Without a doubt, 2020 could easily be called the “year of electric vehicles.” Yet not all companies in this space have been treated equally. Hyliion (NYSE:HYLN), which is seeking to commercialize long-haul electric trucks, seems to get left out of the conversation as HYLN stock can’t get steady respect from traders.

As you may recall, Hyliion went public through a merger with Tortoise Acquisition Corp. in October. Ambitiously, CEO and founder Thomas Healy declared that Hyliion’s powertrain solutions “are designed to significantly reduce greenhouse gas (GHG) emissions and total cost of ownership, enabling our customers to meet both their sustainability and financial objectives.”

If you’re assuming that every stock associated with electric vehicles — particularly those that hitch up with a SPAC — is on a vertical ride to the moon, think again. Healy’s certainly shooting for the stars with his company. Yet, HYLN stock fell victim to the force of gravity.

On that basis, it’s tempting to jump on the bearish side of the fence when it comes to HYLN stock. But then, maybe there’s a bull case to be made for true contrarians and EV enthusiasts.

A Closer Look at HYLN Stock

Back in August and September, things were looking quite good for the HYLN stock bulls. During those months, the stock more than doubled, from $20 to $45, and sometimes even higher than that.

At one point in early September, the shares were trading at a 52-week high of $58.66. (Back then, folks were trading the company via SHLL stock.)

Then came a horrendous October for the HYLN stock bulls. In that month, the share price made a U-turn, plummeting back from $45 to $20.

The bulls attempted to stage a comeback in November, running HYLN stock all the way up to $27. It was a short-lived rally, however, leaving for Christmas weekend at just above $17 a share.

A Better Experience

So, with HYLN stock trading at a discount, does that imply anything about investors’ confidence in the company?

Hyliion’s primary business is to develop and manufacture electrified powertrains for Class 8 trucks. These types of trucks are commonly known as “semis.”

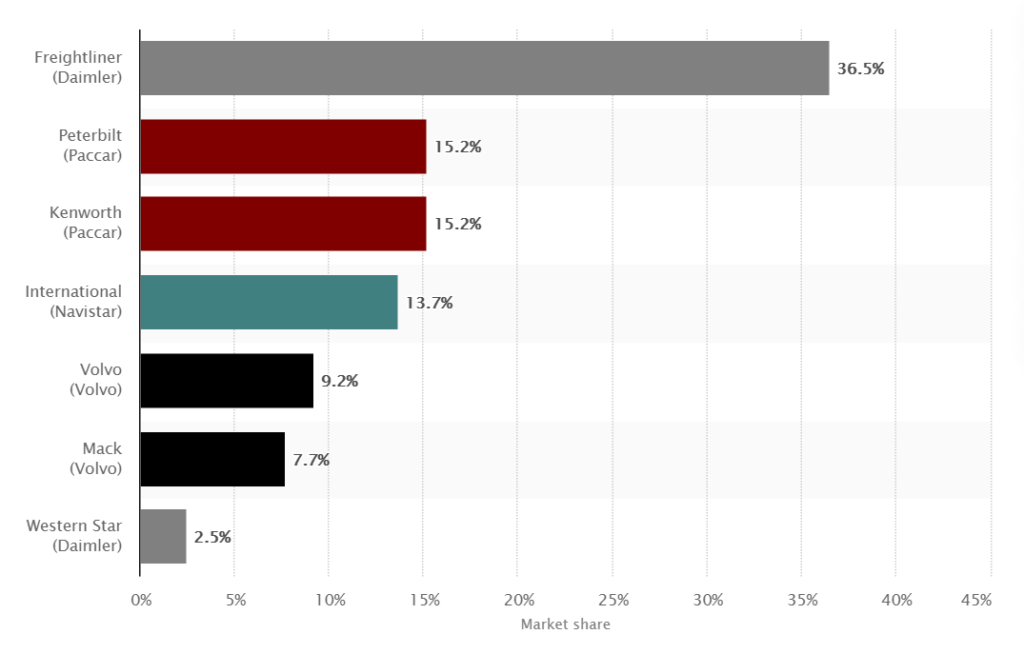

The U.S. Class 8 market is dominated by Freightliner which has a 36.5% market share as recently as a year ago (see below). “This means that more than one in three Class 8 trucks in the United States is a Freightliner-badged vehicle,” wrote Isabel Wagner, Statista’s research lead covering road traffic and motor vehicle manufacturing.

Businesses seeking to work towards zero-emission status will appreciate Hyllion’s environmentally friendly system components. Plus, Hyliion’s hybrid diesel modular design is “brand and engine agnostic,” meaning that the system “can be installed on most major Class 8 commercial vehicles.”

Class 8 truck manufacturers’ market share in the U.S., as of 12/19

Perhaps best of all, this system offers a better experience for the drivers. The features include:

- An intelligence algorithm which reads the road ahead of the vehicle in order to determine energy capture and application

- Additional torque to improve the vehicle’s performance and make the driver’s job easier

- Over-the-air updates to ensures that the drivers have the latest software to maximize fuel savings

- “Regen” (regenerative) braking which supplements the jake brake and reduces brake wear

A ‘Warranted’ Price Decline

By now, you should start to see how Hyliion is setting itself apart through innovative product offerings.

Yet, if you’re not a staunch contrarian, the decline in the HYLN stock price might still bother you. Frankly, you might be looking for reasons why it happened.

For one thing, a number of electric vehicle stocks declined in value in late November and early December. In the two weeks ending Dec. 7, Nio (NYSE:NIO) stock lost 4.4% and Electrameccanica Vehicles (NASDAQ:SOLO) shares lost 28.3%. By comparison, KraneShares Electric Vehicles and Future Mobility Index ETF (NYSEARCA:KARS) gained 6.5% in that time span. NIO stock is the largest holding, at 3.89% weighting, in that exchange-traded fund’s 59 EV-related stock portfolio.

Also, on Nov. 30, Hyliion announced the redemption of approximately 12.5 million outstanding warrants. These warrants were “exercisable for an aggregate of approximately 12.5 million shares of Common Stock at a price of $11.50 per share, representing a total of approximately $144.0 million in potential proceeds to Hyliion.”

That’s a nice injection of capital for Hyliion. On the other hand, the redemption of millions of shares at $11.50 apiece wasn’t necessarily perceived in a positive light by the retail traders who had bought HYLN stock shares at higher prices.

This type of event is temporary and shouldn’t reflect poorly on the company itself. If anything, it’s a way for Hyliion to bring in some capital, which could be used to further develop the company’s product line.

The Bottom Line

Powerful products underscore the bull thesis for Hyliion as an innovator in the electric vehicle space.

And for contrarians and non-contrarians alike, HYLN stock’s decline ought to be viewed as a temporary and compelling buying opportunity.

On the date of publication, David Moadel did not have (either directly or indirectly) any positions in the securities mentioned in this article.

David Moadel has provided compelling content – and crossed the occasional line – on behalf of Crush the Street, Market Realist, TalkMarkets, Finom Group, Benzinga, and (of course) InvestorPlace.com. He also serves as the chief analyst and market researcher for Portfolio Wealth Global and hosts the popular financial YouTube channel Looking at the Markets.