Over the weekend, I was doing research on large-cap stocks and noticed an important detail: buying pressure is dissipating on otherwise good stocks with positive sales and earnings.

One example right now is Facebook (NASDAQ:FB). In its fourth-quarter announcement on January 27, the company reported earnings of $3.88 per share, which was up 51.5% from a year prior and beat Wall Street’s expectations by 19.8%. Sales of $28 billion were up 33% from the year prior and beat analysts’ predictions by 6.2%.

The company is facing regulatory backlash in the U.S. and abroad. It has also recently warned that coming changes in Apple’s (NASDAQ:AAPL) operating system, iOS 14, not to mention a reversal in pandemic trends, could hit its advertising business in the future.

But it’s fair to say that given Facebook’s strong earnings, the company would rate highly in Portfolio Grader. However, that’s not the case this time around.

As you can see, Facebook has a strong Fundamental Grade of “B,” and earns an “A” and a “B,” respectively, for its Sales Growth and Earnings Growth scores.

However, notice the company’s Quantitative Score of “C,” which drags down its Total Grade to “C,” making the stock a Hold right now.

Why the Quantitative Grade is So Important

You see, even more important than my Fundamental Grade is my Quantitative Grade. This measures a stock’s return, independent of the market. I also regress the stocks measured in the Portfolio Grader against different indices and always pick the one with the highest correlation. That way I don’t, for example, compare a small-cap stock to a big index. This would be like comparing a chihuahua to an elephant.

The bottom line is that the Quantitative Score helps me accurately determine the buying pressure from institutional investors behind a given stock. And right now, I’m starting to see that buying pressure is starting to ebb in a lot of good stocks.

It’s why I decided to ring the register on two fundamentally superior Growth Investor companies on Monday that were sitting with triple-digit gains on the High-Growth Buy List.

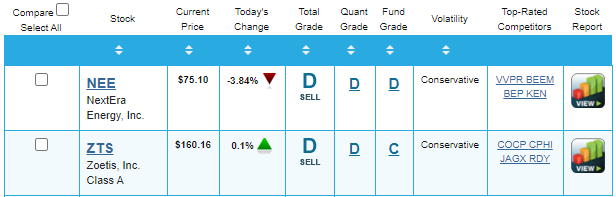

The first was NextEra Energy, Inc. (NYSE:NEE), the largest global utility company in the world.

I originally added NEE to the Growth Investor Elite Dividend Payers Buy List back in October 2017, given its long history of rewarding shareholders. But I shifted the stock to the High-Growth Investments Buy List when its fundamentals stole the spotlight. In fact, during the fourth quarter, NEE achieved adjusted earnings of $0.40 per share, up from $0.36 per share, which topped analysts’ estimates for $0.37 per share.

Looking forward, though, NEE’s earnings momentum has tapped the brakes, and analysts are estimating a 1.7% drop in first-quarter earnings. Analysts have also lowered earnings estimates in the past month. Couple this with a drop off in buying pressure — the stock now has a Quantitative Grade of “D” — and it’s easy to see why I recommended booking a 127% gain, including dividends.

The second was Zoetis, Inc. (NYSE:ZTS), which has been discovering and delivering veterinary vaccines and medicines for more than 65 years.

The company released fourth-quarter results on February 16. For the fourth quarter, Zoetis reported adjusted earnings of $438 million, or $0.91 per share, and revenue of $1.8 billion, which compared to adjusted earnings of $0.92 per share and revenue of $1.67 billion in the fourth quarter of 2019. The analyst community was expecting adjusted earnings of $0.87 per share on revenue of $1.73 billion. So, Zoetis posted a 5.7% earnings surprise and a slight revenue surprise.

Zoetis also provided positive forward-looking guidance: The company expects full-year 2021 revenue between $7.4 billion and $7.55 billion and adjusted earnings per share between $4.36 and $4.46.

However, despite the solid fourth-quarter results and guidance, the reality is that earnings momentum is slowing down and buying pressure is drying up. As a result, Zoetis’ Quantitative and Total Grade in Portfolio Grader dropped to a “D” over the weekend.

I recommended ZTS to Growth Investor subscribers back in January 2018, so those who sold the stock Monday saw about a 130% gain, including dividends.

A Narrowing Market

Going forward, the market appears like it’s headed into a funnel — it’s getting more narrow and more selective.

And my quantitative indicators are starting to say that the buying pressure is beginning to slow in a lot of stocks.

That’s why we remain focused on the crème de la crème, where the buying pressure still exists thanks to great fundamentals.

In other words, we are getting more selective, and that’s a good thing. In fact, buying pressure in more selective stocks means they may have more profit potential going forward.

This is great news for my Platinum Growth Club stocks. Simply put, the current market is diverting investors’ attention back to fundamentally superior stocks. My Platinum Growth Club Model Portfolio stocks fit the bill to a “T,” with their double-digit forecasted sales growth and triple-digit forecasted earnings growth.

So, I look for this flight to quality to propel many of my stocks higher in the upcoming weeks and months. To ensure that Platinum Growth Club subscribers remain well-positioned for the strength that I’m anticipating, I made several changes to my Platinum Growth Club Model Portfolio in my February Monthly Issue. This includes selling three stocks and rolling that cash into seven new buys.

I also added one new stock in Accelerated Profits on Tuesday and one new stock in Breakthrough Stocks in early February. Plus, on Friday, I will be releasing two High-Growth trades in my Growth Investor March Monthly Issue and a fresh list of Top 5 stocks – all of which my Platinum Growth Club subscribers have full access to. This includes a brand-new service I will be unveiling next week. (Stay tuned for more details!)

So, if you’re interested in my latest recommendations and want to get into position to take advantage of the coming strength with fundamentally superior stocks, now is the time to join me here at Platinum Growth Club. Currently, I have more than 100 stocks across all my services to choose from, and as a Platinum Growth Club subscriber, you can get my latest buy advice on each and every one.

Of course, you don’t have to invest in all 100+ stocks to grow and prosper this year. If you’d rather start small, I have you covered there, too. My Platinum Growth Club also comes with my exclusive Model Portfolio. I handpick all of my Model Portfolio recommendations from my different services – Growth Investor, Breakthrough Stocks and Accelerated Profits – so you can rest assured that you’re always invested in the crème de la crème.

If you’re interested and would like to learn more about my Platinum Growth Club and how it can work for you, please click here for full details.

Note: The Editor hereby discloses that as of the date of this email, the Editor, directly or indirectly, owned the following securities that are the subject of the commentary, analysis, opinions, advice, or recommendations in, or which are otherwise mentioned in, the essay set forth below:

Facebook (FB), NextEra Energy, Inc. (NEE), Zoetis, Inc. (ZTS)

Louis Navellier had an unconventional start, as a grad student who accidentally built a market-beating stock system — with returns rivaling even Warren Buffett. In his latest feat, Louis discovered the “Master Key” to profiting from the biggest tech revolution of this (or any) generation.