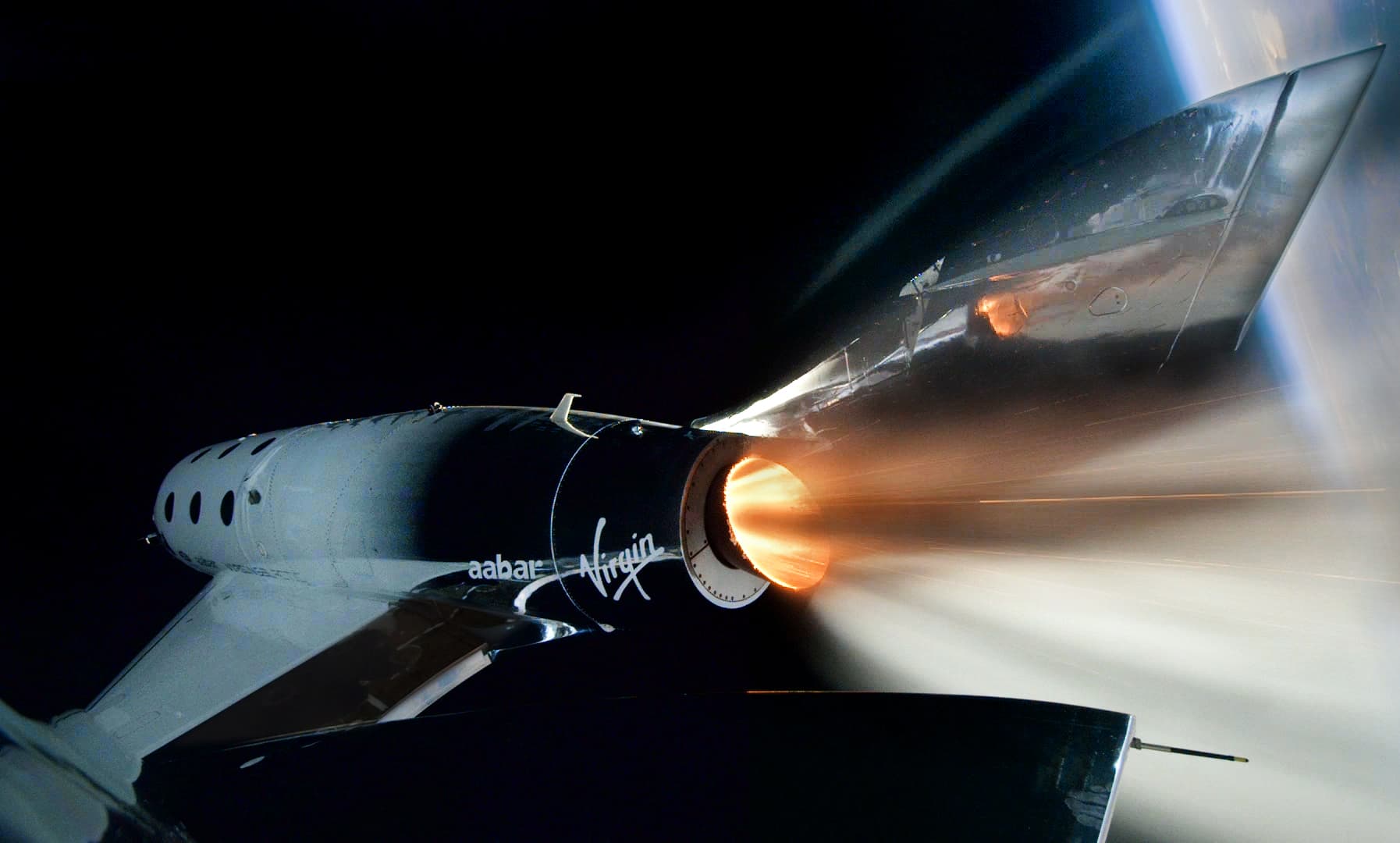

Virgin Galactic’s spacecraft Unity reaches space for the first time.

Source: Virgin Galactic

Ark Invest, which operates the largest actively managed exchange-traded fund, plans to add a “Space Exploration ETF” under the ticker ARKX, according to a securities filing on Wednesday.

While the ETF’s constituents have yet to be announced, shares of space companies Virgin Galactic and Maxar Technologies each jumped more than 8% in after hours trading.

Ark Invest is coming off a wildly successful 2020, with its flagship ARK Innovation fund returning more than 170% last year and growth in assets under management to $17 billion. The fund’s largest holding is electric car maker Tesla, which accounts for more than 10% of its weighting.

Ark founder and CEO Cathie Wood told CNBC last month that investors should “get on the right side of change and stay on the right side of change because it has hit escape velocity in the aftermath of the coronavirus.” Wood, a long-time Tesla bull, has a $7,000 a share price target for the company to hit by the end of 2024.

The Space Exploration ETF would focus on companies that are “leading, enabling, or benefitting from technologically enabled products and/or services that occur beyond the surface of the Earth,” the filing said.

The space industry grew steadily in 2020 despite delays due to the COVID-19 pandemic, with investment bouncing back after a brief lull. Investor interest in space companies has continued at heightened levels, despite only a few publicly-traded companies.

But more space companies plan to enter public markets in the year ahead, with both traditional IPOs and SPAC deals expected in 2021.

Ark divided the industry into four categories: orbital aerospace, suborbital aerospace, enabling technologies, and aerospace beneficiary.

“Space exploration is possible due to the convergence of a number of themes, and a Space Exploration Company may not currently derive any revenue, and there is no assurance that such company will derive any revenue from innovative technologies in the future,” Ark’s filing said.

Ark further explained the four categories of companies that will be in the Space Exploration ETF:

“Orbital Aerospace Companies are companies that launch, make, service, or operate platforms in the orbital space, including satellites and launch vehicles. Suborbital Aerospace Companies are companies that launch, make, service, or operate platforms in the suborbital space, including drones, air taxis and electric aviation vehicles. Enabling Technologies Companies are companies that create the technologies required for successful value-add aerospace operations, including artificial intelligence, robotics, 3D printing, materials and energy storage. Aerospace Beneficiary Companies are companies that stand to benefit from aerospace activities, including agriculture, internet access, global positioning system (GPS), construction and imaging.”

– CNBC’s Maggie Fitzgerald contributed to this report.

Subscribe to CNBC PRO for exclusive insights and analysis, and live business day programming from around the world.