Alarming inflation rates rattled stock markets in the last month, including investors in dividend stocks.

Previously steady performing assets are experiencing pockets of weakness, as risks are higher than before. For example, the financial sector has enjoyed a steady uptrend since November 2020.

Markets thought that the absence of inflationary pressures would lift economic growth for the rest of the year. Yet as energy and raw material prices climbed, the Federal Reserve changed its tune. It sped up its rate hike plans by a year, forecasting an increase in 2023 instead of 2024.

Markets are doubtful that the Fed may keep rates unchanged for another two years. Utilities fell sharply in anticipation of rate hikes coming sooner than expected.

Dividend-income investors who avoid utilities and most of the stocks in the financial sector are fine. Here are seven dividend stocks offer a big, fat, monthly payout check to income investors:

- Broadcom (NASDAQ:AVGO)

- Exxon Mobil (NYSE:XOM)

- Realty Income (NYSE:O)

- Royal Dutch Shell (NYSE:RDS-A)

- Universal (NYSE:UVV)

- Vale (NYSE:VALE)

- W.P. Carey (NYSE:WPC)

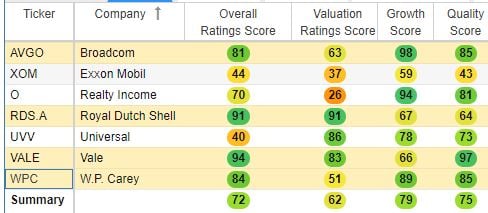

Strong scores among the dividend stocks

UVV and RDS stock both have the highest value score. Conversely, Vale, Broadcom, and W.P. Carey have the best quality. Profitability and balance sheet metrics included gross margin and return on invested capital.

Dividend Stocks: Broadcom (AVGO)

The first of today’s dividend stocks is from the technology sector. Broadcom offers investors a good balance of dividend income and growth. It has so much cash on hand that rumors circulated on July 13 that it would buy SAS Institute. At $15 billion to $20 billion, the deal would have boosted the firm’s software holdings. SAS founders changed their minds.

If Broadcom acquired SAS, it would have boosted the company’s growth prospects at a great price. Alteryx (NYSE:AYX), Snowflake (NYSE:SNOW), and C3.ai (NYSE:AI) are trading at higher valuations compared to SAS. Without SAS, Broadcom is still a dividend-paying monster. The company has a sizable debt-to-equity ratio of around 1.7 times that is manageable. It is carrying a modest debt level to finance its acquisition strategy.

In the second quarter, Broadcom posted non-GAAP earnings per share of $6.62. Revenue grew by 15.2% Y/Y to $6.61 billion. It declared a cash dividend of $3.60 a share. It also approved a cash dividend for its 8% convertible preferred stock.

Exxon Mobil (XOM)

In the energy sector, Exxon Mobil dipped after posting second-quarter results. Investors hoped for a buyback, which Exxon did not announce.

Exxon posted an incredible $4.7 billion in profits. Cash flow topped $9.7 billion, its highest in three years. This is more than enough to cover dividends, capital investments and paying down debt. XOM stock price more than doubled in the last year but as OPEC+ nations limit output, high oil prices will lift the sector.

Investors are most keen on following Exxon’s long-term capital expenditure plans. The board will most likely embrace clean-energy initiatives. This would include investing in pollution and treatment controls projects in its partnership with ClearSign Technologies (NASDAQ:CLIR).

Exxon will balance its green-energy investments against rewarding shareholders. The dividend rate will not fall, while an aggressive stock buyback would reward investors the most. Higher energy prices will increase future cash flow. The stock’s price-to-earnings will fall to value territory. Management should buy the stock back now before shares rise.

Dividend Stocks: Realty Income (O)

In the real estate investment trust space, Realty Income is a strong holding. Realty posted strong net income in the first quarter. Its common stock public offering barely hurt the stock.

Chief Executive Officer Sumit Roy highlighted its $1 billion in property investments in the first quarter. This included around $403 million in investments in the U.K. It now has over $2 billion in assets invested in its U.K. portfolio.

On June 30, Realty issued a 7.25 million stock offering. The company took advantage of the stock price. It will use the proceeds to pay back borrowing under its $3 billion credit facility. It also has a $1 billion commercial paper program to pay back. The stock sale is a shrewd move that will lower its exposure to the risks of higher interest rates.

O stock fell to $66 and below its 50-day moving average only to bounce back within days. Investors who scooped up the stock on the dip will earn a 4.3% dividend yield, excluding future dividend hikes.

Royal Dutch Shell (RDS-A)

Royal Dutch Shell is a Netherlands-based energy firm. On July 29, the company raised its dividend by 38% to 48 cents per share. The dividend hike is in sharp contrast to its dividend reduction previously. Other than CEO Ben Van Beurden undermining shareholder confidence before the dividend raise, RDS stock is a must-hold for income investors.

The CEO said that RDS must balance its dividend and stock buyback against its long-term capital expenditure plans. The firm is cautious in overspending on capital expenditures. For example, it does not plan to go above $22 billion in capital expenditures this year. For the second half of the year, it will spend more on funding its green-energy transition.

Investors who want a sustainable green-energy stock should consider Royal Dutch. In the next year, the energy giant will increase its capital expenses from the $19 billion to $22 billion range to the $23 billion to $27 billion range. For example, look at slide 12. RDS has a double-digit percentage growth target for clean hydrogen sales by 2025.

Dividend Stocks: Universal (UVV)

In the tobacco market, Universal Corporation does not get much attention. The company raised its common dividend annually since 1971. The dividend of 78 cents, announced on May 26, is the 51st consecutive annual dividend increase.

In the fourth quarter, Universal posted a non-GAAP EPS of $2.15. Revenue fell by 2.3% year-over-year to $617.6 million. The firm forecasted a second-half acceleration in leaf tobacco shipments. The segment started slowly in the fiscal year 2021, due to the pandemic. For fiscal 2022, UVV will navigate through increased safety protocols. Should travel restrictions continue to ease in the fall and winter season, Universal’s growth outlook will brighten.

CEO George Freeman III said, “We currently expect global supply for flue-cured leaf tobacco to be in line with anticipated demand and for burley leaf tobacco to be in a slight undersupply position.” Expect stronger demand as the economy heats up. Undersupply conditions will likely continue, which is similar to the chip shortage affecting the technology and automotive markets.

Vale (VALE)

In the cyclical mining sector, Vale is a solid company. The company posted GAAP EPS of $1.49 in the second quarter. Revenue grew by 121.7% YOY to $16.67 billion. Free cash flow from operations topped $6.53 billion.

Demand for metals is soaring. Construction and automotive are driving a need for Vale’s product. Also, the renewable energy boom, driven by the U.S. infrastructure bill, is another positive catalyst. On the conference call, Executive Vice President of Base Metals Mark Travers said, “In Vale Base Metals, we … are in a position to play to all three segments in the nickel industry, a high purity, the stainless as well as the chemical to provide to the EV side.”

Investors will not appreciate Vale’s modest increase in September’s dividend as much as the growth ahead. CEO Luciano Siani Pires said that Vale will take a disciplined approach in capital allocation. It will allocate its excess cash flow to its dividend. Furthermore, strong free cash flow may result in a special September or December special dividend.

Vale will invest the excess cash flow for ongoing projects, company officials said.

Dividend Stocks: W.P. Carey (WPC)

WPC’s impressive second-quarter results posted on July 30 should please income investors.

The company posted revenue growing by 10.1% YOY to $319.7 million. It narrowed its FY 2021 guidance. It now expects total adjusted funds from operations between $4.94 to $5.02 per diluted share. This is above the prior guidance of $4.87 to $4.97.

CEO Jason Fox said that the company is focused on acquisitions to achieve sustainable growth. Furthermore, Fox said, “we believe we’re uniquely positioned for inflation to create additional growth, given the proportion of our portfolio with rent escalations tied to CPI.”

WPC’s real estate revenue benefited from strong rent collection. Furthermore, increased occupancy at its hotel operating property more than offset lease terminations and higher lease-related settlements. As the economy stabilizes and grows from here, WPC stock will likely rise.

On the date of publication, Chris Lau did not have (either directly or indirectly) any positions in the securities mentioned in this article. The opinions expressed in this article are those of the writer, subject to the InvestorPlace.com Publishing Guidelines.

Chris Lau is a contributing author for InvestorPlace.com and numerous other financial sites. Chris has over 20 years of investing experience in the stock market and runs the Do-It-Yourself Value Investing Marketplace on Seeking Alpha. He shares his stock picks so readers get original insight that helps improve investment returns.