Last month I wrote that BP (NYSE:BP) was at least 20% undervalued based on its free cash flow (FCF) and its new lower dividend. I still believe that BP stock is at least 22% too low based on its new situation.

For example, on Oct. 27, the company reported its Q3 earnings that were much better than the Q2 report. I usually ignore most of the stated net income numbers since they have become increasingly meaningless, filled with accounting issues. I turn straight to the cash flow statement.

Cash Flow, Free Cash Flow and What The Company Can Pay

Those are the three things that interest me as a potential investor in a large oil and gas stock. If you look at BP’s Q3 cash flow statement beginning on page 19 you will see that cash flow and free cash flow has improved a great deal.

For example, BP is one of the few foreign companies that actually publishes its quarterly cash flow, as opposed to a cumulative statement for nine months. This quarter cash flow from operations (CFFO) came in at $5.2 billion. This was 39% higher than last quarter.

That is important because as I wrote in my last article the company could not afford the new lower dividend. For example, last quarter FCF came in at $719 million. But the dividend requirement at 31.5 cents per share (down from 63 cents last quarter) was $1.06 billion.

This quarter FCF was much higher now that the CFFO was 39% higher. For example, I calculate that Q3 FCF was $2.6 billion. That more than covered the $1.06 billion dividends paid out in the third quarter.

In other words, the company can now more than pay its dividend. And don’t forget that the stock has a very high dividend yield: 6.7%.

Dividend Yield Valuation

This kind of high dividend yield is usually reserved for stocks where there might be some doubt whether the company can afford the payment. But that is not the case here.

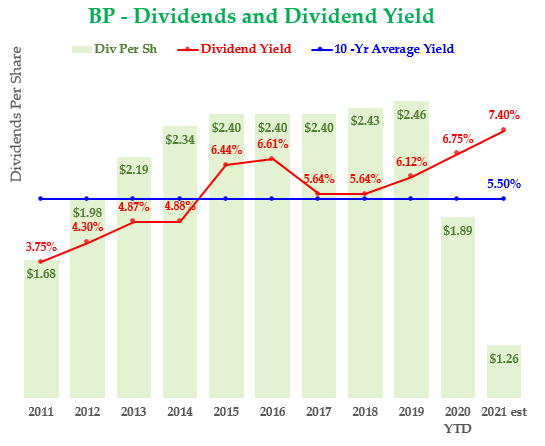

Moreover, as I pointed out in my last article, the stock has had an average yield of 5.5% over the last 1o years. You can see this in the chart.

Therefore, if we take the annualized dividend per share of $1.26 (i.e., 31.5 cents x 4), and divide it by the average yield of 5.5%, the target price is $22.91 per share.

That represents a potential upside of more than 20%. The possibility of this happening is now much higher than in the last quarter. In fact, I would argue that there is a good chance that the stock could end up moving to a lower yield, more normal yield, of between 4.5% and 5%.

For example, at 5% the stock’s target price is $25.20 (i.e., $1.26 / 5%). And if the stock reaches a 4.5% dividend yield over the next yield, the price will be $28.

In other words, the stock is worth between 22% and 49% more, or on average about 35% higher. That puts its value at $25.46 per share.

What To Do With BP Stock

Analysts on Wall Street tend to agree with my assessment. For example, Yahoo! Finance reports that 10 analysts have an average price target of $28.49 on BP stock.

Moreover, TipRanks.com reports that four analysts have recently written reports on the stock and have an average price target of $27.33. The same is true at Marketbeat.com. Their survey says that 22 analysts have a consensus target price of $29.43. The average of all three of these Wall Street surveys is $28.42.

That is even higher than my high forecast price of $28 per share, so it gives me confidence. I am not alone in believing that BP stock is too low.

But more importantly, the price of oil will likely be highly correlated with how well BP’s cash flow will turn to be. The Financial Times recently wrote an insightful article that points out that the forward yield curve for oil is now very gently curving upward.

The oil curve now mildly slopes upward to $49 Brent in the out years. In other words, the market believes that demand for oil will continue to rise over time. This contrasts with when it was in backwardation not too long ago (as opposed to contango now).

My point is simple. Higher oil prices will lead to higher cash flow, higher free cash flow, and hence more dividend security. That, in turn, will lead to a lower dividend yield, as I projected above, and hence higher prices for BP stock.

On the date of publication, Mark R. Hake did not have (either directly or indirectly) any positions in any of the securities mentioned in this article.

Mark Hake runs the Total Yield Value Guide which you can review here.