Urban One (UONE) is America’s largest black-owned media company with just an $80 million market cap.

The company generated over $387 million in revenue over the last 12 months, making Urban One one of the most undervalued stocks on the NASDAQ.

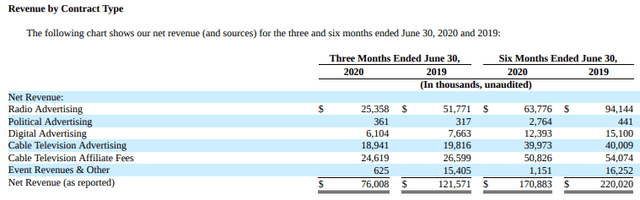

Q2 2020 Revenue Declined Due to COVID-19 but Things Are Improving Gradually

Urban One posted $76 million in revenue, down 37.% from the previous quarter as the effects of COVID-19 hit its advertising revenue pretty hard.

Source: Urban1.com

Radio & Event revenue was hit the hardest due to the global pandemic closures but Q3 has already seen a substantial rebound in revenues according to CEO Alfred Liggins in the latest Q2 2020 earnings transcript.

Proctor & Gamble showed interest in advertising with Urban One and I expect other major corporations to express interest in spending more ad dollars to help aline themselves with Trump’s Platinum Plan promise.

Q3 2020 should show gradual improvement but we won’t see a complete rebound in ad spend until 2021 or so.

Trump’s Platinum Plan Could Boost Advertising Revenue

President Donald Trump announced his “Platinum Plan“, a $500 billion economic plan that empowers the African-American community.

Source: CNN.com

The plan promises to create 3 million new jobs and 500,000 black-owned businesses in the process.

News of the Platinum Plan helped lift shares of all-black owned stocks over the last week as Urban One prepares to recover from a tough Q2 2020.

In this article, I’ll talk about how Urban One performed during the recent quarter and whether investors could profit from an underpriced king of America’s black media industry.

Trump’s Platinum Plan is the Biggest Catalyst to Increased Ad Spend

Black-owned businesses have suffered historically in terms of attracting major advertisers to its network.

The fact that Trump proposed such a robust economic plan shows there is a lot of much-needed progress.

Urban One owns an impressive portfolio of radio, digital, and TV platforms that target a great proportion of African Americans.

Urban One’s website network, One DIgital, receives 24 million visitors per month along with over 1 billion video impressions.

Urban One’s TV Segment, TV One, reaches 59 million households and its radio segment, Radio One, attracts 15 million weekly listeners.

If Trump’s economic plan proves successful then Urban One should see a large boost in ad dollars. There is no other media company in America that reaches as many African-Americans as Urban one does.

MGM National Harbor Investment Could Pay Major Dividends In the Future

One of the least talked about aspects of Urban One is its increased exposure to the gambling industry. The company invested $40 million in MGM National Harbor, a casino that serves a disproportionally African-American audience.

The company suffered major losses during Q2 2020 casino closures but should recoup a bunch of the revenue once everything opens up again.

It would be interesting to see if Urban One invests more in the future of gambling because I believe gambling & sports betting is one of the fastest-growing industries in America.

ONEVIP Card Creates a New Fintech Revenue Stream

In an effort to diversify its revenue stream, Urban One recently launched the ONEVIP card to serve the African-American community.

The ONEVIP card is the first-ever financial solution targeted towards black Americans.

Source: ONEVIP.com

Many of the perks include:

- No minimum balances or overdraft fees

- Earn up to 1.5% cash back on purchases

- Fast direct deposit and simple money transfers

The only catch is a $4.95 monthly fee but ONEVIP will credit $10 in every account if the cardholder uses the card for 3 months and keeps a positive balance.

With a massive reach over TV, internet, and radio, it’s possible Urban One could develop a profitable fintech business to help boost sluggish revenue.

Major Risks include more COVID-19 Closures and Failure to execute the Platinum Plan

COVID-19 was a disaster for ad revenue because advertisers reduced ad spending during lockdowns to conserve cash.

Urban One earns the majority of its revenue from advertising and future COVID-19 lockdowns will seriously affect the business.

Not only does advertising suffer during lockdowns, but Urban One’s event revenue suffers major declines if event-goers practice extreme social distancing.

Event revenue won’t back bounce right away because the CDC still recommends people avoid large public gatherings and wear masks to prevent the further spread of the virus.

Another major risk factor is tied to the long term success of the “Platinum Plan”. A $500 billion economic plan sounds wonderful but Urban One won’t benefit if Trump’s plan fails to take place.

America is dealing with an upcoming election that will be the most important Presidential election in the history of the United States.

How will Trump’s Platinum Plan work if Joe Biden succeeds him as President?

Even if Trump wins, he still must keep his promises and distribute monetary funds towards the African-American economy.

Failure to execute this economic plan won’t help Urban One generate more advertising dollars or expand its operations.

Conclusion

Multi-Year declines in revenue don’t paint the best picture but I believe 2020 is an inflection point for black-owned businesses.

Numerous celebrities and even President Trump have advocated for increased economic opportunity for black-owned businesses and Urban One is one of the oldest publicly traded African-American run companies in the USA.

Urban One stock is grossly undervalued despite soaring to $50 per share during the Juneteenth stock market bubble.

Urban One’s P/S ratio sits at just 0.26 while the Price to book ratio is under 2.

You won’t find too many stocks where the TTM revenue exceeds its market cap 4 times as much.

Part of the confusion may be caused by the difference between UONE & UONEK.

UONE represents class A shares that have 1 vote per share. UONEK represents class D shares that have no votes as a shareholder.

Investors should focus on class A shares because there is a much lower supply than class D shares.

If you are interested in only a short-term trade then UONEK class D shares provide more liquidity for swing traders.

If you liked this article then please click the follow button to get notified when I publish new articles. Thanks for reading!

Disclosure: I am/we are long UONE. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Editor’s Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.