A couple of weeks ago, I detailed how investors in streaming giant Netflix (NFLX) should focus on the big picture. The stock dropped despite a Q3 revenue beat, because not enough subscribers were added and the usual Euro bond revaluation tanked net income. Late last week, shares were caught up in a tech sector selloff, despite the latest news for the name likely being positive.

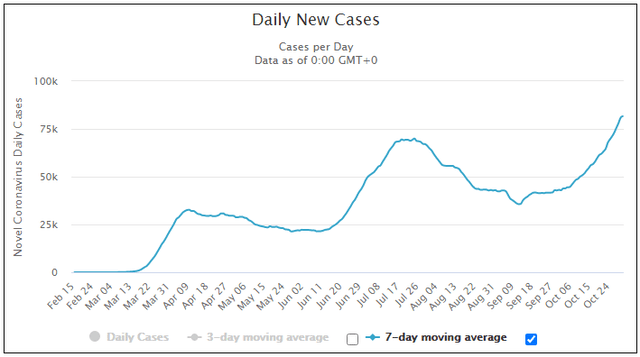

First of all, the coronavirus resurgence that many were afraid of has definitely come. Three major countries across the pond have already announced lockdowns, and with US cases surging as seen below, more lockdowns at home are definitely possible. With temperatures only starting to get colder and a vaccine likely several months away from being effective for mass population use, a harsh winter is approaching.

(Source: worldometers data, seen here)

While nobody is celebrating the impact of the virus, it likely will provide a tailwind for Netflix. The company added almost 26 million new subscribers in the first half of 2020 as shutdowns around the globe were in effect. The next quarter or two could see a benefit that Netflix management hadn’t totally factored in when it gave its latest set of guidance. The company is expected to top the 200 million total subscriber milestone sometime in December, and could add at least another 20 million more subs next year.

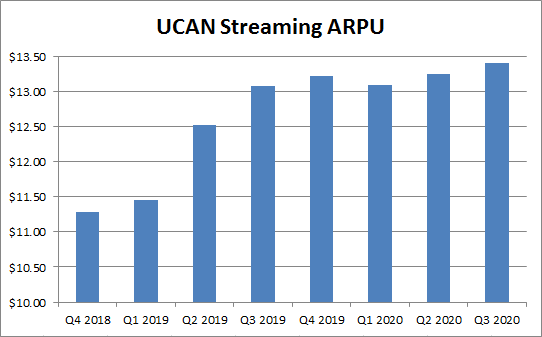

The other good piece of news was that the company announced its next price raise on its top two plans in the United States. The service is still very inexpensive when compared to cable packages, and a dollar or two here or there is not likely to lead to major churn. Average revenue per user growth in the US/Canada has stalled out recently, so this will definitely help.

(Source: Netflix quarterly earnings letters, seen here)

Netflix doesn’t break down subscribers by country anymore, but if we estimate using the Q4 2019 ratio there are approximately 65 million subscribers in the US. Increasing the average revenue per user by $1 on that number would be an extra $780 million in annual revenue, much of which immediately floats to the bottom line. As I discussed in my previous article, Netflix has started to generate meaningful profitability in recent years, with its operating margins going from the low to mid single digits percentage wise to nearly 20%.

Shares of the company jumped last Thursday when the pricing move was announced, but they fell back late in the week thanks to overall tech sector weakness. As of Tuesday, the average price target on the street was $545.12, implying more than 11% upside from current levels. It wouldn’t surprise me to see more price target hikes in the coming days, especially as analysts raise their earnings estimates to reflect the new pricing structure. Better than expected earnings would also lead to more cash flow, helping to avoid future debt raises and resulting in more operating leverage as you move down the income statement.

If we take a look at that average price target, the valuation may not be as crazy as some might think. Netflix shares have consistently traded at a high double digit or even triple digit P/E for many years. Earnings per share are forecast to grow at least 22% each year through 2025 according to the street. Given the name’s trading history and dominance in the space, I think a valuation of 30 times that year’s earnings is reasonable and $25 per share gives you a long term price target of $750.

Given the street has raised its average target by roughly $330 in the last three years, I don’t think it’s crazy to think that the average could rise by another $200 or so by 2025. By then, Netflix may even be producing enough cash flow to start a shares buyback program, which would further benefit earnings per share. The company has shown strength in its operating leverage can really help the bottom line, so long term net income potential may even be greater than the street is expecting currently.

In the end, investors should definitely take another look at Netflix. The streaming giant is likely to take advantage of another round of coronavirus lockdowns around the globe. While the company is already adding millions of subscribers each quarter, a US price raise will also boost the top and bottom line numbers. With the stock getting caught up in last week’s tech selloff, shares now show double digit upside to the average street price target. If you are looking to add stay at home stocks to your portfolio, the streaming leader is likely one place where you want to be.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Investors are always reminded that before making any investment, you should do your own proper due diligence on any name directly or indirectly mentioned in this article. Investors should also consider seeking advice from a broker or financial adviser before making any investment decisions. Any material in this article should be considered general information, and not relied on as a formal investment recommendation.