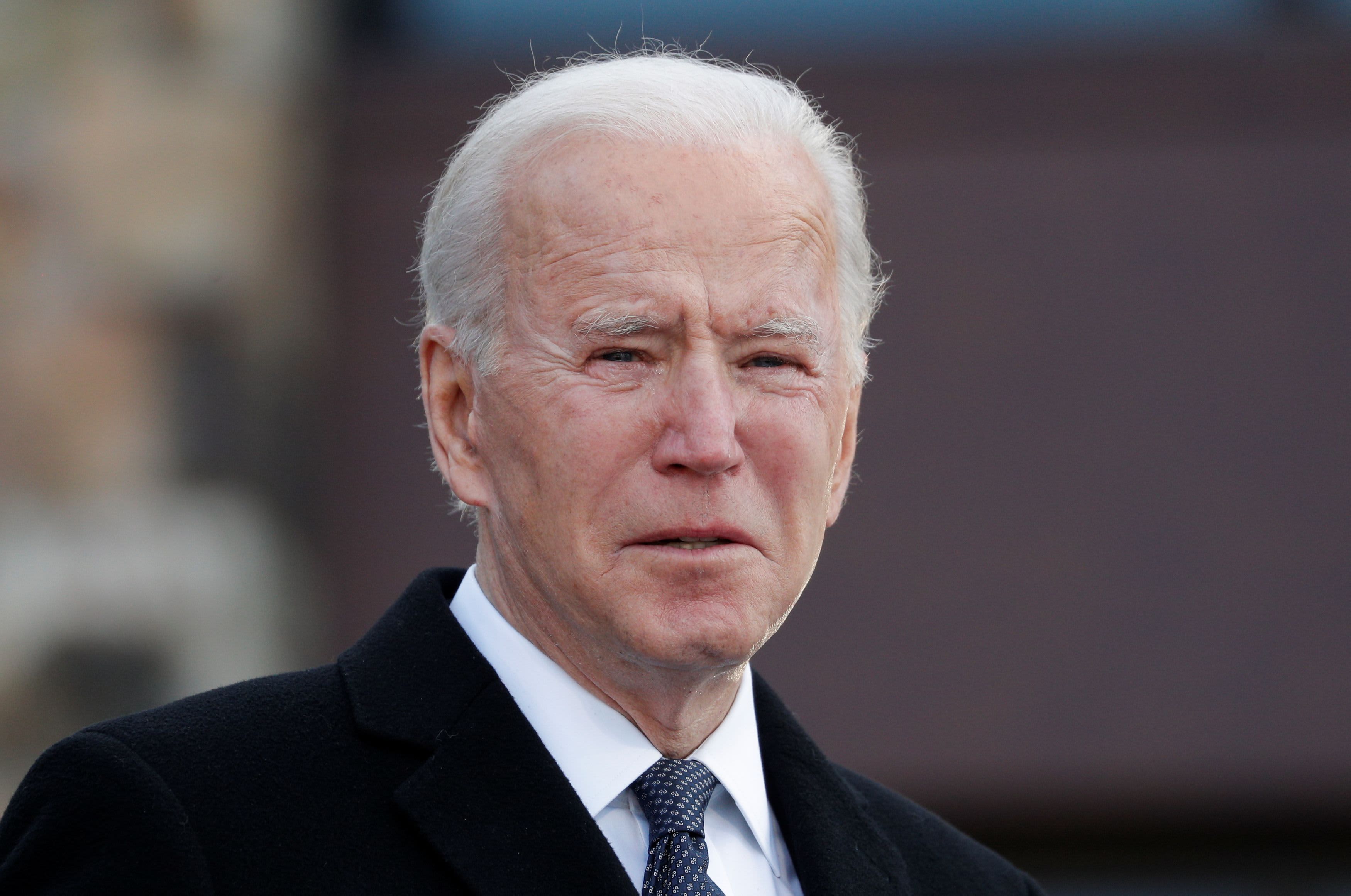

U.S. President-elect Joe Biden speaks about his plan to administer coronavirus disease (COVID-19) vaccines to the U.S. population during a news conference at Biden’s transition headquarters in Wilmington, Delaware, January 15, 2021.

Kevin Lamarque | Reuters

The Biden agenda is expected to result in a faster-growing economy, a stronger stock market and higher interest rates in its first year.

But those outcomes will also be shaped by how much of the new president’s agenda is approved and how quickly his plan to speed up vaccinations can curb the spread of the coronavirus.

The stock market has already been riding higher on Biden policy. The 13% gain in the S&P 500 since the election is the best for any president since at least 1952, according to CFRA data going back to then. The second-best first-term president was John F. Kennedy with an 8.8% gain from election to inauguration.

“The political environment has changed dramatically. It’s just been three months. It’s been kind of a drum beat and that’s not going to reverse,” Michael Wilson, chief U.S. equity strategist at Morgan Stanley, said on CNBC. “We said, ‘Look, the policy response this time around is going to be gargantuan because it’s a health crisis and that’s only going to continue further with the political change in Washington, but that’s all good for growth and rates could go up in a nonlinear fashion.'”

Joe Biden is sworn in as the 46th U.S. president Wednesday, and he has already proposed a $1.9 trillion relief package to help individuals, boost the vaccination effort and provide funds for state and local governments. Policy strategists expect that plan to be significantly pared back before it can get through Congress, but it is expected to be followed up with another in March that would promote job growth and infrastructure spending.

Biden’s policy got a big boost from the outcome of the Jan. 5 Senate runoff elections, when two Democrat wins gave him an unexpected thin majority in the Senate. Each party has now 50 seats, and Vice President-elect Kamala Harris will cast any tie-breaking vote.

Wells Fargo Investment Institute raised its forecast for growth, interest rates and stocks Tuesday, in part on expectations that fiscal spending will be much larger than it would have been if Republicans maintained Senate control.

“Our number for GDP this year is 4.7%. It was 3.8%,” said Scott Wren, Wells Fargo senior market strategist. He said his midpoint target on the S&P 500 is now 4,100 from a previous 3,900. The firm also expects the 10-year Treasury yield to rise to a range of 1.25% to 1.75% by year end, from a previous forecast of 1% to 1.5%.

“The economic numbers have been coming in better than expected. They’ve been consistently coming in better-than-expected. The vaccine logistics and news has been better than expected,” Wren said. “We’re not expecting these lockdowns in states like California and New York to go on endlessly.”

Ed Keon, chief investment strategist at QMA, said even though vaccinations started off slowly, they are beginning to roll out.

“The huge rally we had suggests the market is looking past the virus, but the degree of the recovery of the economy is not a sure thing yet,” he said. “Everybody expects a rebound in the second half. The question is how strong will it be. If you get a big stimulus package o top of the last stimulus package we got, that rebound could really be much stronger than expected.”

The market responded favorably to comments from Biden’s Treasury nominee, former Fed Chair Janet Yellen, when she said “the smartest thing we can do is act big.” Yellen appeared before the Senate Finance Committee. “I believe the benefits will outweigh the costs, especially if we care about helping people who have been struggling for a very long time,” she said.

Quick market impact

Stock strategists have said the Biden stimulus proposal accelerates a market rotation that was already beginning, as investors shift into cyclicals from growth names. “We’re leaning more toward cyclicals,” said Wren, but added he still likes technology.

Since the start of the year, cyclicals have outperformed, with energy gaining the most, up 15%, helped by higher oil prices. Financials were up 5.1%, and materials were up 4.4%.

“All of these cyclicals stocks have moved in advance of what we think will be a higher rate move. Rates have moved up to support that idea,” Wilson said. “We think they could go up quite a bit more over the course of the next several months.”

Besides the impact of higher rates, there is concern that Democrats could move to regulate the big tech names or they could be targeted for higher taxes in the future. Since the start of the year, the S&P tech sector has declined 0.9%, and communications services, which includes FANG names Facebook and Alphabet, was off 2%.

“There are a lot of stocks in the last, call it 10 years, that have benefitted from falling nominal and real rates,” Wilson said. “If that goes in reverse, it doesn’t mean they’re going to get crushed, or go down 40%. It just means they’re going to lag more in this more cyclical recovery that we’re still pricing.”

The closely watched 10-year Treasury yield started the year at 0.91%, and was at 1.09% Tuesday afternoon. Strategist do not see it as a problem for the stock market in general unless it starts to move rapidly higher.

Energy changes coming

One industry that could be reshaped in the Biden era is energy. Weak oil prices hurt energy stocks during President Donald Trump’s administration, but he eased regulatory issues for the sector. One of the first moves Trump made was to clear the way for the Keystone XL pipeline.

Biden is expected to move quickly to rescind the permits from the Keystone XL pipeline project, which would bring oil from the Canadian oil sands in Alberta, to Nebraska. .

“I assume he’ll revoke that because he said he would,” said Andy Laperriere, Washington policy analyst at Cornerstone Macro. “I don’t’ see him trying to destroy the American energy renaissance.”

The new president is not expected to curb fracking except on federal land. He is also expected to immediately put the U.S. back in the Paris climate accord and promote clean energy in his infrastructure plan.

Wren said a play would be to buy alternative energy, electric vehicles and clean energy in ETFs. “You’ve got to buy the basket. It’s like any new technology,” he said. “There’s going to be a lot of these companies that don’t survive. Plus, this is going to take a while. Natural gas is still cheap … We’re going to be using natural gas and oil for decades,”

Clean energy shares and ETFs have done well. Since the election, iShares Global Clean Energy ETF ICLN has risen from $20.15 on Nov. 3 to $31.40. TAN, Invesco’s Solar ETF rose from $69.16 per share Nov. 3 to $114.

Health care uncertain

The S&P health care sector has been performing well since the start of the year and is up 3.8%, but it is an industry that investors have feared would be targeted by Democratic policies.

With the reliance on the healthcare industry for vaccines and Covid treatments, some investors have begun to think the industry will not be subjected to higher pricing.

“I think he’ll expand [Affordable Care Act] subsidies, and I think they’ll cut drug prices. I think there’s real changes that are coming to drug prices that could be meaningful. I think people are skeptical of that … but I think it’s coming,” Laperriere said.

Wren, however, said he likes the sector though it has lagged.

“We thought that would perform better,” he said. “We do like health care and certainly from a longer-term approach I think the quickness with which these vaccines were developed is an indication on what is going to happen in terms of medical breakthroughs.”

Risks include inflation, rates

Covid-19 remains a threat to the economy, and how much activity needs to be shut down will affect growth and corporate earnings. The hope is that the Biden administration will speed vaccinations as he has said he would do.

But there are risks that come with Biden’s stimulative policies.

One is inflation that could move higher as demand picks up in a recovering economy or build as the dollar and debt burden grows. Economists, however, see higher inflation as temporary at some time this year and not a problem at this point.

The other concern is that the Biden administration would have to raise taxes to pay for its stimulus program.

The corporate tax rate, currently at 21%, could be moved as high as 28% under Biden’s proposals, but strategists expect it to be held at 25%. There could also be higher capital gains taxes, and the highest individual tax bracket could be raised.

“lt will be interesting to see what’s going to happen on the tax side. It seems increasing taxes will not be at the top of the agenda, but eventually there will be some tax increases,” said Keon. “I don’t think the market is too worried about tax increases at this point.”

Policy strategists don’t expect to see a corporate tax hike until next year.

“If you get a much stronger economy in the second half of the year, that could trump the negative effects of tax increases,” he said.