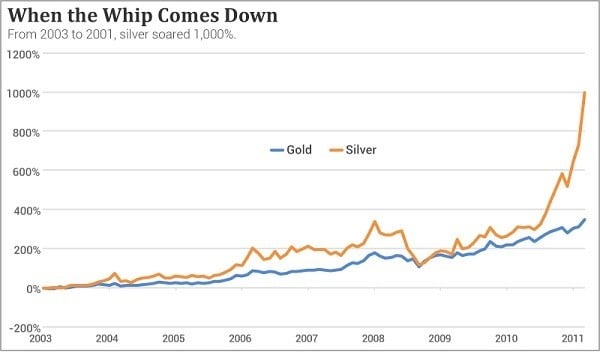

But from that point forward, silver has rocketed upwards 1,000% — far outpacing gold’s gains.

If past is prologue, silver prices will continue to gain momentum and deliver even larger gains than gold.

The silver-gold ratio provides one fascinating glimpse into silver’s speculative potential. Based on this ratio, the silver price still has a lot of “catching up” to do before it reaches its average level relative to gold.

During the last 50 years, about 51 ounces of silver would typically buy 1 ounce of gold. But silver prices have become so cheap that it now takes 94 ounces of silver to buy 1 ounce of gold.

So that means that if the silver price traded back up to its average level, relative to gold, it would be selling for $35.50 an ounce — or 84% above today’s price.

That hypothetical gain assumes no increase in the gold price. But obviously, if the gold price continues chugging higher, the silver price would have to climb that much more to reach its average level on the gold-silver ratio.

Silver’s connection to gold is not a “Law of the Financial Universe;” it’s simply a tendency that manifests itself over time. But I believe the time has come for that tendency to manifest itself once again.

Thanks to these inflows, the silver price is starting to catch up to the gold price, just like it always does.

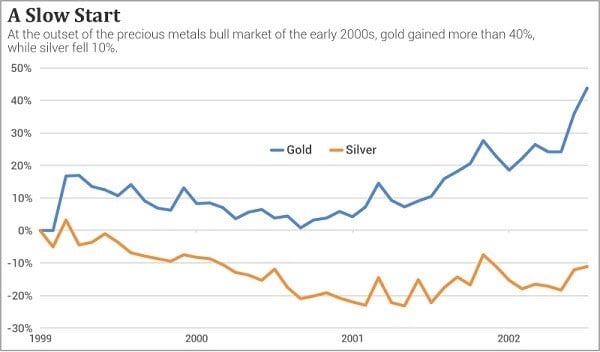

During the four major gold bull markets of the last 50 years, silver has outperformed gold by a large margin. In each case, silver lagged significantly behind gold during the early years of the bull market; but when all was said and done, silver’s gain towered over gold’s.

During the early 2000s, for example, the gold price advanced more than 40% while the silver price fell.

My Silver Prediction

My next target for silver is $35.50, as the precious metals continue mounting their strongest rally since the mid-2000s.

And let’s not forget that silver is one of the few assets that can shine when storm clouds are hanging over the stock market. Historically, both silver and gold have tended to move up when stock prices move down.

But we don’t need stock market losses to reap precious metals gains. In fact, I’m not expecting that scenario any time soon. I’m just looking for much higher silver and gold prices.

So I would reiterate the silver plays I showed you in this space two months ago — the iShares Silver Trust (NYSEARCA:SLV) and the ProShares Ultra Silver ETF (NYSEARCA:AGQ).

SLV, up 23% since I showed it to you a couple of months ago, is the most direct way to participate in any future silver rally. Because this $10 billion ETF is a proxy for physical silver, its share price tracks the silver price nearly tick-for-tick.

Alternatively, traders who want to take on additional risk could buy AGQ, which uses leverage to produce double the returns of silver, for better or worse (and is up 49% since we last talked about it).

But remember, silver is speculative. So buckle up and prepare for a gut-wrenching yet exhilarating ride.

Regards,

Eric Fry

P.S. Silver’s time is coming. But gold’s time isn’t done yet. That’s why I’m urging my readers to get in front of what I see as the next big market move. And that’s gold. But I’m not suggesting you buy bullion, coins, ETFs, mining stocks or any other type of investment you’ve likely heard about before. There’s something much better I’d like to tell you about today. Click here to see the full story.

Eric Fry is an award-winning stock picker with numerous “10-bagger” calls — in good markets AND bad. How? By finding potent global megatrends… before they take off. And when it comes to bear markets, you’ll want to have his “blueprint” in hand before stocks go south. Eric does not own the aforementioned securities.