When it comes to the stock market, sometimes the baby gets thrown out with the bathwater. This means if a particular sector or industry is weak, even the stocks of good companies may go lower.

One signal of a company’s strength is the ability and choice to pay dividends. If they are doing this, it usually means that it is operating at a profit. It’s a choice, because the company could use the money to reinvest it into the business. Instead, they’re supporting a dividend.

The dividend payment is one way that a company rewards its shareholders. Companies pay the same dividend regardless of the price the stock is trading at. This means when the price of the stock falls, the yield of the dividend increases.

These seven companies have not always traded as penny stocks. Their share prices used to be much higher than they are now. As you will see, they have all lost a significant amount of value in a relatively short period of time.

But they have continued to pay dividends to their shareholders. This could be a signal that they will be able to turn things around. Their share prices may eventually reach the levels they used to trade at.

- NL Industries (NYSE:NL)

- Nordic American Tankers (NYSE:NAT)

- NGL Energy Partners (NYSE:NGL)

- Franklin Street Partners (AMEX:FSP)

- VEON Ltd (NASDAQ:VEON)

- Mitsubishi Financial Group (NYSE:MUFG)

- Entravision Communications (NYSE:EVC)

Penny Stocks With High Dividend Yields: NL Industries (NL)

Chart by TradingView

NL Industries is involved in the components products and chemical industries, operating as a holding company. It makes things like ball bearings, ergonomic computer support systems and various security products. Its customers are original equipment manufacturers and distributors in North America and Taiwan.

NL also owns a significant interest in Kronos Worldwide (NYSE:KRO). Krono’s produces and markets value-added titanium dioxide pigments worldwide. These pigments provide “a pigment that provides maximum whiteness and opacity.” They are added to paints and other materials.

In late 2017, shares of NL traded around $15 per share. But since then, shareholders have suffered. The stock went into a steep decline and has lost about 70% of its value. Now it is trading below $5.

The market cap is currently $225 million. But it still pays an annual dividend of 16 cents. At current price levels, this is a yield of about 3.38%.

Nordic American Tanks (NAT)

Nordic American Tankers is an international tanker company. It buys and charters double-hull tankers internationally, currently operating a fleet of 23 Suezmax crude oil tankers. These massive ships get their names because they are the largest vessels that can make it through the Suez Canal.

According to MarketWatch, seven Wall Street firms follow and provide research on Nordic. While on average they have NAT rated as a hold, they also have an average price target of $3.66. That’s about 28% higher than where the shares are currently trading.

The current market cap is about $434 million. As you can see on the above chart, shares have fallen more than 50% since May.

Nordic pays an annual dividend of 16 cents per share. At the current price level, that works out to be a yield of about 5.6%.

NGL Energy Partners (NGL)

NGL Energy Partners owns and operates a vertically integrated energy business. This means it owns both suppliers and distributors of its products.

Since the beginning of November, the price of oil has soared by almost 60%. Some analysts believe that part of this move could be due to the President Joe Biden administration placing new regulations on the industry.

The higher price of oil may slow down the economy, but it will make energy companies like NGL more profitable. This could reverse the long downtrend that many stocks in this sector are in.

The current market cap of NGL is about $384 million. As you can see on the chart above, the price of its shares have dropped by more than 80% since July 2019.

The company pays an annual dividend of 40 cents. At the current price levels of the stock, this is a yield of just over 14%.

Franklin Street Partners (FSP)

Franklin Street Partners is a real estate investment trust, or REIT. It is involved with leasing, rentals and financing of real estate transactions. Franklin Street also acquires, develops and sells properties. Its focus is on central business district (CBD) office properties in America’s Mountain West and U.S. Sunbelt.

As you can see on the chart above, FSP has been a disappointment for its shareholders. The price of its shares has dropped from $9 to its current levels over the past 14 months. The market cap is now down to about $500 million.

But this may be a good time to invest in FSP. Franklin pays an annual dividend of 36 cents. At the current price levels, this equates to a yield of around 7.7%.

Investors who are seeking income should act quickly if they are interested in Franklin. The ex dividend date is Jan. 28. An investor must be a shareholder as of this date in order to be paid the next dividend.

VEON Ltd (VEON)

VEON Ltd is a holding company in the internet services and and provision of connectivity business. It provides communications and digital services, and has more than 200 million customers in 10 different countries.

As you can see on the above chart, shareholders of VEON have had to endure a lot of volatility over the past two years. From its highs around $3.20 in July 2019, it fell as low as $1.20 in October.

The stock has made a decent rebound since then, but despite that, the yield is still very attractive.

The company has a current market cap of $3 billion. It pays an annual dividend of 11.5 cents a share. This works out to be a yield of over 6% at the current share price. But make sure to be cautious — the dividend is irregular.

Mitsubishi Financial Group (MUFG)

Mitsubishi Financial Group is a huge banking conglomerate with a market cap of over $60 billion.

The business of Mitsubishi spans the entire range of the banking spectrum. Its divisions include retail and commercial banking, Japanese corporate and investment banking, global corporate and investment banking, global commercial banking asset management, and investor services.

As you can see on the chart, for the past three years MUFG shareholders have not had a lot to be happy about. In early 2018, shares broke the $8 level. But since then, they have been trending lower. They finally found a bottom in March around the $1.50 level.

Since then, the shares have been working their way higher. But with an annual dividend of 19.6 cents in 2020, they are still generating a high yield. At the current price levels, it works out to be over 4%.

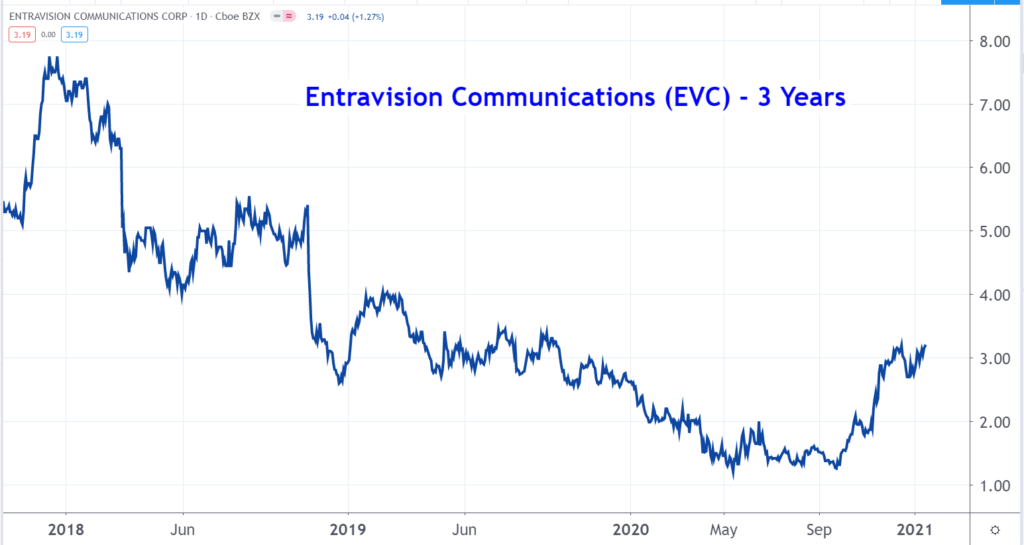

Entravision Communications (EVC)

Chart by TradingView

Entravision Communications is a diversified global media and marketing technology company serving mainly Latino consumers. Entravision’s primary markets include Spain, Mexico, and Latin America. It is the largest affiliate group of the Univision and UniMas television networks.

At the current time, Entravision owns and operates 49 radio stations. It also operates 55 television stations.

On the chart above, you can see that the shares of the company have lost more than 50% of their value over the past two years. In December of 2017, they traded as high as $7.50. Now they are trading just above the $3 level.

The current market cap of Entravision has dropped to about $260 million. The company pays an annual dividend of 10 cents. At the current price levels of the stock, this works out to be a yield of about 3.13%.

On Penny Stocks and Low-Volume Stocks: With only the rarest exceptions, InvestorPlace does not publish commentary about companies that have a market cap of less than $100 million or trade less than 100,000 shares each day. That’s because these “penny stocks” are frequently the playground for scam artists and market manipulators. If we ever do publish commentary on a low-volume stock that may be affected by our commentary, we demand that InvestorPlace.com’s writers disclose this fact and warn readers of the risks.

Read More: Penny Stocks — How to Profit Without Getting Scammed

On the date of this publication Mark Putrino did not have (either directly or indirectly) any positions in the securities mentioned in this article.