Opendoor Technologies (NASDAQ:OPEN) stock deserves to fall. With interest rates rising, its prospects look even bleaker moving forward.

OPEN stock has tremendous upside based on its target price of $16.38 and current price sitting around $9. But that is not worth investing in. Opendoor utilizes a business model that other companies ran from because it was unprofitable.

But Opendoor simply has to stay and fight. And that really looks like a losing proposition given the multiple factors it’s facing.

iBuyer Business Model

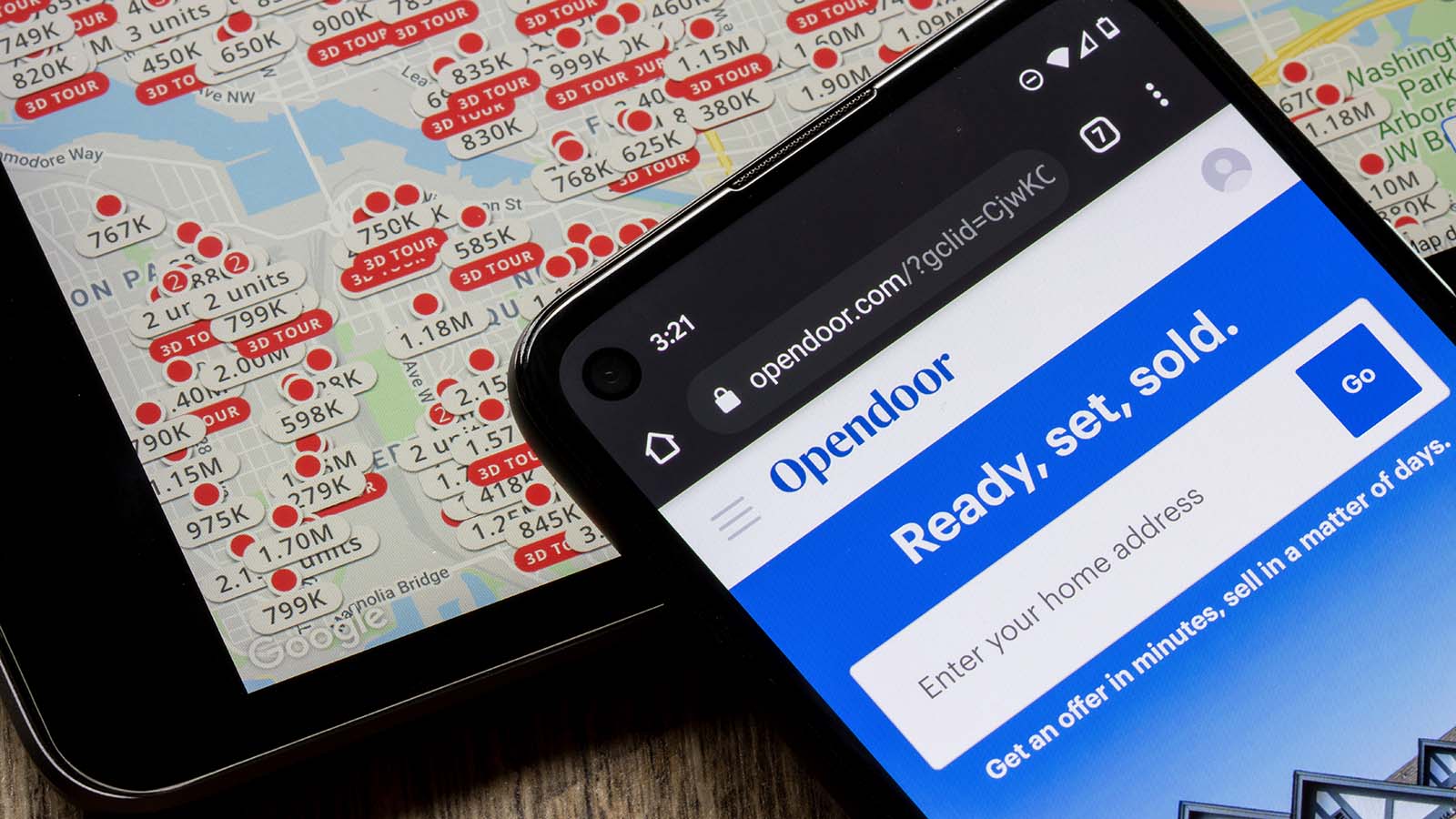

Technology continually promises to make everything better. In the real estate industry, technology is being leveraged in the home buying and selling process. Participants in the process have been referred to as iBuyers. iBuyers, including Opendoor, utilize complex algorithms that make an offer on your home instantly.

iBuyers promise to simplify the complex and often drawn-out process of buying and selling a home. Inherent in that process is the idea that iBuying is itself a good business model.

That isn’t necessarily the case as Zillow (NASDAQ:Z) proved. Zillow’s algorithm proved incapable of identifying correct pricing outputs based on the cash burn it experienced in iBuying. Zillow reported an $880 million loss from the iBuyer business and ultimately exited the business in late 2021.

Zillow, unlike Opendoor, is a much more diversified firm. That should shield it to some degree. But Opendoor is wide open to mounting trouble. Its Q4 earnings report shows as much.

Earnings Fiasco

Bullish investors looking to create a positive narrative for OPEN stock could steer investors toward its revenue growth. But only a little bit of investigation would reveal a misguided take. In 2021 the company’s revenues reached $8.021 billion up from $2.583 billion in 2020.

But even the most fundamental analysis would soon uncover the greater truth. As it turns out, all Opendoor did was dig itself deep into a hole despite rapidly improving top-line results. 2021 net losses increased by 161%, reaching $662 million overall.

That speaks very poorly to the iBuyer business model and seems to justify Zillow’s move out of the business. Another metric called contribution margin is important to understand here.

Declining Contribution Margin

Businesses that want to understand how an individual product contributes to overall profitability utilize something called contribution margin. Joe Knight, author of HBR Tools: Business Valuation, defines it like this: “When you make a product or deliver a service and deduct the variable cost of delivering that product, the leftover revenue is the contribution margin.”

The problem for Opendoor is that it has experienced a declining contribution margin for quite some time. In the fourth quarter of 2020, that figure stood at 12.6%. It declined to 7.5% by the end of Q3 ‘21 and all the way down to 4% to end the fourth quarter of 2021.

Interest Rates Matter for OPEN Stock

A recent article reported “Mortgage rates climbed past 4% for the first time since May 2019. The 30-year fixed-rate mortgage averaged 4.16% in the week ending March 17, up from 3.85% the week before, according to Freddie Mac.”

That’s going to make things harder for Opendoor as it purchased portions of its current inventory when things were cheaper. The company is going to have a tougher time selling its inventory too because home purchasers won’t want to pay the higher mortgage rate. All of that should logically squeeze Opendoor’s contribution margin moving forward. That won’t help it.

Simply put, avoid OPEN stock right now. It was already troubled before recent news emerged. Now it looks worse moving forward. The fed is trying to cool the economy down and that’s going to affect Opendoor directly. The outlook on iBuyer stocks is significantly worse than it was at this time a year ago. OPEN stock is a pure-play example of what that trouble looks like.

On the date of publication, Alex Sirois did not have (either directly or indirectly) any positions in the securities mentioned in this article. The opinions expressed in this article are those of the writer, subject to the InvestorPlace.com Publishing Guidelines.