What do you think of when I say, “renewable energy”?

Probably wind. Maybe solar. Maybe hydrogen.

Those are, after all, the three largest renewable energy sources on the planet.

And, in the midst of a global clean energy revolution wherein essentially every country in the world is aggressively working to cut carbon emissions, all three industries are in hypergrowth mode right now.

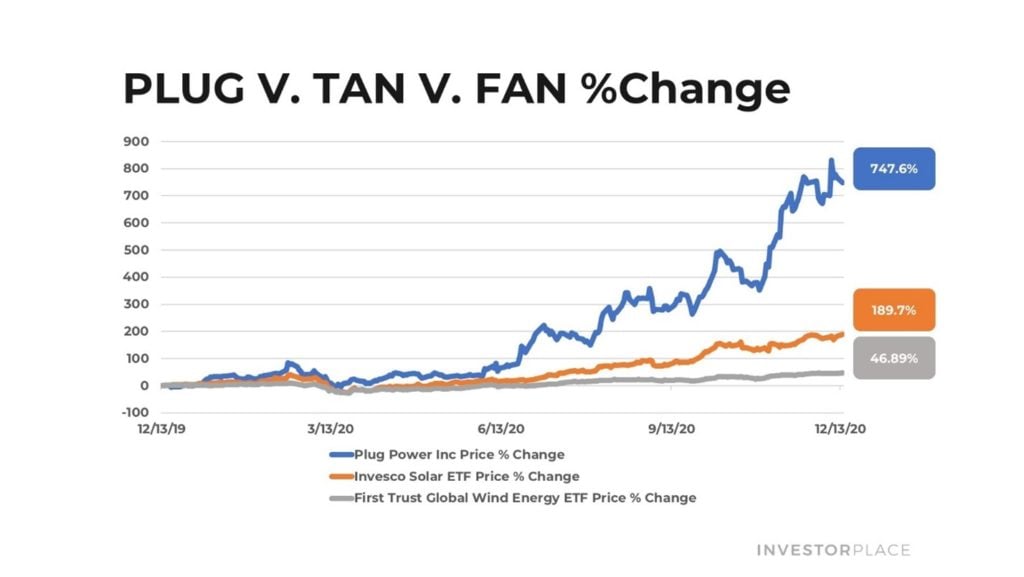

As I wrote this, the First Trust Global Wind Energy ETF (NYSEARCA:FAN) was up more than 45% over the past year, while the Invesco Solar ETF (NYSEARCA:TAN) gained 189% and Plug Power (NASDAQ:PLUG) – a leader of the hydrogen economy – surged 748%.

But… for all their wonderful carbon-reducing benefits… wind, solar, and hydrogen together are not a climate change panacea.

That is, while they will all be tremendously helpful in our fight against climate change, they won’t fix the problem all by themselves.

That’s due to various shortcomings of the three renewable energy sources.

For starters, all three are still relatively niche and nascent energy sources. Scaling them up to meet the world’s enormous and growing energy demand needs will require a lot of money and time to expand infrastructure – but we need to cut carbon emissions today…

Further, wind and solar are intermittent energy sources. Wind only works when the wind is blowing. Solar only works when the sun is shining. Sure, there are tons of companies out there working on clean energy storage techniques – like Tesla (NASDAQ:TSLA) with its Battery Wall – but such storage techniques will forever involve some energy loss.

Hydrogen, meanwhile, isn’t intermittent. But it’s relatively expensive and inefficient. Especially green hydrogen – or hydrogen sourced from renewables.

Thus, in the global fight against climate change over the next several decades, wind, solar, and hydrogen are going to need some help.

Coming to the rescue is a much-slept-on, entirely overlooked and ostensibly counterintuitive energy source, which could be the next big thing in the clean energy revolution.

Readers… meet renewable natural gas (or RNG, for short).

RNG is natural gas that – as opposed to being sourced from fossil fuels, which has been the standard for decades – is sourced from animal, industrial, and food waste.

Importantly, all that waste has a lot methane. If left untouched, that methane is emitted into the atmosphere. That’s really bad for climate change, because methane is basically like CO2 on steroids when it comes to climate change (methane is about 20X better at absorbing heat than CO2).

RNG captures all that waste and uses that methane to produce natural gas. Sure, RNG still involves a combustion process that emits CO2. But the reduction in methane emissions more than outweighs the boost in CO2 emissions, and therefore, RNG is considered a substantially carbon-negative energy source.

Sounds pretty cool, right? It is.

Of course, the upside of RNG is in addressing the shortcomings of wind, solar, and hydrogen. Simply consider that RNG is:

- Immediately usable. Unlike most renewables, RNG doesn’t require the construction of a new infrastructure network to work. It is a plug-and-play solution with existing natural gas infrastructure, which is the largest energy infrastructure network in the planet.

- Exceptionally cost-effective. Renewable prices are rapidly falling. But they still have a long way to go to catch RNG, which in transportation is priced around $1 per diesel gallon equivalent, versus $5-plus prices for hydrogen and solar-/wind-powered battery electricity.

- Always on. Many renewables – like wind and solar – are intermittent energy sources. RNG, meanwhile, is available 24 hours a day, seven days a week, 365 days a year.

Now… to be clear… I’m not saying RNG will take over the global clean energy revolution and entirely displace wind, solar, and hydrogen.

No way. The fact that RNG is not zero-emissions will forever hold it back from being the backbone of the clean energy revolution.

But… what I am saying is that getting the world to net zero emissions and winning the battle against climate change will be a highly complex puzzle.

Solar will be one of the critical pieces to that puzzle. So will wind and hydrogen.

RNG will be a critical piece of the clean energy puzzle, too.

Yet Wall Street appears to be largely sleeping on RNG today.

The lack of attention to this emerging, ultra-important alt energy source is your opportunity…

Over the next few years, the RNG space will jump into hypergrowth mode, much as the solar, wind, and hydrogen industries already have…

And much as solar, wind, and hydrogen stocks have soared in 2020, RNG stocks will soar in 2021-2022.

Names like Hyliion (NYSE:HYLN) – which is pioneering a new class of Class 8 commercial truck powertrains powered by RNG – and Clean Energy Fuels (NASDAQ:CLNE) – whose Redeem fuel is the market-leading RNG fuel in North America – look like potential multi-bagger picks in this hypergrowth industry.

Keep your eyes on those two stocks. And be on the lookout for new RNG companies that could rush onto the scene as Wall Street wakes up and realizes the enormous potential of this emerging industry.

On the date of publication, Luke Lango did not have (either directly or indirectly) any positions in the securities mentioned in this article.

The New Daily 10X Stock Report: Dozens of triple-digit winners, peak gains as high as 926%… 1,326%… and 1,392%. InvestorPlace’s bold new initiative delivers one breakthrough stock recommendation every trading day, targeting gains of 5X… 10X… even 15X and beyond. Now, for a limited time, you can get in for just $19. Click here to find out how.

In addition, you can sign up for Luke’s free Hypergrowth Investing newsletter. Click here to sign up now.