Insider trading happens when people who have access to confidential information about a company use that to profit off its stock. These insiders include folks like the corporate officers and members of the board of directors.

Historically, there have been countless cases of unscrupulous insiders benefitting at the expense of unsuspecting shareholders. For example, suppose an insider knows that some news is about to come out that will cause a company’s stock price to fall. They could go into the market and sell their shares to someone who doesn’t know about the news. Likewise, if there’s news coming out that will drive the price higher, they could buy stock from an unsuspecting shareholder.

In order to prevent this type of activity, the government has developed numerous regulations and laws. One requires that, when a company insider decides to buy or sell shares in their company’s stock, they must publicly disclose it to the U.S. Securities and Exchange Commission (SEC). That gives outside investors a chance to profit, too.

Right now, the market is making all-time new highs. Some analysts believe that this recent insanity with GameStop (NYSE:GME) and the cryptocurrency markets are signs that we are in a bubble. Many companies have seen their stock prices soar for no apparent logical or fundamental reasons.

But within this wildness, there has also been insider trading in the following seven companies. The insiders have decided to take advantage of the rallies and sell some of their shares. That could mean they believe these stocks are over or fairly valued and will eventually trade lower.

- aTyr Pharma (NASDAQ:LIFE)

- ANGI Homeservices (NASDAQ:ANGI)

- Anaplan (NYSE:PLAN)

- Tradeweb Markets (NASDAQ:TW)

- SVMK (NASDAQ:SVMK)

- Smartsheet (NYSE:SMAR)

- Twitter (NYSE:TWTR)

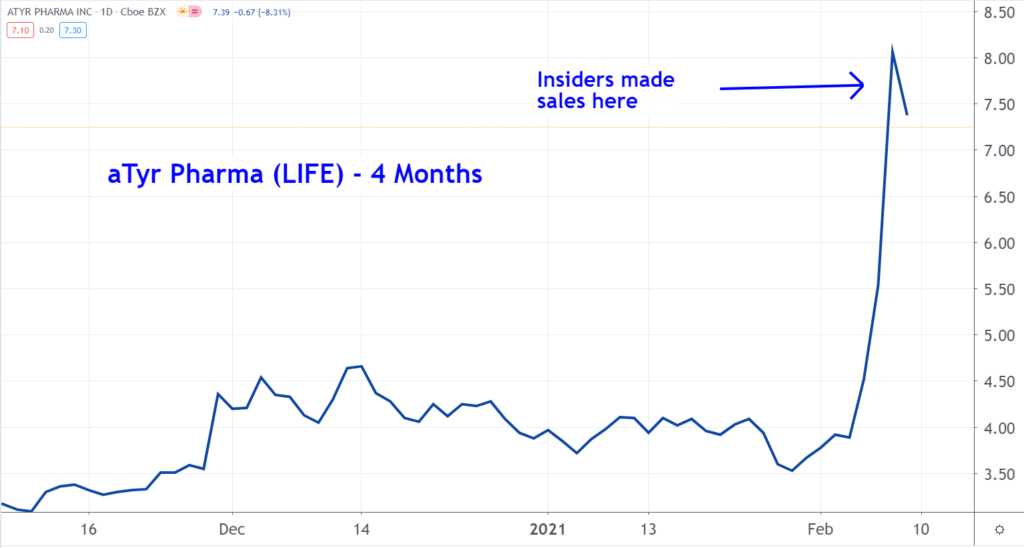

Insider Traded Stocks to Sell: aTyr Pharma (LIFE)

Chart by TradingView

A biotherapeutics company, aTyr Pharma was founded in 2005, is based in California and is the first name in this article on insider trading.

As you can see in the chart above, shares of LIFE stock doubled in just three days. On Feb. 4, the stock opened at $3.90 per share. Then on Feb. 8 — just two trading days later — shares reached $8.33. There was no news, so the stock was probably taken up by the day traders.

However, two company insiders decided to sell some of their shares. President and CEO Sanjay Shukla sold 778 shares at $7.66, while CFO Jill Broadfoot sold 390 shares at $7.66 as well. These were small sales and both insiders continue to hold larger positions. But this could also mean they believe the shares got ahead of themselves in the recent market frenzy.

The three analysts on Wall Street that follow this company think aTyr’s long-term prospects are great. According to Tipranks, they all have strong buy ratings on the stock, with an average price target of $13.33. That is about two times higher than where LIFE stock is now.

ANGI Homeservices (ANGI)

ANGI Homeservices operates a digital marketplace that — you guessed it — connects consumers with home service professionals.

This is another stock that has ripped higher in the recent market chaos. As you can see on the above chart, the share price appreciated by more than 50% in less than a month. Between Jan. 15 and Feb. 8, ANGI stock rose from around $12 to a close of $18 per share.

Allison Lowrie is the CMO of ANGI. She decided to raise some cash and take advantage of the recent move. Based on a SEC Form 4 (which reports insider trading), Lowrie sold 76,903 shares at $17.74 per share. That’s worth close to $1.4 million.

Wall Street seems to agree with Lowrie that this is a fair valuation for the company. On Tipranks, nine analysts follow ANGI and have an average target price of $17.38. That is somewhat close to the current price of just under $16.

Anaplan (PLAN)

Anaplan is a company that provides a cloud-based planning platform to connect people and organizations. The company was founded in 2008 and is headquartered in San Francisco, California.

On Jan. 28, shares of PLAN stock opened at around $62.50. By Feb. 8, they had reached a high of over $83. That represents a gain of more than 30%.

Sandesh Kaveripatnam is a director for Anaplan. In terms of insider trading, Kaveripatnam decided to take advantage of the recent price appreciation and raise some cash. One Feb. 5, he sold 11,991 shares at prices between $78 and $81. That made for a sale amounting well over $900,000.

Wall Street thinks that shares are fairly valued at current levels. Moreover, they probably think that Kaveripatnam has made a smart move. On Tipranks, five analysts follow Anaplan. The average target price is $79.59 — relatively in-line with where PLAN stock is currently trading.

Tradeweb Markets (TW)

Next on this insider trading stocks list, Tradeweb Markets builds and operates electronic marketplaces. According to it’s website, the company “offers institutional, wholesale and retail market participants unparalleled liquidity, advanced technology and a broad range of data solutions.” Moreover, Tradeweb operates in both the United States and internationally. It was founded in 1996.

As you can see on the above chart, TW stock is trading at a resistance level.

Resistance means there is a large concentration of sellers gathered around the same price. When stocks reach resistance levels, they have a tendency to sell off. That has happened with Tradeweb. It hit resistance in both June and December. Now it has reached that level once more.

Enrico Bruni is a managing director for the company. Probably believing shares would sell off again, Bruni reportedly sold 142,861 shares at a price of $67.66 on Feb 9.

Like ANGI and PLAN, the Street thinks TW stock is fairly valued, too. On Tipranks, the seven analysts following the company give this name an average share price of $69.83 — close to current prices.

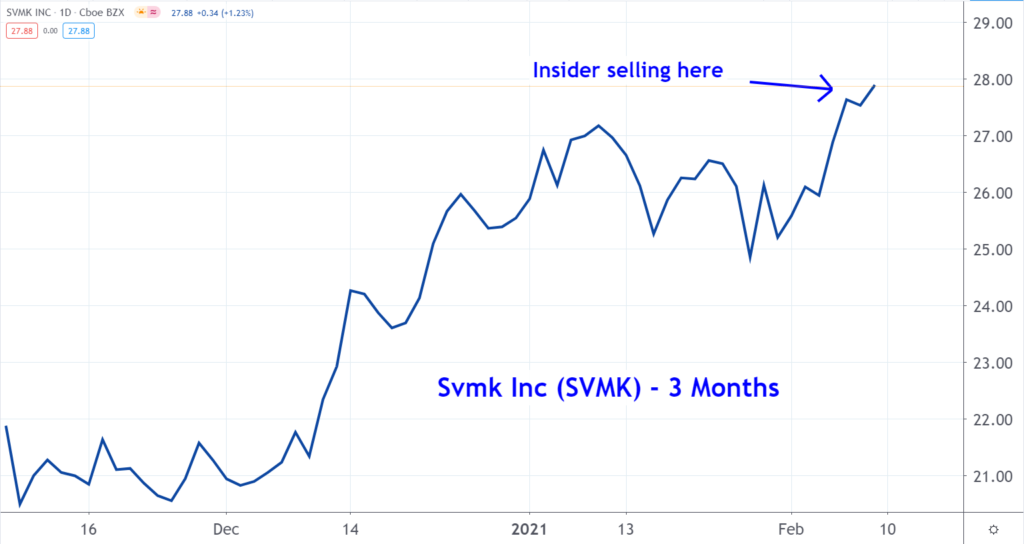

SVMK (SVMK)

Formerly known as SurveyMonkey, SVMK provides clients with survey software solutions. The company’s products allow other companies to engage with their customers and employees. SVMK was founded in 1999 and is headquartered in San Mateo, California.

At the beginning of December, shares of SVMK stock were trading around the $21 level. Since then, they have trended higher. Trading at a high of $28.12 on Feb. 11, the stock currently changes hands closer to $25.

Like with other insider trading names on this list, CEO Alexander Lurie just made a significant sale on the stock. Between Feb. 5 and Feb. 8, Lurie sold a total of 16,595 shares at an average price of $28. This is about $460,000 worth of stock.

Three analysts follow SVMK stock on Tipranks and they probably agree with Lurie’s decision to sell. Each believes shares are trading at a fair price. The average target is $29. This is only slightly higher than the range that the stock traded at over the past several days — and close to the price that the CEO sold at.

Smartsheet (SMAR)

Smartsheet provides a cloud-based platform for the efficient execution of work. The company was founded in 2006 and is headquartered in Washington state.

As you can see in the above chart, between late November and now, shares have rallied from $52 to today’s levels of over $80. With SMAR stock trading at about $84 (and rising), this represents a gain of over 60% in less than three months.

At least one insider is using this move to lighten up their position. In terms of insider trading, CMO Anna Griffin sold 5,500 shares between $75 and $76 on Feb. 5. That made for a gain of more than $400,000. Other insiders have reported selling shares as well.

This company is widely followed by Wall Street. Nine analysts cover the stock on Tipranks. They give it an average target price of $80.89. This is only a few dollars below where it trades today.

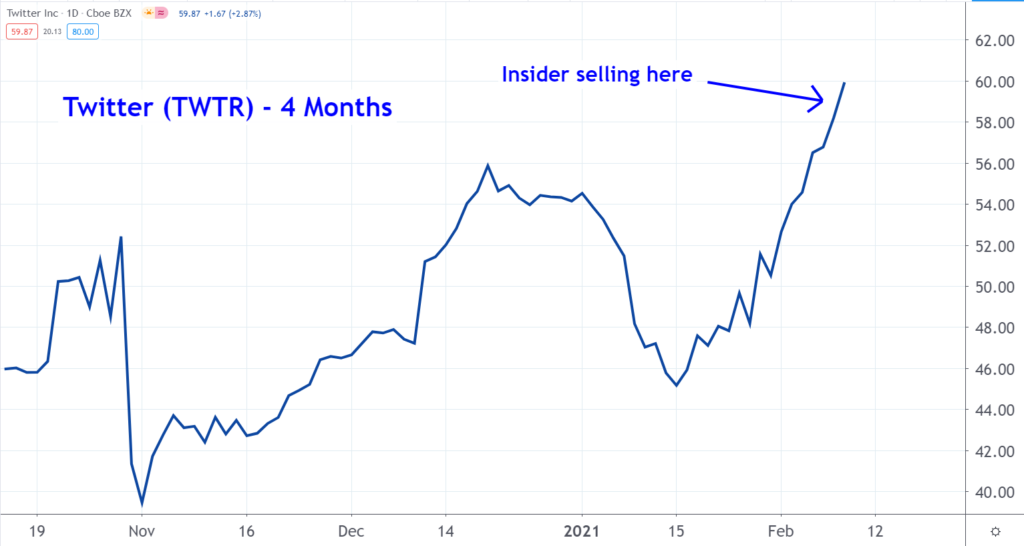

Twitter (TWTR)

Last on this list of insider trading stocks, Twitter is a social media company that operates as a platform for public self-expression and conversation in real time — in both the United States and internationally. It was founded in 2006 and has headquarters in San Francisco, California.

Like other companies in this article, Twitter has rallied and the insiders are selling. In just the past month, the price of TWTR stock has gone from $46 to $60 and above. The stock trades at around $72 today.

On Tipranks, 32 analysts give a price target of $62.86 on Twitter. This is about $10 below the current price.

What’s more, Robert Kaiden is the chief accounting officer of the company and sold shares recently. On Feb. 9, Kaiden reported selling 12,032 shares at prices between $55 and $57 a piece.

At the time of this publication, Mark Putrino did not have any positions (either directly or indirectly) in any of the aforementioned securities.