Hacks happen to the most conscientious among us. Your credit cards, bank accounts, retailer-held account information and other types of individual identification data and information are all lucrative opportunities for all sorts of bad actors around the globe.

And hacks occur every day on a 24/7 basis every second. The Breach Level Index from major defense contractor, Thales (OTCMKTS:THLLY) tracks data hacks. That measure reported more than 9.7 billion record hacks over the trailing six-plus years. And according to the same sources, the U.S. is the leading target, with 85% of all global identity thefts directed at Americans.

Thales goes on to say that on average, hackers hit and steal 75 record every single second of every single day.

And if you think that traditional firewalls and antivirus security keeps you safe? Nope — Thycotic, a Washington-based data security company (private) has interviewed “black hat” hackers, 73% of whom say the traditional security you depend upon is pretty much irrelevant.

And just hacking and getting data, and credit card and every other type of data isn’t the goal of hackers. Using it for fortune or fame is. And this is where the Dark Web – the underbelly of the internet – is there for all of the illicit transactions for any an all bent on mayhem.

The Clock is Ticking

Not a second goes by when you, your family or your company aren’t under attack. Your phone, tablet, laptop wi-fi network and even your smart appliances — if it’s on a network, somebody wants access.

It starts with phishing, where legitimate-looking emails asking for account confirmation can open up hell for those that click “continue.” Malware can embed itself into any device, providing all sorts of tracking or other data. And hackers also know social engineering can get you to willingly click on a link with disaster at the ready.

And all sorts of organizations have suffered at the hands of ransomware, which can lock up data and even entire networks unless a payment is made.

Companies also face all sorts of even more threatening actions that can include distributed denial of service (DDOS) attacks, which inundate servers with requests to lock up the site, causing webpages or webservices to completely shut down.

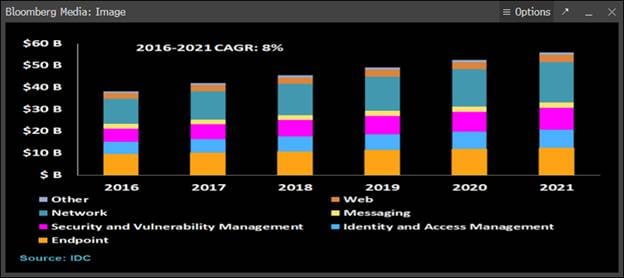

These and plenty of other threats are being developed and improved on a daily basis, making cybersecurity an absolute necessity. And you can see that shown via business investment in hardware, software and services, all of which have seen significant rise in spending. And even for 2020, with business capital expenditures dropping significantly overall in the U.S. and beyond, investing in global cybersecurity products and service continues to rise and rise strongly.

The International Data Corporation is one of the leading data and intelligence companies for information technology, communications and general technology. IDC recently reported that from 2016 through 2021, spending on cybersecurity products and services should see growth around 8.00% on a compound annual growth rate (CAGR).

And that’s a big growth rate when it comes to a multi-billion-dollar market.

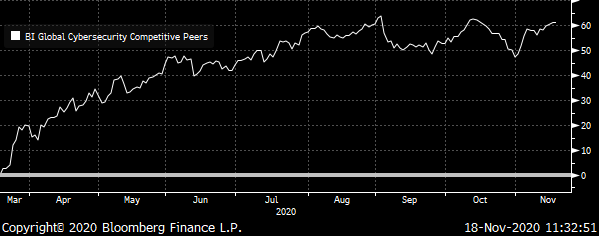

The companies behind our various devices and networks are increasingly a bigger and bigger deal. And even with all of the market mayhem this year has wrought, the leading companies are grabbing business and generating more revenue, and the stock market has taken notice.

The Bloomberg Global Cybersecurity Competitive Peers Index, which compiles leading companies in the network and security market has returned 61.18% to date since March 18 , ahead of the return of the S&P 500 Index.

As remote work and quarantines persist around the world, the need for network capabilities and security has soared. And with Covid-19 cases skyrocketing again around the U.S. and beyond, optimism isn’t high when it comes to getting back to our old normal.

Here are 7 cybersecurity stocks to buy for defense against the dark web:

- Okta (NASDAQ:OKTA)

- Cisco Systems (NASDAQ:CSCO)

- CrowdStrike Holdings (NASDAQ:CRWD)

- Cloudflare (NYSE:NET)

- Zscaler (NASDAQ:ZS)

- Check Point Software Technologies (NASDAQ:CHKP)

- Palo Alto Networks (NYSE:PANW)

If and when vaccines and treatments are developed and more importantly deployed — network capabilities and security needs are still going to firmly remain as IDC data and compiled forecasts present. So, even as plenty of the product and services companies have gotten a lot of market attention this year — there are plenty of reasons to nibble on their stocks in a very growing market sector.

7 Cybersolution Stocks To Buy: Okta (OKTA)

Okta is a company that makes life simpler for users. When you log into your Google (NASDAQ:GOOG, GOOGL), Box (NYSE:BOX), Amazon (NASDAQ:AMZN) or even your Microsoft (NASDAQ:MSFT) accounts you will be using the security of Okta. And it makes it easy to access accounts from any type of device with similar high-level security. Plus Okta keeps track of password and usernames for users while keeping them safe on various platforms.

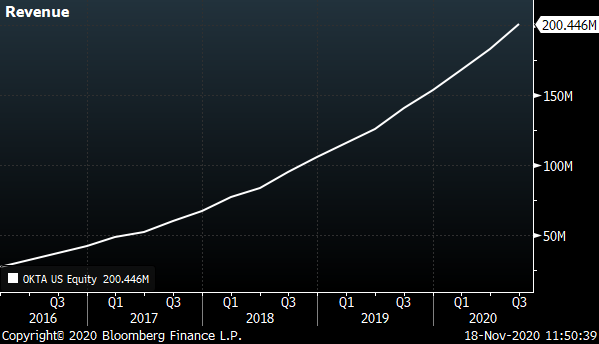

The company states that it has over 3,000 corporate customers serving millions upon millions of users. And all this from a company that only just came public back in 2017.

Revenue for the trailing year is up by 46.80% and this continues to be par for the course as annual revenues for the past five years continues to climb at a CAGR of 55.89%.

So sales growth is working. But cost control and investment for growth aren’t helping margins. Operating margin for the company is running at a negative 31.7% for a negative return on shareholder’s equity.

Yet this stock continues to grab investors’ attention, including via participation in various technology ETFs. The stock has returned a whopping 1221.18% since its initial public offering — growth is being bought and keeps getting bought.

Now, it does have a lots of cash and equivalents on hand to provide coverage over liabilities out a year running at 290%. But it also has debt which is pretty high at 56.5% of assets. But given its client base and users and the go-go growth in revenue, the company should continue to garner positive stock market attention as well as from creditors if needed or wanted.

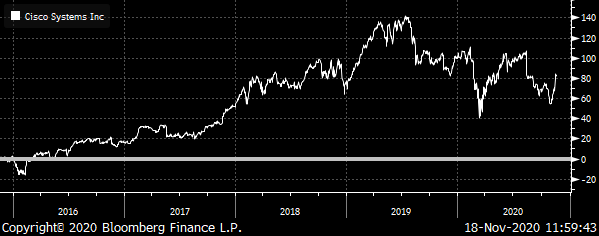

Cisco Systems (CSCO)

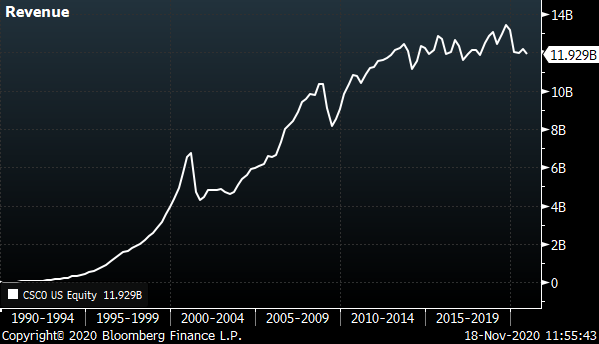

Cisco Systems continues to be one of the go-to providers of what makes networks, networks. Routers, switches, servers and the software to make them work securely are among the products and services Cisco is well-known for. And data centers around the globe, including those in my favorite data center real estate investment trusts (REITs) Digital Realty Trust (NYSE:DLR) and Corporate Office Properties (NYSE:OFC), keep Cisco services humming away behind windowless walls.

Cisco may be an old-line company, but it is still very relevant for networks and cybersecurity. Without at least some of its products, other, more popular companies would be severely curtailed.

Revenue was challenged this year given the company still relies upon one-off hardware sales. But growth in revenue over time has been dependable if not that huge, with gains over the past thirty years expanding by an average of 24.38% on a CAGR basis.

Cisco still sells stuff and services — but it does so at a much more profitable basis than some of its peers that I’m discussing here. Operating margins are fat at 27.60%, and in turn fuels a return on shareholder equity at a very attractive 28.80%.

The company has ample cash on hand, amounting to 170% of current liabilities out one year. And it has low debt, at just 16.40% of assets.

The stock has returned 82.59% over the past trailing five years, close in line with the general S&P 500 Index.

And despite those returns, the stock is still a value play compared to many of its peers in networking and security. CSCO is valued at only 3.70 times trailing sales and only 4.66 times its intrinsic value (book).

And then we come to the dividend — it yields 3.40% and has been climbing in the distribution by an average rate of 11.76% for the past five years.

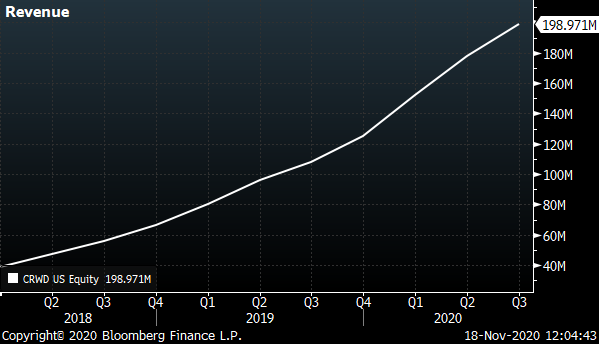

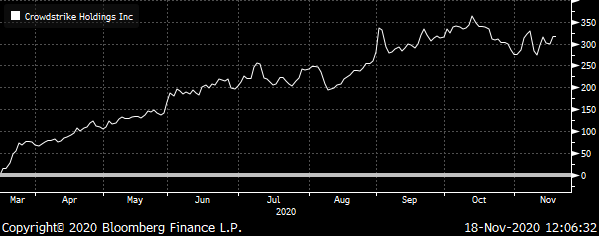

CrowdStrike Holdings (CRWD)

CrowdStrike is an appropriately-named company providing all sorts of protections for companies, networks, service companies and end-point users and customers. Revenue over just the trailing year is up by 92.70%. But there’s clear evidence that the company isn’t just a flash in the pan. Over the past five years, the compound annual growth rate (CAGR) for company revenue has been running at an astonishing 92.26%.

Now for the less than stellar news. Like other hyper-tech companies, the company is so fired up over sales and growth that margins are not that great. In fact, operating margins are running at a loss of 30.30% making for not-so-positive return on shareholder equity. But the company has no real debt and piles of cash amounting to 240% of liabilities going out for the next twelve months. So it can be forgiven for the fixation on growth.

The stock reflects that attention to growth, as it has returned 316.93% since March 16 to date alone.

The stock recently took a pause on October 13, and has pulled back by 9.97%. Valuations, as for its peers, are sky-high, but that’s the market for this sector, making this stock a buy on the pull-back.

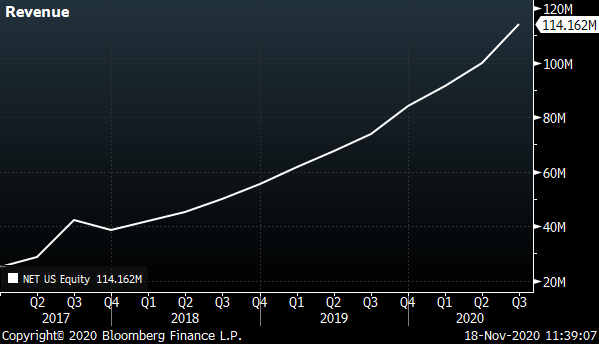

Cloudflare (NET)

Cloudflare provides behind the scenes software that secures digital applications across various platforms. And in a world more and more concerned about national cybersecurity, Cloudflare is a U.S.-based solution for U.S. customers.

So whether companies need secure internet domains, streaming service capabilities or just to keep their servers and services up and running, Cloudflare is there to serve.

Revenue is on the way up, with trailing year gains of 49%. This is part of a longer-term trend of sales gains that has seen an average gain of 54.19% on a compound annual growth rate (CAGR) basis over the past 5 years.

So far, aside from Cisco, our list has a theme of sales growth unconcerned with margins, and that continues for Cloudflare. Operating margins are negative 37.60%, leading to a negative return on equity.

But the good news beyond soaring sales is that the company has little to no debt, with debt to assets running at only a barely-there level of 1.30%. Plus cash and equivalents are running at 820% of near-term liabilities over the next year.

This stock is newer to the public market, with a September 2019 IPO. But since then investors have seen a return of 336.47%.

Valuations are about parity for its peer group, making for a value-proposition on a buy.

Zscaler (ZS)

Zscaler is a company focused on cybersecurity. It provides cloud-based internet security controls for both fixed and mobile devices. This company is a gate keeper for companies around the U.S., protecting companies and their customers from all of the usual threats and attacks.

It is one of the more respected companies in the security market, with a good track record and a wide customer base that is expanding rapidly.

Sales are up over the trailing year by 42.40%. And this is part of a longer-term proven record of sales gains. Over the past five years, revenue is up on average by 53.39% on a CAGR basis.

While growth for growth’s sake is the history of the company, its negative margins are still deemed manageable and in line with some of its peers in this discussion, with operating margin at a negative 26.40%. But again, that still results in a negative return on equity.

The company has also been tapping credit and debt markets to pad its capability, resulting in debts amounting to 49.40% of assets. However, cash and equivalents are running at 370% of current liabilities going out for a year.

But negative margins for now and a bit more debt don’t seem to bother stakeholders. The stock has been working well for investors and traders. Since its IPO in 2018 it has returned 738.94% — so growth is good even without profits for now.

Check Point Software Technologies (CHKP)

Check Point Software Technologies (CHKP) is an information technology security company focused on corporate networks and internet service providers. For companies with remote workers as well as online customers, Check Point provides verification and control products and services. And for service and internet providers, the company provides secure logon and protection from various attack types such as DDOS.

The company has also been expanding by buying and integrating companies including Cymplify and ForceNock.

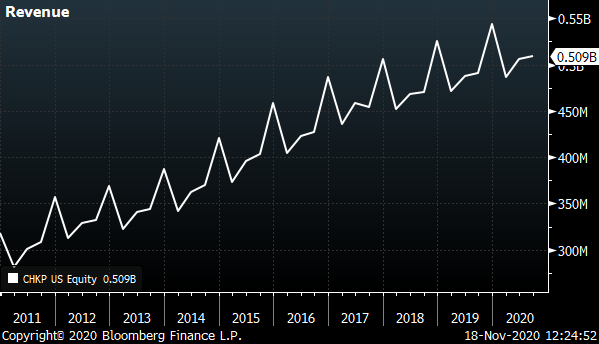

Check Point is a bit more of a slow and reliable grower of revenue, with sales continuing to advance. Over the past ten years quarterly revenue has been gaining at an average CAGR of 4.92%.

But the slower but very steady approach to sales growth comes with actual profitability. Operating margins are very good at 44.20%. And in turn, the company has a very positive return on shareholders’ equity, at 24.50%.

The stock is reflective of the steady gains in revenue and the profitability of the company. Shares have returned 176.04% over the trailing ten years.

No dividend, but debt is nearly zero compared to assets and the company has ample cash and cash equivalents amounting to 150% of current liabilities.

Plus this stock is a comparable value at only 4.98 times intrinsic value (book) and 8.30 times trailing sales.

Palo Alto Networks (PANW)

Palo Alto Networks is another network security company with heavy-duty firewall products and services to limit hacks and DDOS attacks as well as data theft. It was initially based in fixed networks, but has since expanded for mobile devices and become a go-to company during the ramp up in remote work and stay-at-home this year.

PANW focuses on quickly identifying approved usersand also works to limit access per customer needs and wants. This means that customers can use its services to customize not only who can get access, but to what and when. This is increasingly important and provides the company with some competitive advantages in the market for network security.

Revenue is up by 17.50% over the trailing year. And the company has similar history of ramping up revenues year after year with the average for the trailing five years running at an increasing rate of 25.11% on a CAGR basis.

The company is getting better on cost controls with operating margins now running at a lower rate of negative 5.30% — but this still means negative return on shareholders’ equity. Debt is controlled at 38.40% of assets and the company is in good shape with current cash and cash equivalents running at 190% of current liabilities.

The stock has delivered a pretty good return since its IPO back in 2012, with a total return of 584.11%.

The company is delivering security for customers and good returns for shareholders. And this stock is a comparable value for the sector group, valued at 7.70 times trailing sales.

On the date of publication, Neil George did not hold (either directly or indirectly) any positions in the securities mentioned in this article.

As the editor of Profitable Investing, Neil George helps long-term investors achieve their growth & income goals with less risk. With 30+ years of experience in the financial markets, Neil recommends undiscovered and underappreciated companies that offer subscribers double-digit yields now and triple-digit returns over time.