Downward revisions to revenue growth forecasts severely hurt Matterport’s (NASDAQ:MTTR) stock price. Shares are down around 79% from their November 2021 highs around $33. The price is in a precipitous decline that accelerated when the company reported scarier operating losses last month. Key corporate insiders bought the dip on MTTR stock in February. Could better times come around in 2022?

Matterport is a fast-growing spatial data company that is at the forefront of digitizing and indexing the real world. Its treasure trove of 3D data creation and modeling patents secures an interesting future for the business. The value of its offerings will further be unlocked as the metaverse’s growth gathers momentum. However, investors in MTTR stock could still feel more pain before long-term gains accrue.

Concerning Downward Revisions to Growth Outlook

Matterport’s management kicked off a wave of downward revisions to the company’s near-term growth outlook in November. Nothing remained the same since then.

The company lowered its prior sales guidance for $120 to $126 million to a lower range of $107 to $110 million. As a slight positive, Matterport reported $111.7 million in revenue for 2021 in a February earnings report.

The latest management guidance is for a 17% growth in sales to a range between $125 million and $135 million in 2022.

Wall Street analysts have been adjusting their forecasts for MTTR’s revenue and earnings downwards lately. Any fundamental valuation metrics that use the company’s sales estimates as inputs would thus point to lower MTTR stock prices.

But that is not all.

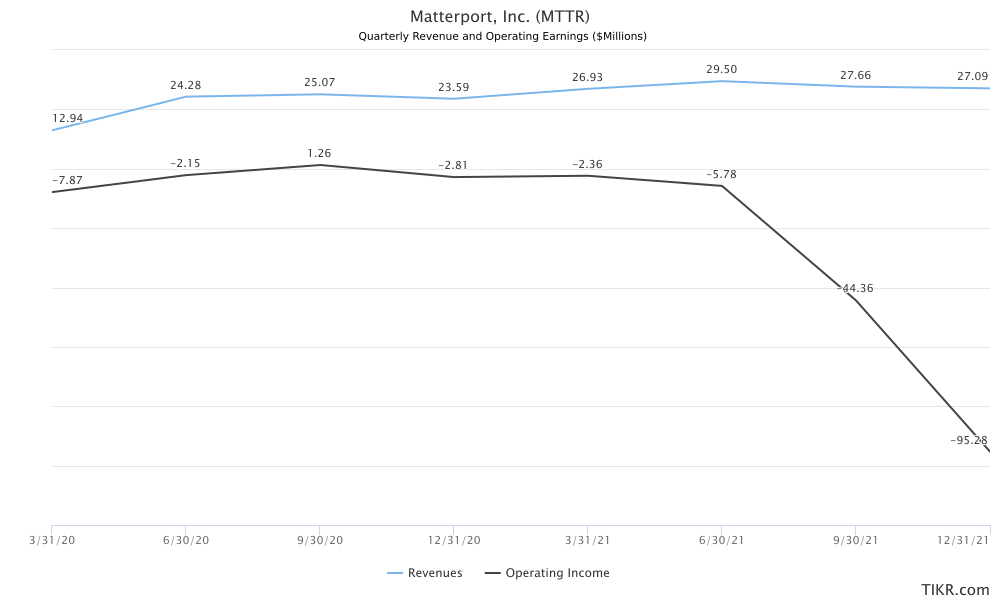

Matterport’s latest earnings installment last month revealed a growing disconnect between revenue growth and operating earnings that could kill retail investor enthusiasm in the short term.

Watch Out for An Operating Earnings Blow

The company’s growing top line is currently accompanied by exponentially larger operating losses. Even more concerning were the two recent sequential drops in quarterly sales during the second half of 2021.

Investors may fret over quarterly sales declining from $29.5 million in June to $27 million by December. Operating losses increased from $5.78 million to more than $95 million during the same period.

Although the business survived a decade of development since 2011 and showed some growth potential in 2021, there is no guarantee that massive investments in scaling up operations will yield the desired outcome — profits.

That said, insiders seem confident.

Insiders Scooped MTTR Stock in February

In a move that could only be bullish for MTTR stock, well-informed insiders bought the dip in Matterport shares last month.

Matterport’s President and Chief Executive Officer RJ Pittman scooped up 40,000 shares worth more than $272,000 in February at prices below $7 a share. Pittman’s transaction followed advisor Peter Hebert’s acquisition of 20,000 shares worth $127,500 the previous day.

Insiders know the business better and they usually invest in their own company’s stock for one good reason: their belief that the business will prosper and its stock price will rise over the long-term.

That said, insiders still own too little of a stake in the company. Total insider interest, excluding that of non-executive director Jason Krikorian, remains under 5%. Venture capitalists and private equity firms own 15.75% of outstanding MTTR shares. Other institutional investors control under 22%. The general public is therefore the majority shareholder in the company.

One could argue that perhaps there is a little alignment of management and shareholder interests. Insiders seemingly have too little skin in the game. However, insiders have invested their time and best career years with the company and they are increasing their stakes in MTTR using personal funds. Perhaps this is a big vote of confidence for Matterport that the market should acknowledge right now.

More Pain Before Gains for MTTR Stock Investors

Technical indicators show negative momentum on Matterport stock in the short-term. Investors could experience further weakness in MTTR as shares search for a new bottom. Further, the company is still in an investing overdrive and it is hiring more personnel to build its capacity. Operating losses could get worse before revenue growth saves the income statement. Valuation could remain subdued.

That said, investors with a high-risk tolerance may still scoop up the cheaper shares and sit out the elevated volatility that has been worsened by market jitters as geopolitical risks shake trader confidence.

Matterport’s shares look cheap with a forward Enterprise Value to Sales (EV/Sales) multiple of 10.2, which is far below its larger competitors. Unity Software (NYSE:U) has a next-twelve-month (NTM) EV/Sales multiple of 16.2 while ANSYS (NASDAQ:ANSS) has a comparable multiple of 12.9.

Not only does Matterport stock have a lower valuation multiple, but the company also has no debt in its capital structure that limits equity risk for investors.

Investor Takeaway

Matterport’s all-in-one 3D data platform enables anyone to create an immersive digital twin of any space. The real estate world is showing significant interest in adopting its offerings. The business could gain more public adoption as metaverses erupt on Web 3.0, the next generation internet.

That said, the company is going through a high-risk phase while investing heavily in its capacity. Shares may trade sideways as weak hands bailout. If management’s latest aggressive efforts pay off, patient investors could reap sizeable returns.

On the date of publication, Brian Paradza did not have (either directly or indirectly) any positions in the securities mentioned in this article. The opinions expressed in this article are those of the writer, subject to the InvestorPlace.com Publishing Guidelines.