Here are the company’s making headlines in midday trading:

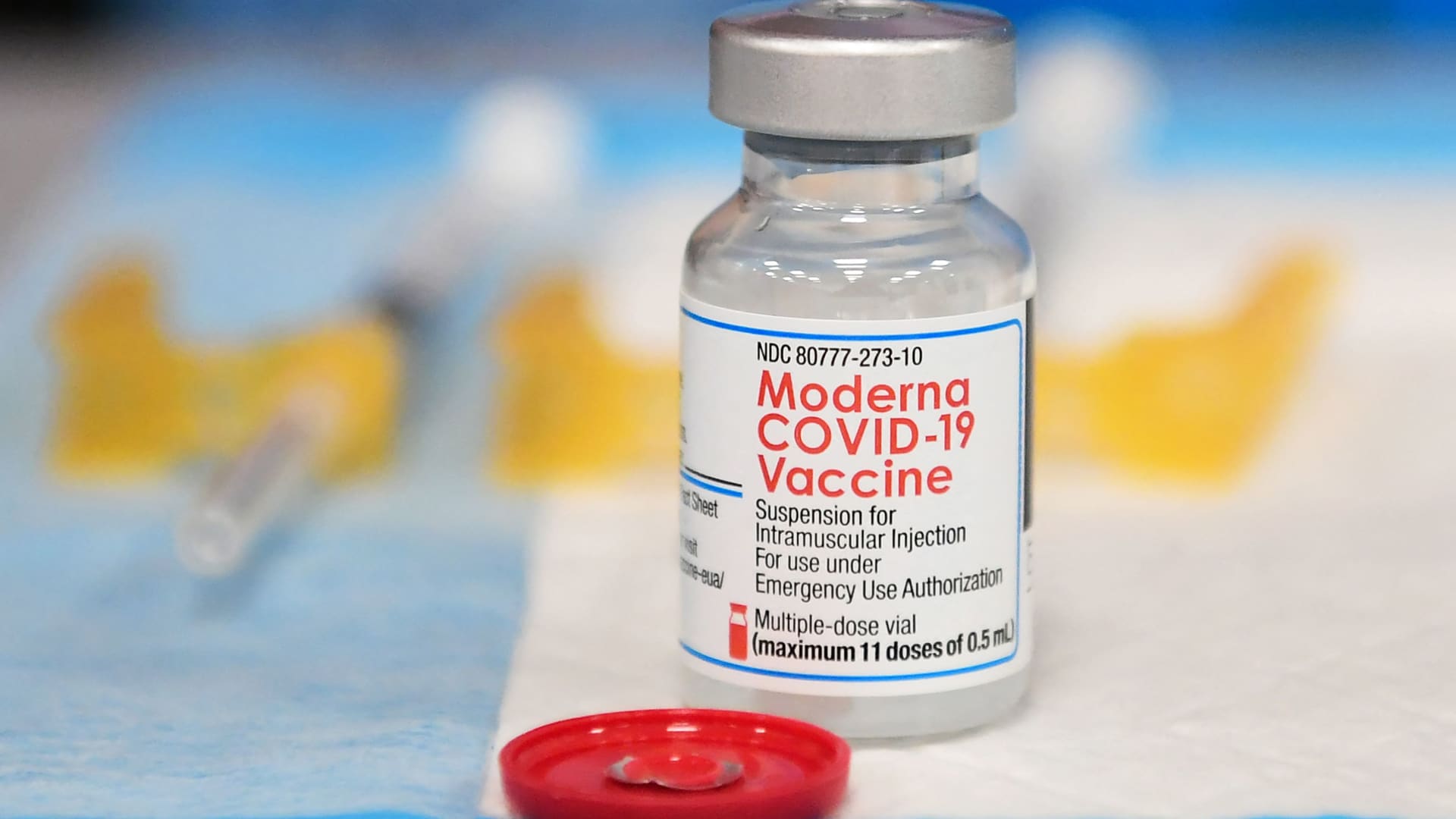

Moderna — The biotech stock jumped 7% after a Food and Drug Administration committee voted to recommend Moderna’s Covid vaccine to children ages six through 17. The FDA is expected to authorize vaccines for children later this week.

Robinhood — Shares of the retail brokerage fell 1.7% following a downgrade to neutral at Atlantic Equities. Atlantic cited declining users and regulatory issues as threats to Robinhood’s stock.

Snowflake — The software stock jumped 7% following an upgrade to buy from hold by Canaccord Genuity. The investment firm said Snowflake’s stock looks cheap based on the company’s long-term growth potential.

Liberty Media Formula One — The sports media stock rose more than 5% after Morgan Stanley upgraded Liberty Media’s Formula One holdings to overweight. Rising interest in the racing series should lead to “compounding growth for its investors,” Morgan Stanley said.

Boeing — The aerospace stock rose 8% after Reuters reported that airline China Southern conducted test flights with Boeing’s 737 Max jet. Shares of Boeing have been volatile recently and are on track for their fifth straight session of a 4% or greater move in either direction.

Skechers — Shares of the shoe company added 2.8% on the heels of an upgrade from Argus Research. Argus cited brand strength and supply chain improvements as reasons to be bullish on Skechers in the coming years.

Spotify — The streaming stock surged 7% after Wells Fargo upgraded Spotify to equal weight from underweight. Wells Fargo said Spotify has room to improve its margins.

Microstrategy — Shares of the tech company rose more than 9% after CEO Michael Saylor defended the company’s strategy of investing in bitcoin on CNBC’s “Squawk on the Street.” The company’s stock has fallen sharply this year as the price of bitcoin has declined by more than 50%.

Tapestry — The apparel stock jumped more than 4% after an upgrade to buy at Jefferies. The investment firm said Tapestry’s improvement in its digital business and opportunities in China provide upside for the stock.

Sweetgreen — Shares jumped more than 3% after the salad chain was named a best small- and mid-cap idea by Cowen. Analysts liked the stock as part of a pandemic recovery play, and for the company’s exposure to higher income consumers.

— CNBC’s Sarah Min and Michael Bloom contributed reporting.