Let’s cut straight to the chase: One of the best stocks to buy for the next five to 10 years may be that of small-cap, Las Vegas-based Artificial Intelligence (AI) tech company Remark Holdings (NASDAQ:MARK). Overall, though, MARK stock is highly speculative and not worth your lunch money. This is not a “sure thing”, and the chances of this $180 million company turning into a multi-billion-dollar giant remain relatively slim.

Nonetheless, it could happen. And it seems that as each day passes, the odds of MARK stock turning into a huge long-term winner are only going up.

Therefore, it may be time to establish a speculative long position in Remark stock — and here’s why.

A Confused AI Company That’s Found Purpose

We can basically call Remark Holdings a confused and floundering AI company that, for the first time arguably ever, finally has a clear purpose and visibility to sustained long-term growth.

One look at Remark’s website, and you may come away asking: Wait… what exactly does this company do?

They have an AI business, with tons of end-market applications. There’s also an online medical advice business, which ostensibly looks like a telehealth play, and a bikini e-commerce website.

See what I mean by confused?

In turn, this confusion has led to Remark’s revenues bouncing around with enormous volatility but ultimately going nowhere over the past decade. Meanwhile, MARK stock has — over the past 10 years — never amounted to anything more than a volatile penny stock.

Then, Covid-19 happened, and Remark found purpose.

A good purpose, with huge upside potential. And that creates visibility for significant gains in MARK stock over the next five to 10 years.

The “New Normal”

The Covid-19 pandemic has forever changed our world. And where there’s change, there’s opportunity.

Naturally, then, investors have been rushing to invest in companies that are positioned to thrive in the “new normal”.

I call these stocks “Covid-19 plays,” and there’s quite a few of them out there. Zoom (NASDAQ:ZM) and RingCentral (NYSE:RNG) for virtual offices and remote work. You also have Teladoc (NYSE:TDOC) for telehealth, Activision (NASDAQ:ATVI) for gaming, Netflix (NASDAQ:NFLX) for streaming, Shopify (NYSE:SHOP) and Wayfair (NYSE:W) for online retail and Clorox (NYSE:CLX) for increased cleanliness standards.

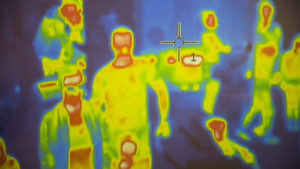

And, yes, Remark for thermal imaging and facial recognition.

Overall, the reality is that the “new normal” is one that — at least for the foreseeable future — will include thermal imaging and facial recognition technology to scan for Covid-19 symptoms, mask-wearing and social-distancing.

Ubiquitous Solutions

Moreover, Remark provides AI-powered technology solutions which do just that, and have the potential to reach public setting ubiquity over the next few years.

Specifically, the company’s Remark Thermal Imaging Kits are essentially cameras which provide contactless, mass scanning of persons in purview of the camera, looking for Covid-19 symptoms, most notably a fever. It’s a fast, efficient, contactless, and non-intrusive and non-disruptive way to scan for Covid-19 symptoms across various subjects, all at one time.

So, to that end, it’s a perfect thermal imaging solution for customer-facing, public-setting businesses, like restaurants, gyms, bars, airports, etc.

Meanwhile, Remark also provides facial recognition kits, which leverage AI tech to unobtrusively see if someone is wearing a mask and if people are social distancing. Obviously, the applications of this technology are essentially identical to the applications for the thermal imaging cameras. Place this facial recognition tech alongside the thermal imaging cameras, and boom, you have an all-in-one, seamless, unobtrusive way to keep public locations relatively safe during a pandemic.

Needless to say, it’s easy to see this combo of thermal imaging and facial recognition technology become ubiquitous at all restaurants, gyms, bars, airports, etc over the next few years.

Strong Momentum for MARK Stock

Sure, that doesn’t mean Remark’s solutions will reach ubiquity.

In fact, there’s a ton of competition in this market. FLIR (NASDAQ:FLIR) is the market leader, and that company will ultimately emerge as the big winner from this megatrend.

But — at a $5 billion market cap — it’s arguably already priced for some this thermal imaging upside.

However, Remark — with a $160 million market cap — is not.

Yet, through various partnerships and deals with casinos, police departments, schools and social clubs, Remark has proven that its technology is no slouch, and does have broad adoption potential.

Of note, Remark will be providing thermal imaging cameras to The Meadows School — a private school in the Las Vegas area — to assist in the school’s reopening efforts. Also, Remark will be providing the same solutions to Zero Bond — a social club in New York City — to assist that club’s reopening efforts.

Sure, these aren’t huge deals. The Meadows School has less than a thousand students.

But you have to start somewhere, and these two small deals could help establish proof-of-concept for Remark’s breakthrough imaging solutions. And once proof-of-concept is established, big growth could follow. After all, Remark is in the same town in which such solutions will be of paramount importance (Las Vegas), thanks to the city’s vast array of casinos, restaurants and clubs.

A few big deals with a few big casino operators — many of whom have properties all over the world, too — could push this $180 million stock into multi-billion-dollar territory.

The Bottom Line on MARK Stock

Remark Holdings is a speculative investment opportunity with compelling Covid-19 driven upside potential, in the event that management executes strongly against the company’s enormous opportunity in AI-powered thermal imaging and facial recognition technology.

Does that make MARK stock a buy?

I’d say so. Don’t go all in, but take a nibble and see what happens. This one could be a flyer.

Luke Lango is a Markets Analyst for InvestorPlace. He has been professionally analyzing stocks for several years, previously working at various hedge funds and currently running his own investment fund in San Diego. A Caltech graduate, Luke has consistently been recognized as one of the best stock pickers in the world by various other analysts and platforms, and has developed a reputation for leveraging his technology background to identify growth stocks that deliver outstanding returns. Luke is also the founder of Fantastic, a social discovery company backed by an LA-based internet venture firm. As of this writing, he was long NFLX and SHOP.

Luke Lango is a Markets Analyst for InvestorPlace. He has been professionally analyzing stocks for several years, previously working at various hedge funds and currently running his own investment fund in San Diego. A Caltech graduate, Luke has consistently been recognized as one of the best stock pickers in the world by various other analysts and platforms, and has developed a reputation for leveraging his technology background to identify growth stocks that deliver outstanding returns. Luke is also the founder of Fantastic, a social discovery company backed by an LA-based internet venture firm. As of this writing, he was long NFLX and SHOP.

Luke Lango is a Markets Analyst for InvestorPlace. He has been professionally analyzing stocks for several years, previously working at various hedge funds and currently running his own investment fund in San Diego. A Caltech graduate, Luke has consistently been recognized as one of the best stock pickers in the world by various other analysts and platforms, and has developed a reputation for leveraging his technology background to identify growth stocks that deliver outstanding returns. Luke is also the founder of Fantastic, a social discovery company backed by an LA-based internet venture firm. As of this writing, he was long NFLX and SHOP.

Luke Lango is a Markets Analyst for InvestorPlace. He has been professionally analyzing stocks for several years, previously working at various hedge funds and currently running his own investment fund in San Diego. A Caltech graduate, Luke has consistently been recognized as one of the best stock pickers in the world by various other analysts and platforms, and has developed a reputation for leveraging his technology background to identify growth stocks that deliver outstanding returns. Luke is also the founder of Fantastic, a social discovery company backed by an LA-based internet venture firm. As of this writing, he was long NFLX and SHOP.

Luke Lango is a Markets Analyst for InvestorPlace. He has been professionally analyzing stocks for several years, previously working at various hedge funds and currently running his own investment fund in San Diego. A Caltech graduate, Luke has consistently been recognized as one of the best stock pickers in the world by various other analysts and platforms, and has developed a reputation for leveraging his technology background to identify growth stocks that deliver outstanding returns. Luke is also the founder of Fantastic, a social discovery company backed by an LA-based internet venture firm. As of this writing, he was long NFLX and SHOP.