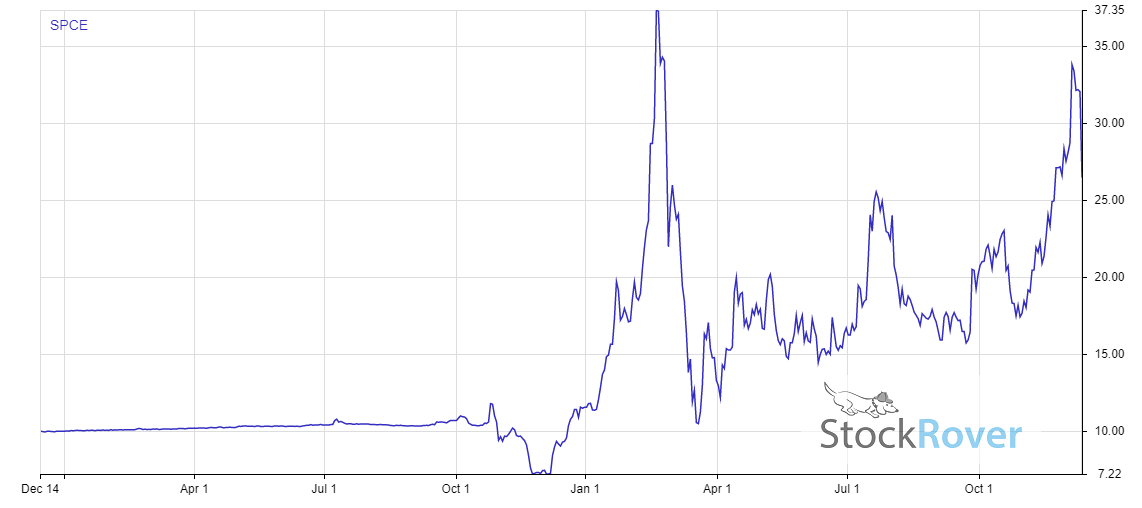

I’ve been asking InvestorPlace readers to treat Virgin Galactic (NYSE:SPCE) stock as a spec play for a while now. That sentiment hasn’t changed. In fact, with the highly-anticipated weekend test flight ending prematurely, shares become even riskier.

It was set to be the first human-crewed spaceflight from New Mexico. But the engine of its SpaceShipTwo vehicle did not fully ignite as it attempted to launch. Inevitably, it will lead to shares falling more rapidly and steeply than usual. This isn’t the first time this has happened to Virgin Galactic. There have been several instances in the company’s history when test launches have gone wrong, and pilots have died.

Granted, this a new space we are talking about. Hence, there will be risks. However, if I have to invest, I will choose Tesla over and above anyone else. Now I know that you cannot invest in space exploration directly with Tesla. But that’s an advantage in my book for risk-averse investors.

Tesla is a diversified conglomerate, but its focus is squarely on electric vehicles, a red-hot market that will only grow. That will give you some protection against losses while the space exploration business continues to pick up steam.

You don’t have that luxury with SPCE stock. Plus, the failed launched launches lead me to believe that a lot of work is still done on the engineering side.

Becoming No. 1 Is Easier Than Remaining No. 1

Virgin Galactic is perceived as a high-margin business. It’s one of the many companies that plan to commercialize space travel. Its weapon of choice is SpaceShipTwo, a design based upon the award-winning 2004 spaceship developed by Mojave Aerospace Ventures.

Originally, the ticket was priced at $200,000 per person. However, Virgin Galactic’s suborbital SpaceShipTwo’s ticket prices jumped 25% to $250,000 after the successful launch of its first rocket-powered test flight. Although the flight’s success had a part to play with the hike, it has more to do with the rise of expenses needed for day-to-day business operations.

This is a double whammy situation. On the one hand, it needs funds to maintain operations and fend off competition from Blue Origin and SpaceX.

However, at the same time, Branson needs to drum up capital for other business lines such as Virgin Atlantic, which is in shambles due to the pandemic. Earlier this year, Branson had to sell up to $504.5 million of his stake in Virgin Galactic to help shore up finances for the airline.

Although we finally see the rollout of novel coronavirus vaccines, it will take a long time for things to get back to pre-pandemic levels. So, it’s not like Virgin Galactic is a pure play that Branson is solely focused on.

Tale of the Tape

Finally, competition in the space is heating up. SpaceX has become successful in the launch business and is now the world’s most valuable privately held company. Recently, Musk celebrated the 100th flight of a Falcon 9 rocket, which delivered 60 satellites to orbit for SpaceX’s Starlink network. Falcon 9 routinely transports cargo to the International Space Station and lifted NASA astronauts there twice this year, with 2021 to have more trips.

Meanwhile, Jeff Bezos’ Blue Origin is also making waves. Founded in 2000, the company is led by CEO Bob Smith. It aims to make access to space cheaper and more reliable through reusable launch vehicles. Recently, it made headlines by sending a proposal to NASA for a landing system designed to carry astronauts down to the moon’s surface and bring them back. On Oct. 13, it launched its New Shepard rocket on an uncrewed test flight over West Texas.

Let’s Talk About the Addressable Market

Before we wrap up, we must talk a bit more about the market size for space exploration. At the same time, investors may feel that the ticket price may restrict demand. But in reality, the demographic of high net worth individuals is expanding.

UBS estimates that, in a decade, high-speed travel via outer space will represent an annual market of at least $20 billion and compete with long-distance airline flights. UBS analysts Jarrod Castle and Myles Walton wrote in the note, “Space tourism could be the stepping stone for the development of long-haul travel on earth serviced by space.”

Virgin Galactic plans to price its tickets at a minimum of $250,000. So it only has approximately 2.4 million potential customers. According to financial services firm Cowen, approximately 39% of people with a net worth of more than $5 million are actually interested in taking a Virgin Galactic flight.

Final Word on SPCE Stock

There’s a lot of buzz surrounding space exploration, and justifiably so. Investors are always trying to cash in on the latest trends to get ahead of the competition. But whenever you decide to invest your money, you should seek a sound investment with a solid growth strategy. Aside from its first-mover advantage, one that will evaporate soon, there is not much else SPCE can tout.

Tesla remains the best investment in space exploration. SpaceX executives aren’t focused on spinning off SpaceX’s internet-from-space project into its own company right now. Instead, Musk believes, “We need to make the thing work.”

Richard Branson deserves plaudits for throwing his hat into the ring. But there’s little that he has to show for actual progress. Perhaps the company should have followed Musk’s attitude and gotten better on the engineering side before entering this market.

SPCE stock is a sell for me.

On the date of publication, Faizan Farooque did not have (either directly or indirectly) any positions in the securities mentioned in this article.

Faizan Farooque is a contributing author for InvestorPlace.com and numerous other financial sites. Faizan has several years of experience analyzing the stock market and was a former data journalist at S&P Global Market Intelligence. His passion is to help the average investor make more informed decisions regarding their portfolio.