Saul Loeb | AFP | Getty Images

Check out the companies making headlines in midday trading.

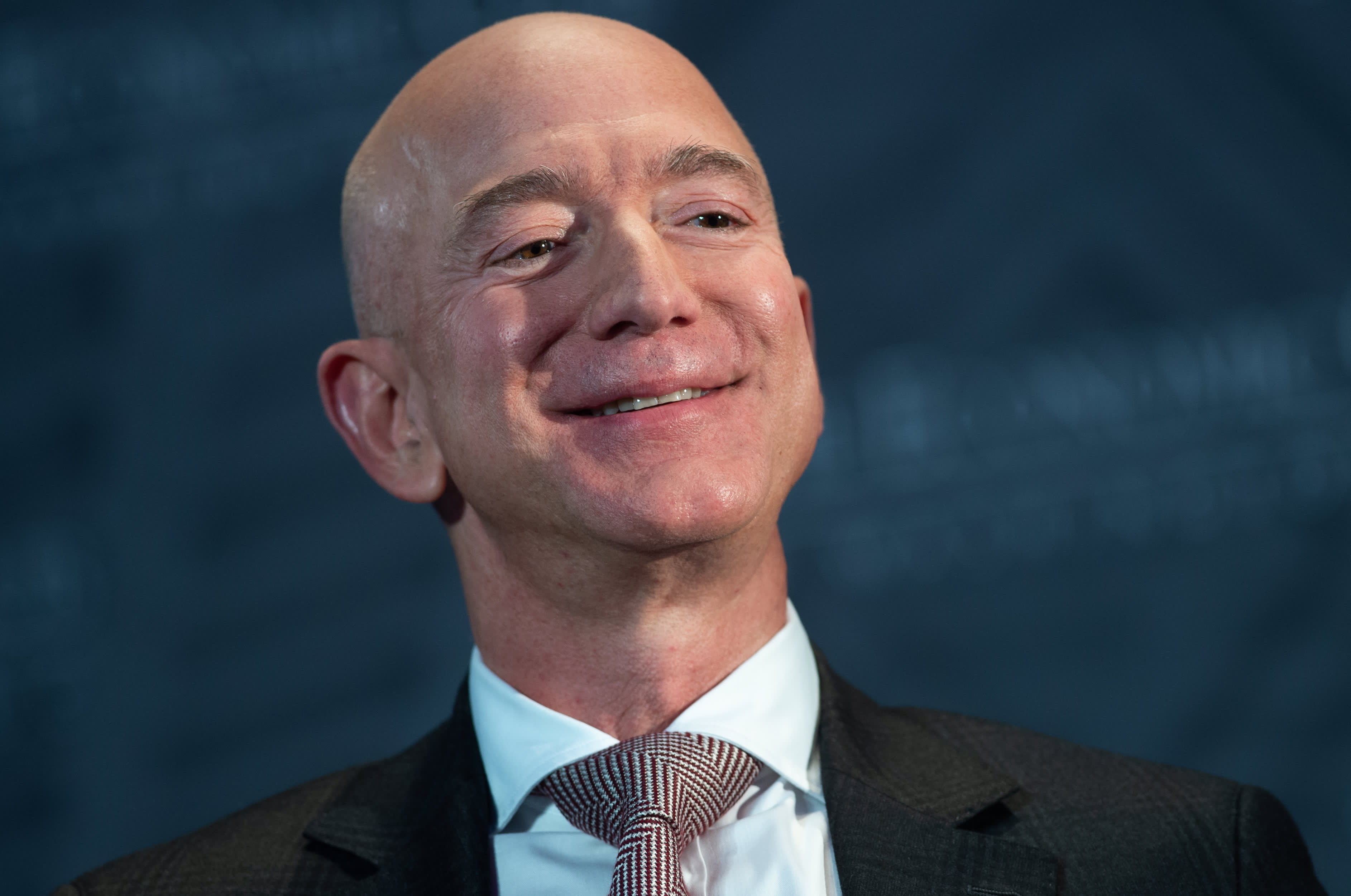

Amazon – Shares of Amazon climbed nearly 3% after Bernstein upgraded the e-commerce giant to outperform from market perform. The Wall Street firm said the recent pullback created an attractive “entry point” for the stock, adding it undervalued the power of its online retail demand. Amazon is down more than 10% this month amid a broad rotation out of tech.

Carvana — Shares of the online marketplace for used cars soared 29% after Carvana announced that it expected record results across several metrics for its third quarter, including total revenue and retail unit sales. The company also said that its profitability metrics were improving. Addtionally, the stock was upgraded by Goldman Sachs and JPMorgan.

Peloton – Shares of Peloton dropped more than 2% after Amazon announced a competitive exercise bike with fitness company Echelon called Prime Bike. The new product retails for less than $500 and it’s the only connected fitness product designed for Amazon exclusively, NBC News reported.

Teladoc — Shares of the telehealth company popped nearly 2% after DA Davidson initiated the stock with a buy rating and $250 per share price target. The Wall Street firm said the company is growing at a rapid rate and expanding markets due to the coronavirus pandemic.

Tesla — Shares of the electric car maker slid 6% ahead of the company’s annual meeting of stockholders and Battery Day presentation. The highly anticipated event kicks off at 4:30 pm ET, where CEO Elon Musk is expected to give updates on the company’s battery production.

Nikola — Shares rose more than 2% as the stock attempted to claw back some of Monday’s steep losses. The stock is coming off a more than 19% drop after founder and executive chairman Trevor Milton said he was resigning from the company.

Comcast — Shares of the media giant popped more than 2.5% on news Nelson Peltz’s Trian Fund Management has taken a 0.4% stake in the NBCUniversal and CNBC parent. The hedge fund said it had recently begun conversations with Comcast management, but it is unclear what Trian is focused on other than the idea that Comcast shares are undervalued.

Illumina — Shares of Illumina dropped more than 1% after being downgraded to hold from buy at Stifel and to neutral from buy at UBS. The Wall Street firms raised concerns about the the gene sequencing company’s planned purchase of cancer blood test developer Grail.

— with reporting from CNBC’s Jesse Pound, Pippa Stevens and Yun Li.

Disclosure: Comcast is the owner of NBCUniversal, parent company of CNBC and CNBC.com.