So much has happened in 2020, and the ripple effects will be felt for years. And while the tragedy of this virus cannot be overstated, there are some economic bright spots that came about because of it as well. Among those pandemic-proof stocks, e-commerce and cloud computing companies have led the pack.

One segment of pandemic-proof stocks have emerged to lead the rally back on Wall Street. They are booming while the rest are various degrees of struggle. These are companies whose products or services revolve around e-tail and anything to support the cloud. They would make for great stocks to buy into next year with confidence.

For decades the world has been on a consistent march towards digitization. This push has been strong but slow. There will always be holdouts resistant to change. But the novel coronavirus pandemic has forced everyone’s hand as self-quarantines and economic lockdowns forced many to stay home.

The popularity of social media is great proof of concept. Nearly half the people on earth actively use Facebook (NASDAQ:FB). Now the goal is to expand this digital connectedness into other daily activities, whether that be shopping for goods or working for a living.

And that’s good for the companies providing those services, but also for those providing the underlying communications and internet infrastructure. Hordes of companies that provide digital storage, e-security, integration services and more are now flush with cash. Case in point, look at Friday’s trading.

The news that President Trump tested positive for Covid-19 caused the Nasdaq to fall 2.5%. But at the same time, cloud communications company Twilio (NYSE:TWLO) was notching new records, rallying 14% on Friday.

TWLO had just announced that the quarter was going much better than they had anticipated. And that’s a recurring theme for a number of these companies. Many were even struggling before the pandemic reversed their fortunes.

Today’s we’ll look at three pandemic-proof stocks:

There is no doubt that these three companies will do well in the future. The problem is finding an entry point that makes sense. I will refer to two strategies in general and everyone is familiar with the first: if I like a stock for the long term, I just buy it. The second is a bit trickier because it involves options trading. In these modern times, it’s important that investors expand their basket of tools.

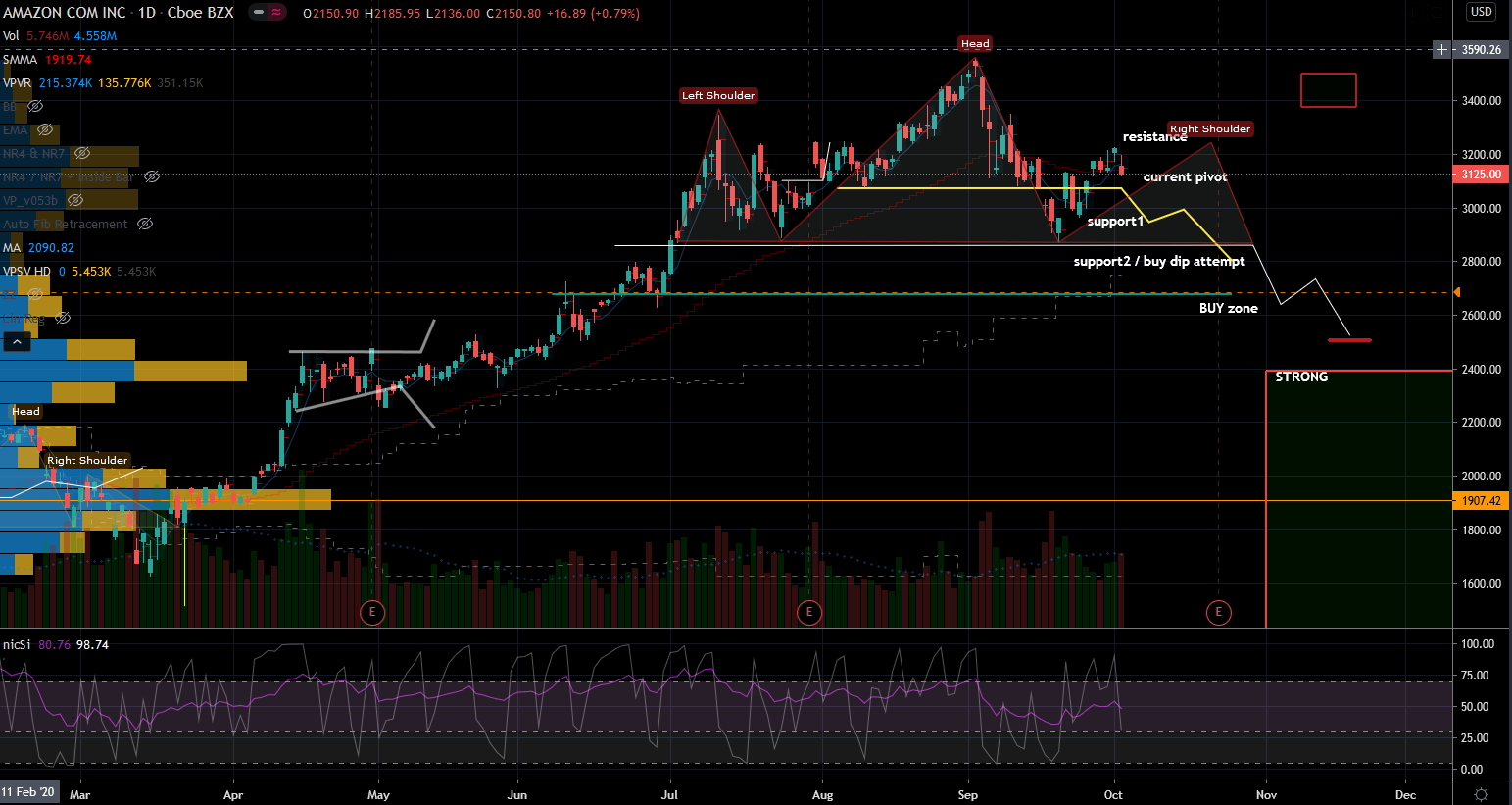

Stocks to Buy For Confidence During Covid-19: Amazon (AMZN)

It’s been so long I can’t remember when Amazon wasn’t a stock to buy. And judging by how big the breakout was this year, every dip was another opportunity to stock up. The social distancing movement plays directly into AMZN stock strength. After all, what better way to avoid people than ordering everything online?

Amazon is the unquestioned leader when it comes to ecommerce. Under the leadership of Jeff Bezos this company continues firing on all cylinders. Critics hated it for decades but their fundamentals are the envy of the world.

Even at these levels it’s not expensive. Investors only give it credit for 5.5 times full year sales in the stock price. There is hardly any frothiness here and it remains cheaper than all other megacap stocks, even Apple (NASDAQ:AAPL).

AMZN carries a very high price-to-earnings ratio but that is by design. They spend a lot because the are still delivering 30% growth after a decade.

Owning AMZN stock for the long term is a valid thesis from every level. It is important to note that if the markets correct again, this one technically could fall below $2650. I know it sounds crazy, but there is a looming bearish pattern that could take it there. This is not my thesis, but it is a scenario that exists.

Nevertheless, I would prefer earning my money the easy way. Instead of buying into the current fears, I would generate income without immediate risk. To do that, I would sell the December $2400 put and collect $43 per contract. This trade has an 89% theoretical chance of winning, and it doesn’t even need a rally to win. In fact the AMZN stock can fall 23% and it could still work out.

Wayfair (W)

It’s not often that a stock goes from $21 to over $350 in just three months. But that’s just what Wayfair stock did off its March 19 lows. Up until February, the stock was struggling, down 50% from 2019 highs. It’s almost as if global disaster was its savior.

The digital revolution suits W stock’s business model well. There is so much business pouring into cyberspace that all companies in the sector are benefiting. Amazon can’t take all the ecommerce business, though that certainly won’t stop them from trying.

Credit goes to the Wayfair management team that they kept at it and pounced on the opportunity. Speaking anecdotally, on several occasions this summer I found myself on their website shopping for an air conditioning unit. It is a sign of a strong e-marketing campaign when they can land my click shopping for AC split systems. That’s not an item I would think to shop for on Wayfair.

The bulls have been in charge of the stock for the last six months, with trends of higher-lows and higher-highs. August marked a top of sorts, since W stock has not yet made a higher-high.

The technical risk now lies in reversing the trend. However there are no imminent signs of this happening yet. As long the buyers successfully defend $273 then $233 zones they would remain in charge.

Dips are buying opportunities. The upside opportunity is to chase the breakout above $325 per share. From there the stock has a realistic chance to set new highs.

Earnings are coming soon in early November. After a rally this big, the company runs the risk of getting hurt by overzealous expectations. Instead of buying shares here, investors can still be bullish by selling puts.

For example I can sell the October 30 $250 put and collect $5 for it. It is a chance at creating income out of thin air or owning it for cheap. The worst that can happen is to own the shares at a more than 18% discount from here. The breakeven point on this is $245 per share.

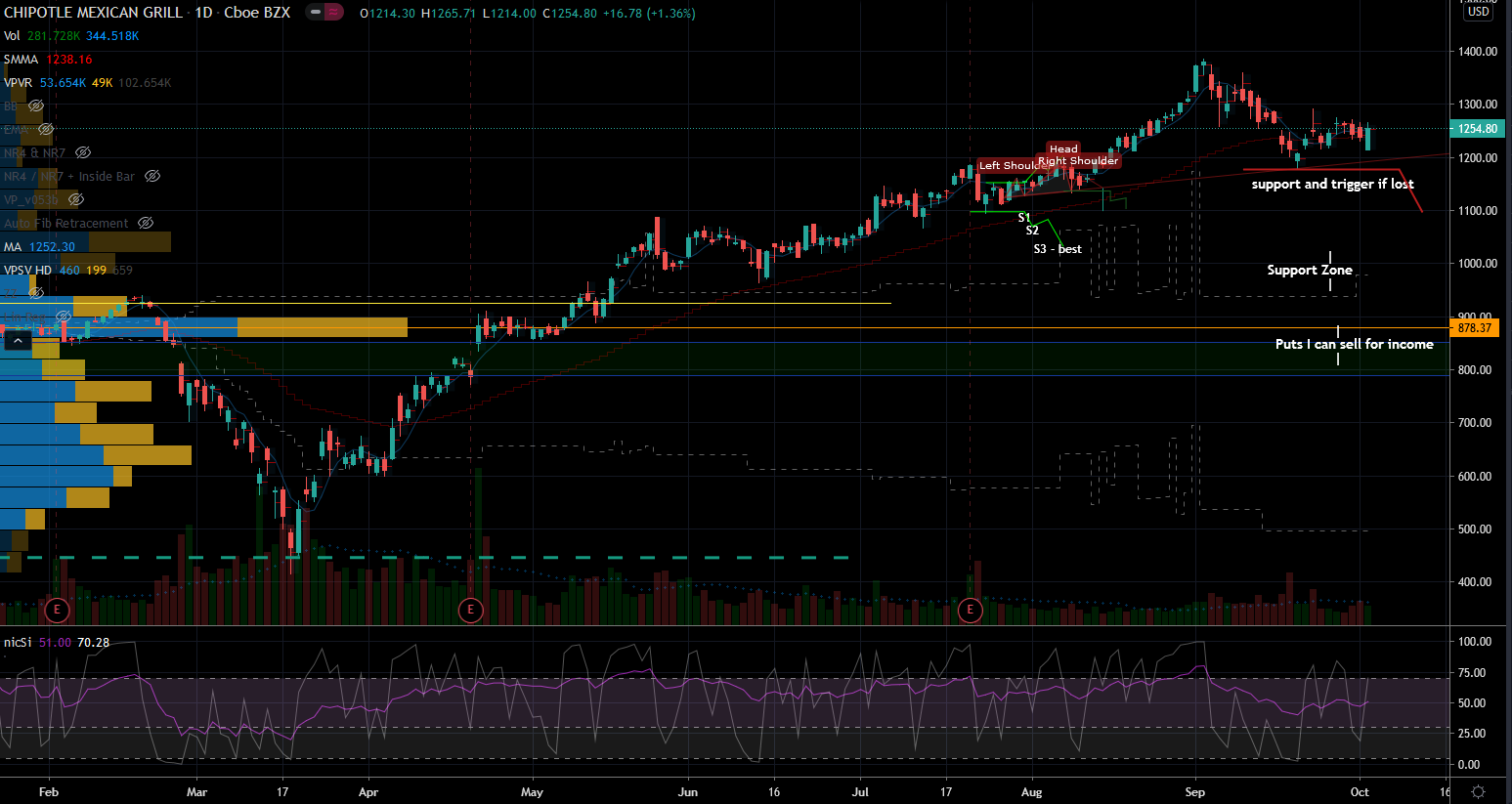

Chipotle (CMG)

A restaurant chain isn’t an obvious choice for a list of pandemic-proof companies. Yet CMG stock continues to defy all logic. For years, Chipotle has been at the industry forefront when it comes to technology, which has served them well during our present crisis.

In fact, CMG turned positive comp sales during the shut down period, which is astonishing. Clearly they will continue to do well under pressure in the future. The company even weathered its own health disaster headlines back in 2015, but that’s all in the past now. CMG stock has been a bullish monster for years, and it’s not about to turn on a dime now.

Technically, I like that it is off the highs, but I would like it better closer to $1,100 per share. I would wait to buy on the next dip for an entry point. Otherwise, investors can sell the December $860 put and collect $6 for it. This gets them long now with room for error. The profits will come even if CMG stock falls another 30% from here.

I mentioned buying on dips, but they continue to be few and far between. Fishing for a perfect entry is futile, so it’s best to decide on a time frame and use a method to execute. Experience tells me that markets will always correct. They need corrections to establish better footing. This year we have more variables that can become negative catalysts, so patience could pay off. These include the elections, Covid-19 resurgence, economic wars and more.

If I choose to buy now I should rent some protection by owning some upside in the CBOE Volatility Index (INDEXCBOE:VIX). It has been holding its worth even during big market rallies. That’s a new phenomena this year and investors should take advantage of it.

On the date of publication, Nicolas Chahine did not have (either directly or indirectly) any positions in the securities mentioned in this article.

Nicolas Chahine is the managing director of SellSpreads.com.