Shares of Avis Budget Group Inc. rallied Thursday, after Deutsche Bank analyst Chris Woronka said the stock has fallen enough in the past two months that he no longer recommends investors sell.

The car rental company’s stock

CAR,

jumped 4.4% in midday trading. On Wednesday, it had dropped 3.8% to close at the lowest price since Nov. 1, which was the day before the stock skyrocketed 108.3% to a record close of $357.17 in a meme-inspired rally after third-quarter results.

Don’t miss: Stocks don’t get more Meme than Avis.

Deutsche Bank’s Woronka raised his rating on Avis to hold, after cutting it to sell after the Nov. 2 close. He kept his stock price target at $210, which implies about 3% upside from current levels.

Woronka said that when he downgraded Avis two months ago, he was constructive on the rental car industry’s fundamentals, but said certain trading dynamics had pushed valuations to “unreasonable” levels.

“However, based on Wednesday’s closing price, we view risk/reward as being considerably more balanced than it was on Nov. 2,” Woronka wrote. “In the absence of compelling reasons to reduce either our target multiple or estimates, quite simply we believe the most proper course of action is to change our rating from sell to hold, and that is what we have done.”

Wednesday’s closing price of $194.90 was 45.4% below the Nov. 2 close.

Although Avis’s stock trades at a premium valuation to shares of rival Hertz Global Holdings Inc.

HTZ,

Woronka said that’s more a reflection of Hertz being undervalued. He reiterated his buy rating on Hertz and his $34 stock price target, which implied about 46% upside.

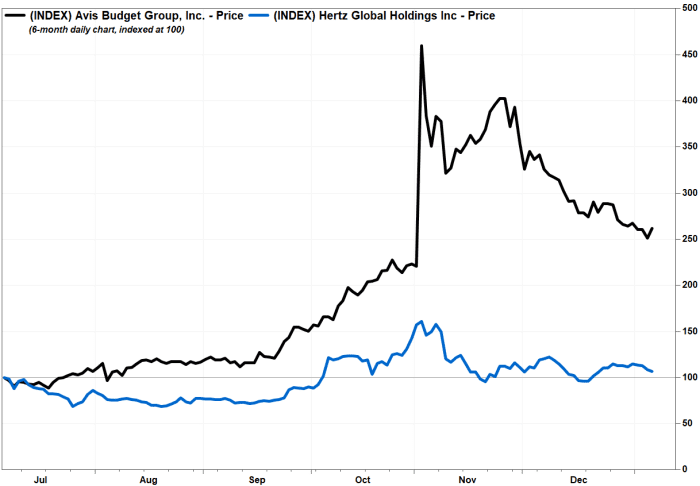

FactSet, MarketWatch

Despite the recent pullback, Avis shares have still run up 162.0% over the past six months, while Hertz’s stock has tacked on 7.4% and the S&P 500 index

SPX,

has gained 8.4%.