Since air traffic volumes are still down more than 70% year-over-year, it is no surprise that airline stocks are still struggling to gain any traction in their recovery. Unlike the rest of the stock market, they didn’t bottom until May. But when they finally did — and thanks in large part to trading platform Robinhood — they soared like rockets.

Airline stocks have since fizzled out and given back half of that rally. The good news for bulls is that they have not yet reverted to the lows of the year. This is usually constructive price action that indicates that investors are getting more comfortable with the worst-case scenario. In the beginning stages of the crisis, the concern was over survivability of the major U.S. airlines. Even industry experts like Boeing’s (NYSE:BA) CEO voiced this opinion publicly.

But consensus now is that the “death” scenario is off the table this year. U.S. airlines have since borrowed enough from the government and private sector to guarantee their operations for many months to come. Although it is not ideal to bury a company in debt — especially when it has virtually no sales — at least now they can see this reopening process through. Bad is definitely better than dead.

Plus, public concern over the novel coronavirus will eventually abate and people will move about the world once again.

With this in mind, I want to share three ways to trade the recovery process in airline stocks. These opportunities are ideal for long-term investors and short-term traders alike. Start with these three stocks:

Airline Stocks to Buy: United Airlines (UAL)

United Airlines bottomed in March, so the May low qualifies as a double bottom. This could indicate better conviction from its investors. UAL stock did however fall below a major level of contention from 15 years ago, which could become a concern. Regardless, the quarantine crisis was as serious as it could have been and is not likely to repeat for years.

Why? Governments cannot afford to close the world again, so the March struggle was a one-off scenario. They will find other means of dealing with the next virus crisis.

Meanwhile, long-term investors in UAL stock should be comfortable owning the shares near this bottom. Taking the bullish side in a beaten-down sector requires patience and a long-term time frame. Short-term traders also have reason to trust in the recent bottom. There’s immediate support just below $30 per share and much stronger support above $25 per share. It is reasonable to expect more upside potential for both long- and short-term investors for UAL stock than downside risk.

My family and I recently flew to vacation in Cancun, Mexico, and we took four flights in the process. All of them were oversold — especially in first class. This is an indication that United Airlines is managing its efficiency pretty well. As public fear of the coronavirus subsides, United and its peers should solidly head toward recovery.

Delta Air Lines (DAL)

Unlike UAL, Delta did make a new low in May. This could indicate relative weakness, but the thesis behind United extends to DAL stock as well. The upside potential from here is larger than new downside risk. The bottoming of a stock is usually a process where investors panic at first, and then bounce. This repeats several times with smaller amplitudes before the pendulum starts to swing in smaller increments. This is how investors gain confidence and allow conviction in their positions to build.

Until then, there will be stints like the one DAL stock had in June as it fell 30% from that top. To really appreciate price levels in airline stocks, we must consider about two decades of stock performance. Only then it becomes evident that they have fallen into a major pivot zone. These usually offer support on the way down, so it will take tremendously bad news to break through from here.

For example, DAL stock successfully bounced off the $21 zone which has been in contention since the financial crisis. It broke out from this zone in 2013, and it just retested it during the virus crisis.

Now the onus is on bears to pierce this bottom — and I bet they can’t do it alone. There would need to be a market-wide tizzy large enough to shake Wall Street. There isn’t one on the horizon.

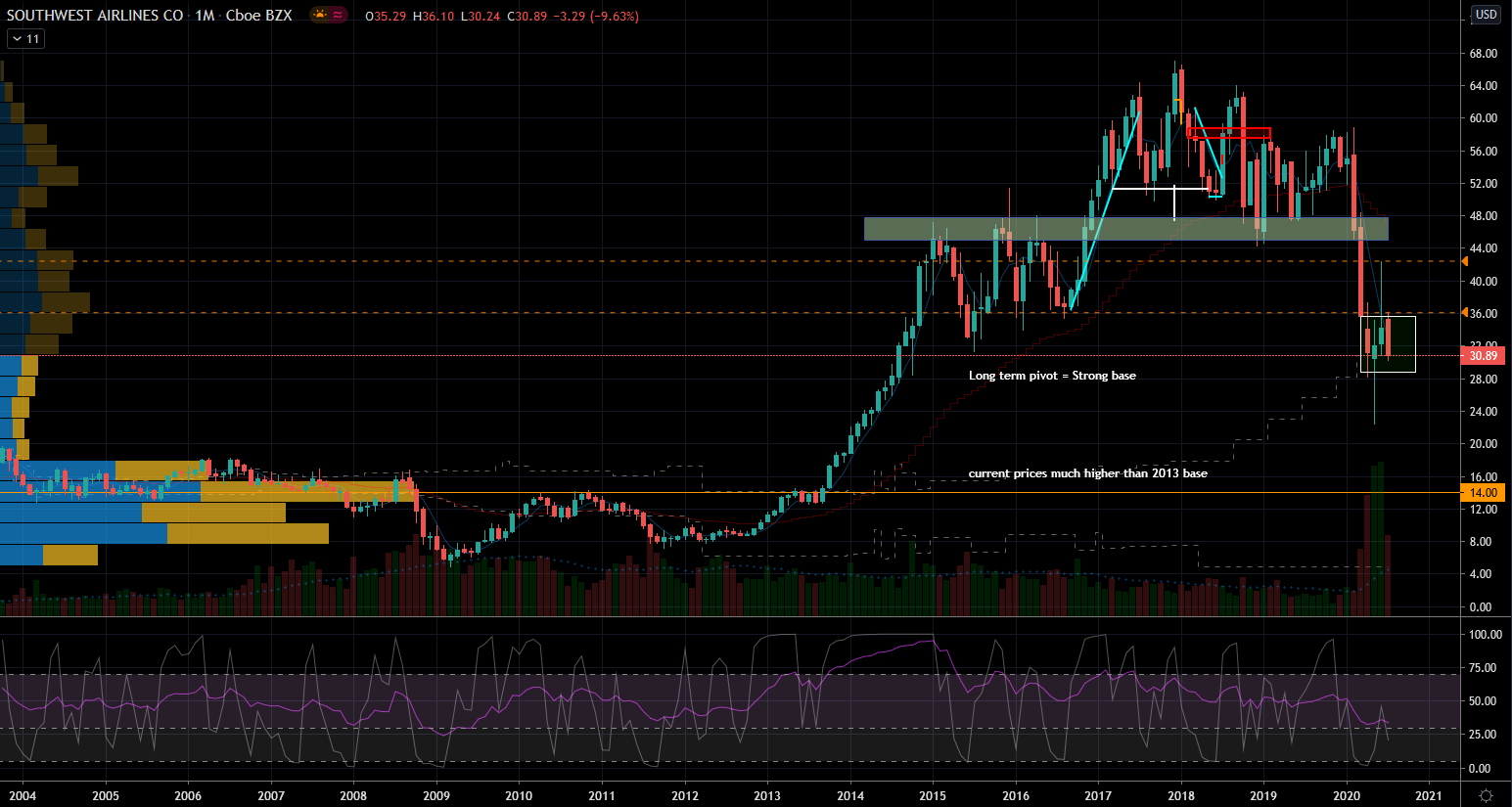

Airline Stocks to Buy: Southwest Airlines (LUV)

Southwest Airlines is my favorite of the bunch. This is perhaps the original no-frills airline, which means that it knows how to operate on slim margins. Now, LUV stock is a cut above the other legacy airlines. Just look at its history! It successfully broke out from much lower levels in 2013. This should give investors confidence in its abilities today.

Furthermore, LUV stock has a base near $27 per share, so I am confident that investors who own it here have more upside potential than downside risk. The point of investing is to buy low and sell high, and this is a good opportunity for it. While all three airline stocks today have viable investment theses, I would favor Southwest. Then, it’s a close tie between Delta and United.

In all three instances investors will need patience and fortitude. There are a lot of obstacles still to overcome, but people need to fly. The work-from-home concept and video-call parties are eating away at the airline business. But eventually, there will be no substitute for human-to-human contact. Don’t miss this opportunity in airline stocks now.

Nicolas Chahine is the managing director of SellSpreads.com. As of this writing, he did not hold a position in any of the aforementioned securities.