Controversial Palantir (NYSE:PLTR) stock is up 236% in three months, prompting overvaluation concerns. I have written a couple of times on the company. It’s no secret that I am bullish on PLTR stock, considering the business model and its client list. However, shares are trading at 303 times forward price-to-earnings, and there is no shortage of attractive options out there now that vaccines are rolling out and the economy is whirring again.

The latest data also reveals that short interest in the stock sits at about about 6% of the float. Out of six analysts at TipRanks covering the stock, only one has a bullish view.

Its average 12-month price target stands at $17.83 per share, implying a 44.4% downside to the current price. However, a company in the intersection of defense, policing, surveillance, big data, and AI, with large government contracts, is not your average overpriced tech stock.

Furthermore, Palantir has won a plethora of important contracts recently, adding to its already impressive resume. Its recent Demo Day was also a success, impressing analysts and industry experts alike. The bottom line is the government and businesses will use the company’s tools to improve results. That makes it a must-have for your portfolio.

I remain long-term on Palantir. Nonetheless, wait for shares to dip a bit before buying in. If you purchased a nice amount of PLTR stock, it might be the right time to cash in before the lock-up date expires.

Lockup Expiration and What It Means for PLTR Stock

When a firm goes public, the owners tend to sell roughly 15%-20% of the company. As part of the initial public offering (IPO) process, the remaining 80%-85% is almost always subject to a lock-up period, usually of 90 to 180 days, in which they have agreed not to sell any of their shares. Upon completion of this period, these shareholders are then free to sell their existing shares. Thus, it results in a permanent shift in the number of available shares in the marketplace.

The Securities and Exchange Commission (SEC) does not mandate this. However, it’s a self-imposed practice to ensure that big investors do not flood the market with shares. Typically, if there is a sharp increase in the number of available shares, the stock price is pushed down.

It is not surprising to see a stock’s share price fall on the first day that the lock-up shares can be traded. If other investors (not subject to the lock-up period) begin to sell in the days before the lock-up expires, it is a typical sign of shareholders taking short term profits before the stock price loses steam.

Palantir’s lock-up period is set to expire after the release of Q4 earnings. If you invested a large amount of money, now is the right time to book your profits by selling a small stake from your holdings.

Long-Term Prospects Look Excellent

In the short term, there are some headwinds that PLTR stock will have to contend with. However, the long-term thesis for the company remains bullish. Palantir recently had a great Demo Day. It captured the attention of investors and industry professionals alike.

Palantir has two major platforms through which it conducts its business. Its Gotham software platform focuses on government intelligence and defense sectors. Palantir expanded into various commercial markets with its Foundry software platform with plans to become the preeminent data operating system for companies and industries.

I have already gone into detail regarding the company’s ties to the Pentagon in my previous articles. I won’t reiterate them here. However, I will say that the company’s association with the defense establishment is a strength rather than a weakness.

In the government sector, PLTR estimates its total addressable market to be approximately $26 billion in the United States and $63 billion when combining U.S Allies and other liberal democracies.

Its clients include the U.S Army, Navy, Air Force, Special Operations Command, the intelligence community, and other federal agencies, including the Department of Homeland Security, Center for Disease Control, Department of Agriculture, Food and Drug Administration, and SEC.

Excellent Stock but Wait for the Dip

PLTR has signed seven new contracts since Nov. 2020. Late last year, the company signed a two-year contract worth $31.5 million with the U.K. National Health Services. They will utilize Palantir’s Foundry platform in COVID-19 response efforts.

In January, it inked a one-year partnership with SOMPO Holdings in Japan worth $22.5 million. In the same month, PLTR signed an $8 million contract with Fujitsu (OTCMKTS:FJTSY) that will see the latter become the first distributor of its enterprise resource planning (ERP) suite in the Japanese market.

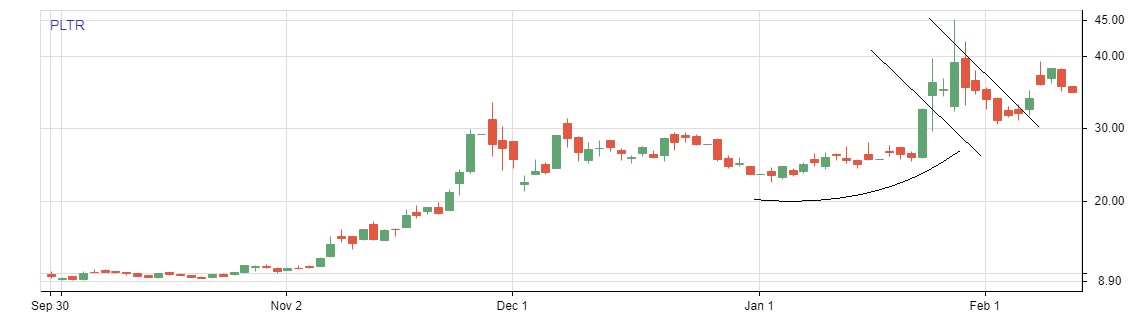

From a technical standpoint as well, we see a bullish cup-and-handle pattern forming. It’s considered a bullish signal, with the right-hand side of the pattern typically experiencing lower trading volume. Generally, cups with longer and more “U” shaped bottoms provide a stronger signal. However, I believe shares will lose steam for the next couple of weeks, after which normal service will resume.

In conclusion, wait for PLTR stock to dip after the lock-up expiration before buying in. If you want to make some profit from your large position, now is the time to act.

On the date of publication, Faizan Farooque did not have (either directly or indirectly) any positions in the securities mentioned in this article.

Faizan Farooque is a contributing author for InvestorPlace.com and numerous other financial sites. Faizan has several years of experience analyzing the stock market and was a former data journalist at S&P Global Market Intelligence. His passion is to help the average investor make more informed decisions regarding their portfolio.