On April 13, Tesla CEO Elon Musk offered to buy Twitter

TWTR,

for $54.20 a share. Twitter’s stock closed at $45.08 (17% below Musk’s takeout offer price) on April 14, making it clear that many investors believe the deal won’t take place.

Louis Navellier makes the case for Twitter’s board of directors to accept Elon Musk’s offer.

Meanwhile, David Trainer, Kyle Guske and Matt Shuler of New Constructs have a warning for Twitter’s shareholders: Musk’s offer might be an expensive distraction.

More on Musk and Twitter:

Where you might live if you no longer drive

Row houses near DuPont Circle in Washington, D.C.

Getty Images/iStockphoto

In the Where Should I Retire? column, Silvia Ascarelli helps a woman who can no longer drive with three possible locations to suit her budget and transportation needs, while allowing her to pursue cultural and educational opportunities.

Try MarketWatch’s retirement location tool for your own custom search. It includes data for more than 3,000 U.S. counties and incorporates climate risk.

More on retirement moves: Six things to consider before you move in retirement

Here’s how activist investors can help you

Tonya Garcia digs into a fascinating trend: shareholders fighting corporate boards in order to bring about changes that will increase companies’ value.

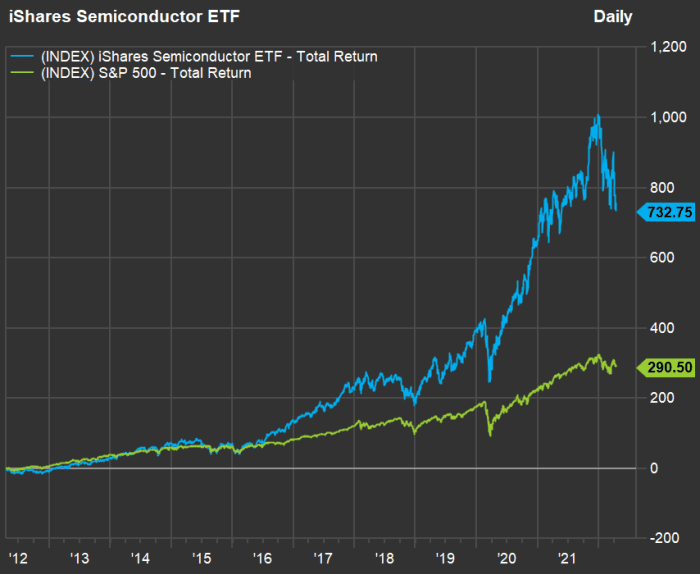

How the semiconductor industry has evolved

FactSet

The chart above shows how semiconductor stocks as a group have outperformed the benchmark S&P 500

TWTR,

over the past 10 years. But so far this year, the iShares Semiconductor ETF

SOXX,

has plummeted 23%, while the S&P 500 is down 8%.

Wallace Witkowski explains how the semiconductor industry has evolved, while looking into its recent volatility.

Inflation rises again and hits the working class

This week the government reported that consumer inflation in the U.S. hit a new 40-year high of 8.5% in March, while wholesale prices were up 11.2% from a year earlier.

Rex Nutting explains why this inflation cycle has been the toughest one for the working class.

Read on: Gas is going up, but this is how inflation really hurts older Americans

Here’s an easy way to protect yourself from inflation — and it’s poised to look even better next month

Getty Images/iStockphoto

U.S. Series I savings bonds, known as I-bonds, currently have an interest rate of 7.12%. The rate resets every six months, in May and November, and is based on the inflation rate. Mark Hulbert expects the May reset to bring the interest rate well above 9%. He explains how I-bonds work and considers whether it might be better to buy them now or wait a month.

Investors are looking to emerging markets

AFP/Getty Images

U.S. investors have been pouring money into emerging-market stocks, according to Bank of America. Michael Brush makes the case for EM outperformance and shares lessons learned from Neal Dihora, who co-manages the Wasatch Emerging Markets Select Investor Fund.

More on emerging markets: Russia’s invasion of Ukraine is changing ESG investing

Other stock-market ideas:

- 20 high-volatility stocks you might want to avoid in a hair-trigger market

- Three value stocks that can provide safety as interest rates rise

Retirement and planning for it

As part of her Help Me Retire column, Alessandra Malito helps a couple who faces a difficult Social Security timing decision. Some of the details may surprise you.

Also: As Social Security’s finances teeter, Congress could make it worse with this rule change

More on retirement and planning for it:

- Retired and bored or — worse yet — boring? Try this

- 4 big expenses you should factor in for retirement

A hopeful home flipper

In The Big Move column, Jacob Passy helps a couple that spent much more to fix up a house than they expected. The quandary: Sell now or rent it out?

More about the housing market:

- Mortgage rates soar to highest level in over a decade — even wealthy home buyers are feeling the pain

- Remember the tiny house movement? How’s that working out?

Want more from MarketWatch? Sign up for this and other newsletters, and get the latest news, personal finance and investing advice.