U.S. stock futures were mixed on Monday, as investors digested the latest news on the spread of the coronavirus and prepared for new inflation data later in the week.

What’s happening

-

Futures on the Dow Jones Industrial Average

YM00,

+0.33%

rose 91 points, or 0.3%, to 34658 -

Futures on the S&P 500

ES00,

-0.01%

were nearly flat at 4538 -

Futures on the Nasdaq 100

NQ00,

-0.60%

fell 71 points, or 78 points, to 15639

Last week, the Dow Jones Industrial Average

DJIA,

fell 0.9%, the S&P 500

SPX,

declined 1.2%, and the Nasdaq Composite

COMP,

dropped 2.6%.

What’s driving markets

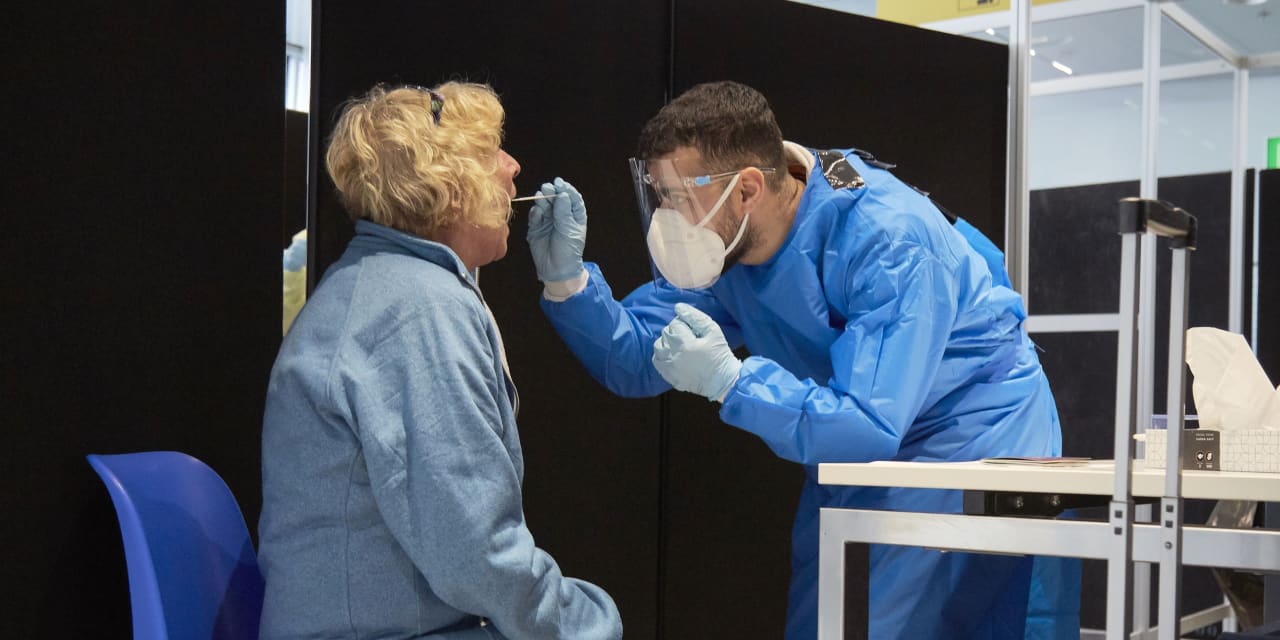

Dr. Anthony Fauci told CNN’s “State of the Union” that the early reports of the spread of the omicron variant of coronavirus suggest it might be less dangerous than the delta wave. Reports from South Africa show that while the virus is rapidly spreading, hospitalizations are not.

Traders were left trying to parse the implications of Friday’s mixed report on jobs, which showed slowing jobs growth but a steep decline in unemployment, as they prepare for Friday’s release of consumer price data. There also was critical news from China, where the central bank cut reserve requirements for banks while China Evergrande

3333,

admitted it might not be able to repay creditors.

Luca Paolini, chief strategist at Pictet Asset Management, said economies have adapted well to the pandemic. “Consumer and industrial demand is robust, supply bottlenecks look set to ease, and corporate earnings and margins remain healthy,” he said. The firm is neutral on equities and negative on bonds.